Korea Forecast: Partisan Strains, Fiscal Headwinds and AI-Driven Investment Momentum

WHAT YOU NEED TO KNOW

- President Lee Jae Myung has maintained steady approval ratings in the first six months of his administration since his June inauguration, backed by relatively stable economic and foreign policy management. Political stability has been reinforced by the ruling Democratic Party’s overwhelming majority at the National Assembly.

- The Lee administration unveiled its policy agenda in August for the next five years, emphasizing artificial intelligence (AI), semiconductors, Korean culture, and renewable energy as future growth drivers.

- The local stock market reached record highs in November, supported by renewed optimism in the global information technology sector and Lee’s commitment to addressing the so-called “Korea discount.” Strong foreign capital inflows have signaled improved investor confidence.

- Prolonged U.S.-China trade negotiations have weighed on Korea’s export sectors, including automobiles, semiconductors, batteries, steel, and shipbuilding.

- Seoul’s efforts to improve relations with Beijing have been constrained by issues such as China’s installation of steel structures and floating platforms in the Yellow Sea’s Provisional Measures Zone.

ON THE HORIZON

- The Lee administration is expected to continue its drive for prosecutorial, judicial and other institutional reforms while promoting greater market fairness. It will also continue to try stabilizing the real estate market, promote the equity market, expand youth employment and strengthen social welfare.

- Seoul-Washington relations may face challenges ahead amid uncertainty over U.S. President Donald Trump’s policy direction.

- Seoul-Tokyo cooperation is expected to continue with Japan’s new leadership under Prime Minister Sanae Takaichi.

- The government will likely sustain its conciliatory gestures toward China and North Korea to maintain regional stability.

- Local and by-elections on June 3, 2026, will serve as a key midterm test for President Lee and his Democratic Party to gauge public support.

Korea Market Overview and Forecast

Political Climate

Deepening Partisan Divide and Legal Challenges Ahead of 2026 Elections

In aftermath of the June 2025 presidential election and the run-up to the 2026 local and by-elections, Korea has witnessed escalating confrontations between the two major parties and the widening scope of investigations involving figures within the opposition People Power Party (PPP). The special prosecutor’s probe has expanded to examine alleged ties between the PPP and the Unification Church — including charges of illicit funding from the church — as well as potential irregularities in party membership. These developments are expected to weigh on the party’s preparations for next year’s elections. With the investigations continuing, the ruling Democratic Party may be dragged into the same controversies that it wanted to use against the PPP.

At the institutional level, the aftermath of sweeping prosecution system reform continues to reverberate throughout the country. The transition from the Prosecutors’ Office to the newly established Public Prosecution Service has generated discontent within the legal community, while the ruling Democratic Party’s proposal to expand the Supreme Court and introduce new judicial oversight mechanisms has stirred controversy and growing resistance from judges. Disagreements between the presidential office and the Democratic Party’s more hardline lawmakers are expected to persist over the pace and scope of reform. Meanwhile, the PPP faces ongoing internal challenges over leadership and ideological direction as the party leader, Jang Dong-hyuk, is accused of overly appeasing conservative extremists and thus losing the support of centrists.

