China Forecast: Navigating Growth, Tech Ambitions, Social Strains and Investment Opening

WHAT YOU NEED TO KNOW

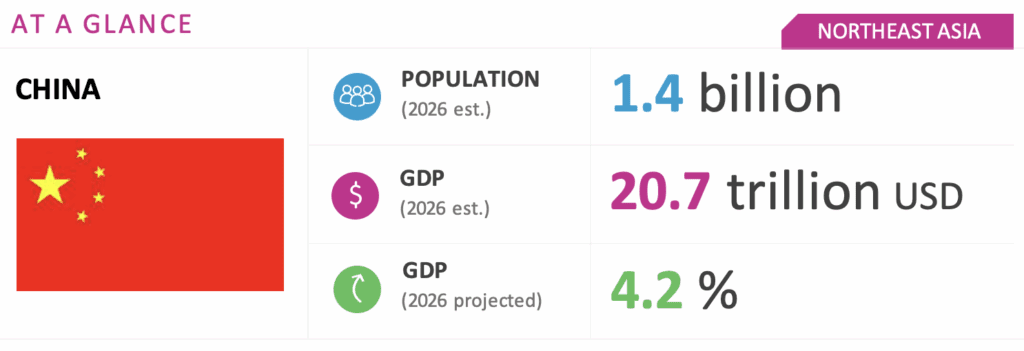

- Economic growth in 2025 has been resilient, but private investment is weak, households are cautious and the property market is soft. Officials still aim for full-year growth near 5 percent, requiring about 4.5 percent in the fourth quarter. The 2026 target will likely be around 5 percent.

- A fragile U.S.-China trade truce has been reached with a one-year pause on planned U.S. export-control expansions, China deferring rare earth curbs and both sides suspending port fees. China has already begun to crack down on the export of fentanyl precursors to North America. Despite the persistently high U.S. tariffs, China’s exports returned to growth in the third quarter, up 6.6 percent year on year in dollar terms, and Beijing is widening its customer mix via an updated free trade agreement with the Association of Southeast Asian Nations (ASEAN).

- The Chinese Communist Party Central Committee’s recommendations for the 15th Five-Year Plan prioritize high-quality growth with advanced manufacturing at the core, closer alignment of development and security, higher productivity, a more unified national market and high-standard opening to sustain market access.

- The Fourth Plenum in October signaled a continuing anti-corruption drive and tighter top-down control, likely speeding priority execution of key performance indexes while making local officials more risk averse.

ON THE HORIZON

- The legislative “two sessions” will launch the 15th Five-Year Plan in March 2026 to set clear rules for using artificial intelligence (AI) in industry, such as how to expand computing centers with usage goals and map milestones and funding to the 2030 and 2035 targets.

- Targeted fiscal and monetary support will back investment and local projects. The central bank will keep borrowing costs low, consider reserve ratio cuts, roll over funding and push banks to lend to deliver quick jobs and visible projects.

- There will be limited capital-market reforms for long-term investors, and regulators will strengthen Shenzhen’s ChiNext initial public offering board, allow faster follow-on equity via shelf registration, streamline foreign investor access and add investor protections.

- Industry upgrading with AI and greener standards puts the priority on stronger supply chains and strategic minerals, wider factory digitalization and connected devices, more computing capacity, easier computing satellite service entry and support for small and mid-sized firms.

China Market Overview and Forecast

Political Climate

Balancing Control, Growth and Social Stability

Beijing faces the major challenge of maintaining strong central control over essential policy issues amid a complex international and domestic landscape. The government is increasingly promoting technocrats to oversee critical sectors and address ongoing macroeconomic structural challenges. At the same time, it is pressured to strengthen social safety nets and increase revenue as fiscal income reaches its peak or even starts to decline.

