Kenya’s Strategic Position as a Regional Financial and Technology Powerhouse

WHAT YOU NEED TO KNOW

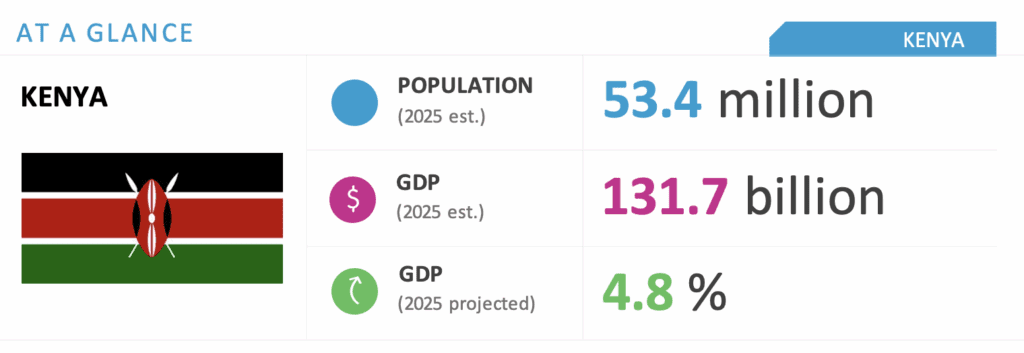

- The macroeconomic environment is projected to remain favorable, with GDP growth projected at 4.8 percent. The effects of a stronger currency, growing foreign exchange reserves and lower food and energy prices are expected to sustain a stable inflation rate. The monetary policy is projected to loosen, with the goal of cutting loan interest rates and spurring economic activities.

- Fiscal pressures will persist. The 2025-2026 budget deficit capped at 4.5 percent of GDP will necessitate austerity measures and new borrowing that might in turn affect retail lending rates. Debt servicing will continue to be a significant portion of government expenditure, although recent Eurobond and commercial loan pay-offs have alleviated liquidity pressures and rollover risks.

- The tempo of political activities will increase with the appointment of the election commission and contribute to a highly dynamic environment with potential realignments across the political spectrum.

ON THE HORIZON

- The National Treasury September 30 will publish a comparison of the actual financial performance from 2024-2025 against set appropriations. This will also update and highlight changes in the macroeconomic and financial forecasts.

- The Africa Growth Opportunity Act (AGOA), under which Kenya has enjoyed duty-free market access for some goods in the United States, will expire in September. A comprehensive trade agreement will be important to address baseline tariffs imposed by the United States April 2. It is unclear how Kenya’s relations with China will affect discussions given geopolitical tensions.

- Although not factored into the 2025-2026 budget, the government has begun discussions for a new International Monetary Fund (IMF) lending facility. This follows the abandonment of the extended fund facility and extended credit facility programs.

Kenya Market Overview and Forecast

Political Climate

Environment To Be Shaped by Early Preparations for 2027 General Election

The political environment will be shaped by several factors associated with the 2027 general elections. The most significant of these will be shifting political alliances that trace back to the fallout between President William Ruto and former Deputy President Rigathi Gachagua. To boost his support, Ruto struck a political alliance with former Prime Minister Raila Odinga’s Orange Democratic Movement (ODM). The alliance remains shaky because some ODM leaders are concerned about the electoral implications of supporting the president. Opposition politicians will focus on building a credible coalition to challenge Ruto. Realignments are expected and will be driven by regional and ethnic dynamics, which have historically influenced voter preferences. Ruto’s policy and administrative decisions will continue to be influenced by these dynamics and the need to consolidate political support.

The appointment of the Independent Electoral and Boundaries Commission (IEBC) will herald new forms of contestation. The IEBC is expected to review the voter register within six months of reconstitution. This process, alongside a decision on the delayed electoral boundary delimitation process, is a likely flashpoint for polarization. Despite these and trends of increased youth activism, the country is expected to remain politically stable.