Macroeconomic Climate

Korea Eyes Modest Recovery in 2026 as Fiscal Pressures Mount

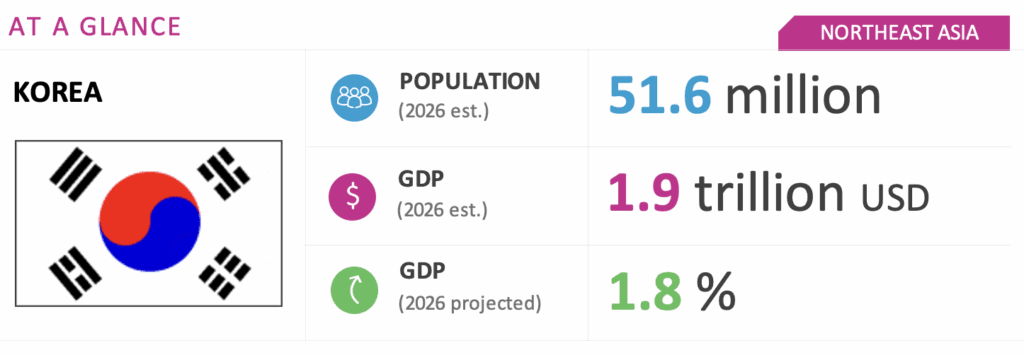

Korea’s macroeconomic outlook for the first half of 2026 points to a modest but steady recovery. According to the International Monetary Fund (IMF), the country’s GDP is expected to grow 1.8 percent, supported by easing global uncertainty, accommodative policies and base effects from a slower 2025. Domestic consumption and investment are projected to regain momentum gradually as policy support filters through the economy.

The Bank of Korea is expected to maintain its key rate at 2.5 percent through the end of 2025, with a potential rate cut in the first quarter of 2026 if inflationary pressures continue to subside. Exports could remain a relatively bright spot as Korean firms actively diversify markets and strengthen resilience against global volatility.

The weakness of the won is one key concern for policymakers. The Finance Ministry and the central bank are holding frequent meetings over the issue. Fiscal sustainability is often mentioned among conservative commentators as another key concern, which the progressive Lee government denies. The government projects the national debt-to-GDP ratio to increase from 49.1 percent in 2025 to 51.6 percent in 2026, reaching 58 percent by 2029. The IMF expects Korea’s D2 ratio (consolidated general government debt) to reach 53.4 percent this year, up 3.6 percentage points from 2024, ranking third among 11 non-reserve-currency advanced economies, after Singapore (175.6 percent) and Israel (69.2 percent).

Investment Environment

Pro-Business Lee Government Drives Investment Momentum With Growth Fund and AI Push

The Lee administration’s pro-business stance is expected to continue into 2026, reaffirming its goal of making Korea a preferred market for global investors. The government aims to bolster investor confidence through structural reforms and predictable fiscal management, supported by major capital-market developments. The April 2026 inclusion of Korean government bonds in the World Government Bond Index is expected to attract significant foreign inflows and enhance market liquidity.

If the current broad-based rise in asset prices across multiple sectors persists, part of the aging population’s wealth could shift from real estate to financial assets, aligning with Lee’s vision of a more balanced investment culture.

Meanwhile, the government plans to mobilize the KRW 150 trillion ($105.4 billion) National Growth Fund to channel long-term capital into strategic sectors such as AI, semiconductors and biotechnology. In parallel, the administration has pledged KRW 10 trillion ($7 billion) in AI investments for 2026, alongside large-scale research and development and infrastructure projects, including the semiconductor mega-cluster and a national AI data center, marking the first major budget execution year under the Lee government.

On the sidelines of the Asia-Pacific Economic Cooperation summit in Gyeongju, Korea, on October 29, Seoul and Washington agreed to lower U.S. auto tariffs on Korean cars and auto parts from 25 percent to 15 percent in return for a long-term Korean investment commitment of $350 billion in the United States. To minimize volatility in the dollar-won market, the investment will be structured in two parts, with $200 billion delivered in cash through annual installments capped at $20 billion. The United States also agreed to ensure that any semiconductor tariffs would not disadvantage Korean chip exports compared to those from Taiwan. The agreed points were released in a joint fact sheet November 13.

The agreement offers near-term certainty for Korean automakers and their supply chains by safeguarding U.S. market access. However, the scale of overseas investment could constrain domestic capital allocation and affect Korea’s broader investment priorities, which the government is mindful of and actively addressing through various policy measures.

We will continue to keep you updated on developments in Korea as they occur. If you have questions or comments, please contact BGA Korea Managing Director B.J. Kim at bjkim@bowergroupasia.com.

Best regards,

BGA Korea Team

B.J. Kim, PhD

Managing Director