A significant social issue involves providing adequate employment opportunities for young people entering the workforce. With overall unemployment averaging 5.2 percent from January-September 2025, and even higher rates among youth, officials are implementing measures such as internship and first-job subsidies, hiring credits for small businesses, short-term practical training in factory and data skills. These initiatives aim to stimulate household borrowing, boost service spending and reduce burdens on businesses to sustain hiring and investment. Even with these measures, official youth unemployment for the 16-24 age group remains in the mid-teens, reinforcing young people’s reluctance to marry, have children and commit to big-ticket spending.

At the same time, Beijing is tightening and expanding core social security programs from gradual retirement-age hikes to stricter contribution enforcement to support consumption and manage aging pressures. The government is also mandating full payment of social-insurance contributions and rolling out new child care and elder care benefits that will reshape labor costs and household balance sheets.

Additionally, the government must navigate the ongoing downturn in the property sector, which poses risks to long-term macroeconomic stability. Current efforts focus on completing and delivering homes already paid for, including about 1 million units in urban renewal projects and older housing upgrades and maintaining these policies through the end of 2026 to prevent a loss of confidence. However, it remains uncertain when the property market will finally stabilize.

Macroeconomic Climate

Tech and Innovation To Lift All Boats

Beijing’s technology policy focuses increasing productivity while strengthening homegrown capabilities. Investment is steering toward the low-altitude economy (commercial drones and electric air taxis), aerospace, new materials and new energy, with national computing hubs and data-center clusters supporting AI deployment on factory floors, among others. China already leads in several critical technologies reshaping the global economy, but excess capacity in some, such as electric vehicles and solar cells, is a persistent problem. The new policy task is therefore to upgrade quality, tighten standards and discipline expansion so productivity, not volume, drives gains.

Reforming Industrial and Social Policy as Land Sale Revenue Fades

Beijing aims to create a more unified national market and lift demand by steering funds to consumption, productive investment and public services. At the same time, it is expanding the social safety net, shifting more responsibility to provinces and cities. With land sales no longer a dependable revenue source, local governments need steadier tax income and stronger collection, broadening the tax base where feasible, standardizing fees, improving transparency and prioritizing core services such as health care, social assistance and basic public goods. A national child care subsidy, phased moves toward free preschool and a long-term elder care strategy are designed to lower family burdens while anchoring a more consumption-driven growth model. These new family and social-service obligations will increasingly compete with infrastructure and industrial subsidies for limited local fiscal resources as land sale revenue fades and more of the burden shifts to central government bond issuance.

Redefining Roles Internationally

China continues to emphasize “opening up” while assuming a larger convening role among the Global South. Beijing has pledged to forgo special and differential treatment as a “developing country” in future World Trade Organization negotiations, even as it continues to describe itself as the world’s largest developing country. The country now prioritizes service-sector opening, more balanced trade and two-way investment, alongside deeper coordination with Belt and Road partners and upgraded economic ties with ASEAN. The aim is to preserve market access, diversify demand and build more resilient supply chains, aligning external engagement with domestic priorities.

Investment Environment

Relaxing Regulations To Attract Foreign Investment

China is actively trying to stabilize the investment environment with targeted opening-up measures and service guarantees for foreign firms. However, foreign direct investment flows remain weak and uneven across sectors, underscoring ongoing concerns about policy predictability, data regulation and geopolitical risk. With the 15th Five-Year Plan proposals approved at the October 2025 Fourth Plenum and formal adoption expected at the March 2026 two sessions, 2026 will clarify policy priorities for the next five years, and U.S.-China trade ties are expected to stabilize with fewer abrupt policy shocks. Beijing also has room to deepen global trade and investment links with the Global South, broadening routes for capital, energy and technology.

We will continue to keep you updated on developments in China as they occur. If you have any comments or questions, please contact BGA Adviser Eric Wang at ewang@bowergroupasia.com or Account Manager Sam Overholt at soverholt@bowergroupasia.com.

Best regards,

BGA China Team

Eric Wang

Advisor