Kenya Forecast: Preelection Uncertainty, Economic Resilience and Rising Investment

WHAT YOU NEED TO KNOW

- Political uncertainty, new alliances and leadership changes in the government will become more pronounced as the country grapples with the absence of former Prime Minister Raila Odinga, who died` in October. Odinga was arguably the most influential political leader and enduring factor in Kenya’s political landscape over the last three decades. To maintain stability, President William Ruto will likely strive to uphold the “broad-based government” agreement with Odinga’s Orange Democratic Movement (ODM) and retain most of the key ministers appointed to the Cabinet as part of the agreement.

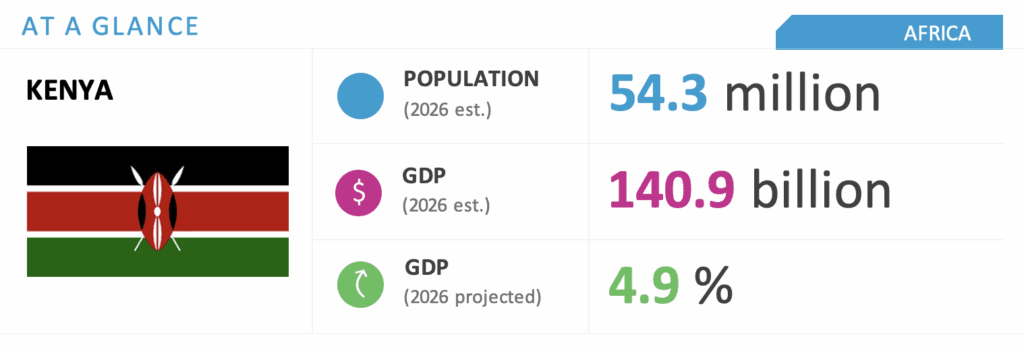

- Kenya’s macroeconomic outlook will remain resilient during the first half of 2026, with GDP growth — estimated at 4.9 percent — driven by continued strong performance in agriculture, a recovery in the industrial sector and financial sector stability. Inflation is projected to remain within the target range, while growing foreign exchange reserves, a stable exchange rate and declining interest rates are expected to result in more credit to the private sector and increased economic activities.

ON THE HORIZON

- In the first quarter of 2026, the government will begin developing the 2026-2027 budget by publishing the budget policy statement, which outlines key government economic priorities and programs. The budget process will be significant because it will reveal development and revenue priorities for the last year of Ruto’s current term in office.

- In March 2026, the government will host the Kenya International Investment Conference to promote the country as an investment destination, with an anticipated focus on agro-processing, infrastructure development, technology and fintech opportunities.

- In mid-2026, the one-year countdown to the 2027 general elections will begin. The contest between Ruto — who will seek a second term in office — and opposition parties will intensify, with renewed focus on the president’s record. Heightened political tension risks will spill over into policy decisions as the temptation to engage in populism intensifies.

Kenya Market Overview and Forecast

Political Climate

Political Uncertainty Abounds as Kenya Approaches Countdown to Elections

The political climate will remain uncertain as the country adjusts to the absence of former Prime Minister Odinga, who died in October. Odinga was an influential actor in Kenya’s politics for more than three decades, and through a series of post-election agreements had played a stabilizing role for successive governments through moments of crisis. In Odinga’s absence, political stability will depend on whether President Ruto is able to maintain the support of Odinga’s party, Orange Democratic Movement (ODM), and on how the government responds to political challenges, particularly as the country nears the one-year countdown to the 2027 general election. A securitized approach to political challenges is highly unlikely but if pursued will test the country’s stability, which has long relied informally on Odinga’s brokerage to consolidate support around a peace-first agenda.

Several issues will likely impact political stability. First, Ruto will need to navigate the 10-point agreement with ODM that led to the formation of a broad-based government as a counter to youth protests and political fallout within the ruling party. The most significant challenge will be how Ruto manages the different factions within the ODM, some opposed to his 2027 reelection bid. Second, Ruto will still need to contend with a restive and more active youthful population as electioneering gains momentum. Moreover, the opposition will likely be buoyed by the absence of Odinga to launch a spirited campaign against Ruto’s policies and second-term bid. At the same time, Ruto will work hard to secure new allies from the opposition. These issues will define a vibrant but uncertain political climate as the country adjusts to politics in the post-Raila era.

