Asia-Pacific Forecast | H1 2022

Below is an introductory letter by BGA President and CEO Ernie Bower on thecompany’s latest half-yearly Asia-Pacific Forecast, circulated to our clients to help inform their planning for the upcoming months.

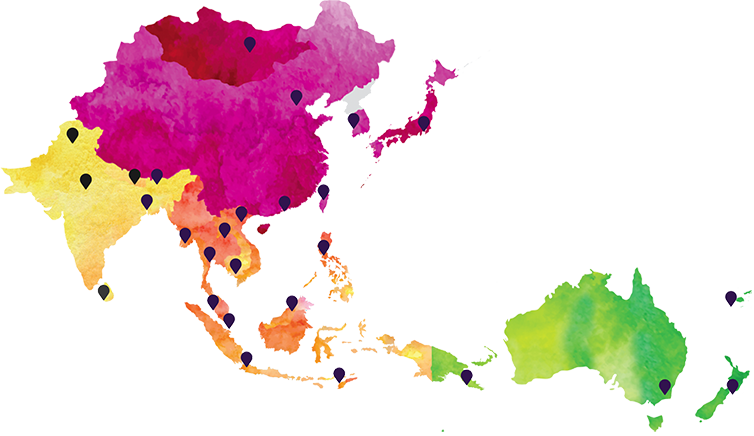

As we look into the first half of 2022, we are pleased to provide you with BGA’s bi-annual assessment of the coming six months. I am really proud of the work we are sharing from our 26 offices across the region we call the Asia-Pacific, meaning here all of South and Southeast Asia, Australia, New Zealand and the Pacific, Northeast Asia and the United States. My team is particularly well-suited to advise you in this regard, as we now have offices in 26 countries and over 170 outstanding people working in those places. Enclosed are detailed country summaries that will help you and your teams anticipate what is coming, invest in your agility and help you prepare to seize opportunities.

Asia will lead the way in the world’s economic recovery from the Covid-19 pandemic, in part because of the region’s enormous size, blockbuster demographics and innate diversity. However, companies should expect uneven progress. Recovery narratives will vary widely in different countries due to politics, the effectiveness of planning and governance and the varied impact of geopolitical influences on supply chains, standards and even the risk of confrontation.

Green shoots of recovery are emerging. The International Monetary Fund expects India to lead Asia’s recovery with 9.5 percent growth, followed by other markets such as China and New Zealand. Countries in South Asia and the Pacific are gradually opening for travel and shifting to an endemic approach to managing Covid-19. In areas like the Mekong subregion, countries are looking to make progress on cross-border energy and infrastructure projects. The initial impact of new and relatively comprehensive regional trade agreements will be seen as countries reform rules to comply and companies begin to take advantage of new opportunities.

Countries such as Singapore and Australia have shifted towards reopening after feeling compelled to reimpose restrictions, while this year’s pandemic epicenters such as Indonesia and India are adopting a more cautious approach and preparing for future spikes of the virus. Some smaller and less developed countries in South and Southeast Asia are still grappling with sluggish vaccine rollouts and lax enforcement of existing regulations to protect their citizens. The result will be higher risk of retrenchment in those places.

National politics will influence the pace of recovery and focus on reform. Countries as diverse as Papua New Guinea, the Philippines, South Korea, Timor-Leste and the United States will hold national polls, and others like Australia and Malaysia could as well. In some markets, non-electoral developments will serve as visceral gauges of public sentiment, as is the case in Myanmar’s as we witness the bloody contest between the ruling military junta and the opposition national unity government.

Regional architecture continues to play a key role. Thailand and Cambodia will both hope to lead the transition back to in-person meetings as hosts of the Asia-Pacific Economic Cooperation forum (APEC) and Association of Southeast Asian Nations (ASEAN) respectively. China’s hosting of the Winter Olympics will serve as a litmus test of global sentiment about Beijing, and a challenge for companies engaged in the event, amid calls for boycotts surrounding its human rights abuses.

Asia’s road to recovery will not be without its share of risk. Nationally, new regulations are on the horizon in key economies like Vietnam and India who are intent on reshaping their approaches to data flows. Countries will be making decisions about 5G, rules about privacy and new payment systems such a creating regulations for cryto-currency. Many plan to adjust their monetary and fiscal policies in response to shared challenges, including rising inflation and surging energy prices as the U.S. Federal Reserve considers its own rate hike timeline.

Cross-border developments will open opportunities for some but will complicate business planning for others. Issues including intellectual property rules impacting vaccines, supply chain resilience and the global minimum tax will expose divisions in approaches among countries in Asia. This will occur in the context of shifting institutional dynamics, including at the Group of Twenty (G-20) major economies which will be chaired by Indonesia in 2022 followed by India in 2023.

Geopolitically, U.S.-China tensions will continue to loom large, fueling concerns about flashpoints ranging from Taiwan to the South China Sea. Leaders in countries that understand the imperative for the United States to remain substantively engaged both economically and from a security stand point are extremely concerned about political risk in the United States and the outcome and impact of mid-term elections. The fallout from the botched U.S. Afghanistan withdrawal is likely to revive fears of growing militancy and terrorism in parts of South and Southeast Asia. The struggle between democratic and authoritarian regimes is likely to play out on issues ranging from the plight of China’s Uighurs to the Rohingya refugee crisis to President Joe Biden’s Summit for Democracy in December.

We see opportunities in this diverse landscape and multilane road to recovery. Government focus on digitalization and green growth, already supercharged by the pandemic, will continue in the first half of 2022, especially amid the global conversation around big tech and environmental, social and corporate governance (ESG). Easing of movement restrictions could also lead governments to develop incentives to boost consumer-facing industries such as retail, food and beverages and tourism related sectors.

Cross-border collaboration could provide openings for companies to engage. Successful resumption of cross-border travel will require creative thinking in the meetings, incentives, conferencing and exhibitions (MICE) industry that cannot be accomplished by governments alone. Forums like the Quad, which comprises Australia, India, Japan and the United States, will also incorporate private sector input in areas such as education, vaccines and emerging technologies, such as semiconductors.

Regional dynamics will offer pathways for companies. The entry into force of the Regional Comprehensive Economic Partnership (RCEP) agreement in January will affect how firms work across Asia. The Biden team’s evolving Indo-Pacific economic agenda, while still nascent, could develop in the first half of 2022 ahead of November midterms and the US hosting of APEC 2023. These may offer opportunities for companies in areas such as infrastructure, particularly energy, finance and semiconductors.

The recently concluded global environment summit in Glasgow highlights opportunities for companies ready to innovate. One area primed for growth is renewable energy from wind and solar. Other opportunities exist in ecologically friendly construction and help for cities facing threats from severe flooding and more intense storms. Countries in the Indo-Pacific are looking for financial solutions from green bonds to micro-loans and private investment to tackle the climate threat.

So buckle up with us. The ride over the next six months will be uneven, but be reassured that we are going to a better place. Asia will grow faster than other regions of the world, and accomplish that from a very significant baseline. Companies are responding to this opportunity and global economic/opportunity rebalancing by increasing their investments in understanding the key players and dynamics in priority countries, and positioning to be part of the recovery.

My team and I at BGA are on the ground across the region and ready to support you as needed. Good luck, stay safe and keep your eyes open.

Sincerely,

Ernest Z. Bower,

President and CEO, BowerGroupAsia

Ernest Z. Bower

President & CEO