Macroeconomic Climate

Macroeconomic Resilience

Despite fiscal challenges and an uncertain global trade environment, the IMF projects macroeconomic resilience. Kenya’s GDP growth is projected at 4.8 percent, a downward revision from the IMF’s October 2024 forecast of 5 percent, reflecting concerns over a global economic slowdown. Kenya’s projected growth trends above global and regional averages — which are projected to ease to 2.8 percent and 3.8 percent, respectively — and the country is set to become East Africa’s largest economy. Growth will continue to be supported by enhanced agricultural productivity and the service industry, particularly in the financial sector. Slowed global demand and low global market prices for some agricultural products will pose risks.

Inflation is projected to stay within the target 5 percent. If inflation remains within this margin, the Central Bank of Kenya (CBK) will continue easing the monetary policy to stimulate economic activities through lower interest rates. Growing foreign currency reserves, a steady trend of diaspora remittances and the success of this year’s Eurobond issuance will help the Kenya shilling remain relatively stable, although some level of depreciation should be expected.

Fiscal pressures will continue to evolve. Moody’s revision of Kenya’s credit outlook from negative to positive reflects progress in debt management. However, the 2025-2026 budget expenditure faces deficits that the government plans to cap at 4.5 percent of GDP. Options to bridge the budget deficit will rely on a mix of borrowing, spending efficiency and broadening the tax base. The government will likely focus on commercial borrowing and tapping into the domestic market. This will undercut the CBK efforts to curb interest rates and lower the cost of retail borrowing.

The risks posed by external shocks and global economic uncertainty are considerable. A global economic slowdown will have ramifications for Kenya’s exports. U.S. President Donald Trump’s imposition of a 10 percent baseline tariff on Kenya’s exports and the uncertainty surrounding the renewal of AGOA threatens preferential market access of Kenyan exports to the United States. Although the government downplays the effect of the tariffs, indirect exposure to global trade disruptions may risk economic stability. The conflict in the Middle East and the potential impact on oil prices further poses risk that could undercut progress in stabilizing inflation rates.

Investment Environment

Positioning Kenya as a Regional Financial and Technology Innovation Hub

The government will continue with sustained efforts to position Kenya as a regional financial and technology innovation hub. The recent launch of an artificial intelligence strategy, the drafting of a regulatory framework for cryptocurrency and digital assets and improvement of the national payments system will complement earlier innovations in mobile money transfers and create opportunities for investors. This year’s Finance Bill similarly proposes a reduction of the digital assets tax from 3 percent to 1.5 percent, a move designed to boost the digital economy. Effective July 1, the CBK will lift a long-standing freeze on licensing of new commercial banks, opening opportunity for new investments in the sector.

The government’s efforts to bridge fiscal deficits have often resulted in expanded revenue collection measures targeting both individual taxpayers and the private sector. This year’s Finance Bill does not propose any incremental increases in personal income taxation. By taking a conservative approach to revenue-raising measures, the government hopes to avert the kind of hostile public response that was witnessed during the launch of the 2024-2025 budget. However, this raises questions about revenue gaps and the need to narrow deficits and might lead to a situation in which the government changes strategy, through supplementary budgets, within the budget period. More robust interventions are therefore needed to achieve tax predictability and consistency. Budget deficits also provide impetus for the government to emphasize public-private partnerships, particularly in infrastructure projects.

The small and medium-sized enterprises (SMEs) sector will continue to be a priority under the Bottom-Up Economic Transformation Agenda. The sector has great potential to contribute to growth through the economic empowerment of traditionally excluded populations such as women, youth and persons with disabilities. To address challenges facing the sector, the government has initiated a review of the SMSE 2020 policy with the goal of improving market access, upgrading micro, small and medium-sized enterprise infrastructure, reducing regulatory barriers and strengthening access to finance.

Corruption remains a significant factor impeding investments in the country. Despite a strong legal framework, fighting corruption remains an uphill task. The government is enacting a conflict of interest law that will seek to provide an institutional framework for the management of conflicts of interest applicable to all public officers. If passed, the key test will remain in the law’s implementation.

We will continue to keep you updated on developments in Kenya as they occur. If you have questions or comments, please contact BGA Kenya Managing Director Dickson Omondi at domondi@bowergroupasia.com.

Best regards,

BGA Kenya Team

Dickson Omondi

Managing Director, Kenya