Macroeconomic Climate

Economic Resilience and Recovery

Kenya’s economic outlook is positive, with the government projecting GDP growth of around 5.3 percent — higher than the International Monetary Fund’s (IMF) projection of 4.9 percent — driven by continued strong agricultural performance, a gradual rebound in the industrial sector and steady services. A steady exchange rate, growing foreign exchange reserves and inflation rates staying within the government’s target of 5 percent will continue to favor a conducive macroeconomic environment. The country’s diversified economy will buffer against external shocks. Macroeconomic and fiscal policies will target increased private sector credit, through lower interest rates, as a strategy to boost economic activities and accelerate growth. The challenge of fiscal consolidation will persist, despite recent progress in paying off external debts. Other risks to economic growth include the impact of potential weather disruptions on agricultural production, the delayed effect of uncertain global trade policies and tariffs, externalities related to global fuel and commodity prices and an uncertain political climate, particularly as the country approaches the one-year mark to the August 2027 general elections. Overall, the economy will remain resilient and is projected to register modest growth.

Investment Environment

Policy and Regulatory Environment

The government will continue to take steps to position Kenya as a key investment destination in East Africa. This will include efforts to create a conducive regulatory framework, particularly targeting the digital economy. In the recent past, the government promulgated a regulatory framework for virtual assets and clarified the implementation of significant economic presence tax through regulations. The government is expected to enact an e-commerce policy; amend antitrust laws; and finalize a policy for micro, small and medium-sized enterprises, among other policy and regulatory initiatives. Robust industry engagement will be necessary to ensure that new laws do not negatively affect or stifle investment and innovation. As the government starts the process of preparing the 2026-2027 budget, uncertainty about taxation policies will again come to the fore, particularly given constraints in raising domestic income taxes. Overall, the government will be keen to promote foreign direct investment given the more competitive regional landscape.

Opportunities and Government Priorities

Government economic activities will continue to be centered around the Bottom-Up Economic Transformation Agenda, with a major focus on agriculture, housing and settlement and supporting small and medium-sized enterprises. These will be considered easily achievable outcomes for Ruto’s reelection campaign. The government will also seek to expand its efforts in building public infrastructure and will continue to lean on public-private partnerships, prioritize the privatization of state assets and create a new infrastructure fund. Other priorities will include robust efforts to consolidate Kenya’s regional leadership in technology and fintech, support the creation and operations of special economic zones and position the country as a destination for business process outsourcing.

The government plans to host an international investment conference in March 2026, which is expected to showcase Kenya’s potential and opportunities in agro-processing; financial services; technology, with Konza Technopolis as a key highlight; the blue economy; and the reviving manufacturing sector. The country’s vast potential and commitment to green energy will also likely be featured, as will opportunities to invest in energy transmission infrastructure.

Impact of Global Geopolitical and Trade Shifts

The impact of U.S. trade policies has not adversely affected Kenya, beyond the imposition of a 10 percent baseline tariff, compared to other countries. However, uncertainty about the long-term viability of the now expired African Growth Opportunity Act trade preferences regime, the significant reductions in U.S. foreign aid and delays in accessing a new IMF country program are incentivizing the country to increasingly focus on new partnerships and investment opportunities in Asia. While the current administration was formerly seen as leaning toward the United States, parallel efforts to deepen trade ties with China and other Asian countries will continue, particularly as the government seeks additional investments and funding for infrastructure projects. Kenya’s foreign policy will therefore continue to prioritize strategies and partnerships that align with country’s economic interests.

We will continue to keep you updated on developments in Kenya as they occur. If you have questions or comments, please contact BGA Kenya Managing Director Dickson Omondi at domondi@bowergroupasia.com.

Best regards,

BGA Kenya Team

Dickson Omondi

Managing Director, Kenya