Indo-Pacific Forecast | H2 2022

Below is an introductory letter by BGA President and CEO Ernie Bower on the company’s latest half yearly regional forecast, circulated to clients and prospects to help inform their planning for the upcoming months.

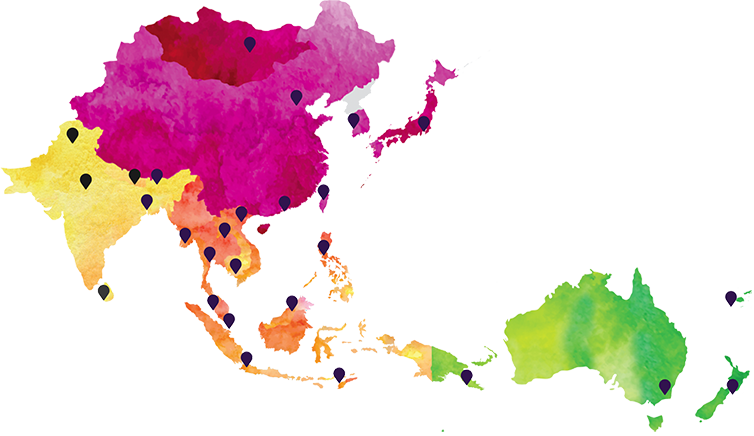

In the second half of 2022, Asia will enhance its case as the world’s most compelling market. The region will continue its steady economic recovery from the pandemic, but that growth will remain modest. Threats of higher inflation and recession in key markets suggest possible downward adjustments to those projections. Yet relative to rest of the world, Asia is young, growing, resilient and home to the most consequential trade opening agreements on the planet.

Politically, change remains the constant as new governments take control in Canberra, Colombo, Manila and Seoul and key political events loom in Beijing, Washington and several other capitals. Geopolitically, the stakes steadily rise as Asia cements its role as the most dynamic region in the world.

Asia is set for modest growth, even though the Russia-Ukraine conflict has made the road to recovery rockier amid lingering COVID-19 concerns, rising geopolitical competition and an uncertain monetary environment. This mixed picture presents an environment in which corporate teams with a strong commitment to growth, compelling global and local narratives, well-managed risk and superior on-the-ground insight will make marked progress. Assumptions that had limited options in the past must be reassessed now as policymakers rapidly adjust to new developments.

Vladimir Putin’s invasion of Ukraine has exponentially accelerated geopolitical developments and has already had significant economic and political impacts in Asia. Supply chain disruptions and rising food and energy prices have exacerbated a range of domestic concerns in many countries, prompting questions about government legitimacy.

The spectrum of effects can already be seen in cases across the region, from the recent unseating of Sri Lanka’s government to youth protests on the streets of Mongolia’s capital. U.S. President Joe Biden, on his first visit to Asia since being elected, was challenged to articulate his stance on defending Taiwan’s sovereignty and provided an unambiguous affirmation that has riled China’s leadership.

Despite these risks, the region is set for modest growth on a rocky road to recovery. The International Monetary Fund expects India to lead Asia’s recovery, despite some slowing, with a projected growth rate of 8.2 percent. South and Southeast Asia are expected to follow with growth rates of between 5-6 percent in leading performers like Bangladesh and Vietnam.

Politics remain turbulent across the Indo-Pacific. Elections in Fiji and Papua New Guinea; local contests in Cambodia, India and Japan; and midterms in the United States could have significant impacts on policies and economic decision-making.

Other contests could be called in important Association of Southeast Asian Nations (ASEAN) economies such as Malaysia and Thailand. And the congress of the Chinese Communist Party — held once every five years — and expected election of Xi Jinping as leader for an unprecedented third term will take place in November, setting the trajectory of Chinese policy and China’s approach to the region and global issues for at least the next five years.

Indonesia’s hosting of the Group of 20 (G-20) Summit in November will provide a sense of how Jakarta can balance divergent views about Russia’s inclusion while making progress on its own priorities around health and sustainability. The follow-up work after the recent Quadrilateral Security Dialogue (“Quad”) Leaders’ Meeting in Tokyo — grouping Australia, India, Japan and the United States — will reveal more about the Quad’s ability to influence the Indo-Pacific and convince China to help make and play by a collective set of rules.

While most analysts rightly focus on growing China-U.S. competition, the rest of Asia is working hard to convince both regional giants to anchor themselves economically in Asia through a series of trade opening and facilitating agreements such as the Regional Comprehensive Economic Partnership (RCEP), Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and still-nascent Indo-Pacific Economic Framework (IPEF) that President Biden along with 12 other Asian countries launched in Tokyo on May 23.

These agreements will compete to set standards, open markets and enhance trade and investment around the region. Future leaders of governments and companies will be challenged to nudge government decision-makers away from competition and confrontation and toward cooperation, though the next six months will not offer many opportunities for bonding.

Asia will not be without its share of challenges for businesses to navigate amid this mixed outlook. Government budgets — from some of the world’s wealthiest countries such as Brunei to less-developed ones like Laos — still need to focus on economic recovery for sectors like travel and finance while providing relief for struggling businesses and people. Key economies like Vietnam and Taiwan could see new regulations issued in areas such as the digital domain, which bear close watching for companies tapped into the promise of Asia’s ever-growing connectivity.

Geopolitically, the Russia-Ukraine conflict has put more of a spotlight in Taiwan as a regional flashpoint, even though an outright invasion still appears unlikely. Another round of tensions could erupt in the South China Sea in late 2022 as regional rebalancing occurs amid the post-election environment around Ferdinand “Bongbong” Marcos Jr. in the Philippines and Cambodia’s chairmanship of ASEAN. The fallout from Myanmar’s unstable post-coup environment will continue to radiate across parts of the region.

Yet opportunities abound for businesses in key Indo-Pacific markets. Korea’s newly inaugurated government is developing sector-focused economic thinking in diverse areas like semiconductors, artificial intelligence, nuclear power, the mobility industry and digital asset infrastructure. India is cementing economic ties with Europe and could sign bilateral pacts with the United Kingdom and European Union in addition to further developing the newly launched EU-India Trade and Technology Council in the second half of 2022.

Cross-border collaboration could also provide openings for companies to engage. Forward-thinking countries like New Zealand and Singapore are looking past new travel lanes and undertaking partnerships in areas ranging from carbon pricing to data centers. Energy policies in nearly every country are changing rapidly in response to Russia’s disruption of the market and related sanctions.

Countries are also considering avenues in a number of areas, including the future of cryptocurrencies, fintech rules and cloud computing. Meanwhile, China’s struggles with its zero-COVID policy may have slowed its ambitions for trans-Asian connectivity in areas like the Greater Mekong Subregion. This could pick up again in the coming months, putting the spotlight on projects such as the $6 billion China-Laos railway completed in late 2021.

Asia’s dynamism and scale are alluring but present a set of complex puzzles and tests whose rules and core assumptions are challenging. The second half of this year will see moderate economic growth but reveal signs of the future direction the United States and China will take based on their national politics. Companies that commit to the region, embrace change and diversity and build a foundational database of core relationships and knowledge at the country and community levels will be in the best position to not only navigate risks and opportunities but also thrive and be a part of driving change and building prosperity.

Sincerely,

Ernest Z. Bower,

President and CEO, BowerGroupAsia

Ernest Z. Bower

President & CEO