Malaysia Forecast: Political Realignment, Fiscal Reforms and Investment Incentive Overhaul

WHAT YOU NEED TO KNOW

- Malaysia signed an Agreement on Reciprocal Trade with the United States October 26, under which the United States will continue to impose a 19 percent tariff on Malaysian imports. However, the agreement does not address potential tariffs for several of Malaysia’s key exports to the United States, including pharmaceuticals, medical devices and semiconductors.

- The Malaysian government launched the 13th Malaysia Plan (2026-2030) in July. The five-year plan focuses on developing Malaysia’s capacity in the fields of digital economy, artificial intelligence (AI) and renewable energy. This includes investments in developing the workforce and building supporting infrastructure.

- Prime Minister Anwar Ibrahim is set to reshuffle his Cabinet in December following the resignation of the minister of investment, trade and industry. Anwar must also appoint a minister of economy and minister of natural Resources and environmental sustainability to fill vacancies that have existed since May.

ON THE HORIZON

- Anwar’s administration will turn its attention to the next general election following the Sabah state election and Cabinet reshuffle at the end of 2025. Although the general election is not due until late 2027, it can be held in 2026 to align the electoral cycle with state elections in Melaka and Johor.

- A carbon tax will be introduced in 2026 targeting the steel, cement and energy sectors. An estimated MYR 3 billion ($710 million) in revenue will be generated from the taxes, which would then be reinvested into green innovation funds and programs.

- The New Investment Incentive Framework will be fully implemented in the manufacturing and services sectors in the first half of 2026. The framework addresses Malaysia’s aspiration to become a high-income country by focusing on investment outcomes, including the creation of high-income jobs and the bridging of economic gaps between regions.

Malaysia Market Overview and Forecast

Political Climate

Anwar Balances State Polls, Cabinet Reshuffle and General Election Timing

Prime Minister Anwar’s unity government is expected to face the repercussions of two key political events, scheduled to happen before the end of the year. The recent November 29 state election in the eastern state of Sabah has seen the ruling incumbent, Gabungan Rakyat Sabah (GRS), maintain its hold on the state government, albeit with a smaller majority and coalition size. Despite partnering with GRS, Anwar’s own national coalition, Pakatan Harapan, experienced a near-total wipeout, winning only one seat for the elected State Legislative Assembly. The complex nature of the election is further underscored by the presence of both GRS and that of their primary state opposition, Warisan, within the federal unity government.

The election outcome will have ripple effects at the federal level. Both GRS and Warisan have consistently campaigned for greater state autonomy, including control over revenue collection from the state’s oil and timber resources. Anwar has publicly noted that the federal government does not intend to stand in the way of the revenue collection matter, meaning federal revenue projections will need to be augmented. This may have further implications on the government’s capacity for fiscal expansion, including on developmental expenses.

The second key political event is the impending Cabinet reshuffle, which is expected to take place in December. The reshuffle will be prompted by the expiration of Minister of Investment, Trade and Industry Tengku Zafrul’s second and final Senate term. Tengku Zafrul will not be able to hold a ministerial post without a seat in Parliament. Anwar must also fill the positions of the Ministry of Economy and Ministry of Natural Resources and Environmental Sustainability, which have been vacant since May. The respective ministers, Rafizi Ramli and Nik Nazmi, resigned from their positions following their losses in the party elections of Anwar’s People’s Justice Party (PKR). Anwar will likely consolidate internal party support by accommodating the newly-appointed PKR leaders into the new Cabinet.

These intertwined political events will determine the durability of Malaysia’s multi-coalition political framework heading into 2026. Nevertheless, the Anwar administration is expected to remain broadly stable as the main opposition Perikatan Nasional coalition struggles with political infighting.

The outcome of the Sabah state election and public reception to the Cabinet reshuffle will intensify internal discussions to advance Malaysia’s next general election. While the general election is not constitutionally due until late 2027, the government has reportedly considered holding the general election in the second half of 2026. An early general election will align with state elections in the government strongholds in the states of Melaka and Johor, which are due in late 2026. Streamlining the political cycles will also allow the unity government to contest all major elections under a unified strategy, reduce electoral costs and minimize voter fatigue.

Macroeconomic Climate

Anchored Growth Amid Fiscal Consolidation and Structural Reforms

After hosting the 47th Association of Southeast Asian Nations summit from October 26-28, Malaysia received long-awaited clarity regarding U.S. tariff rates with the signing of the Agreement on Reciprocal Trade. Under the agreement, the United States will maintain a 19 percent tariff on Malaysian imports. This provides much-needed stability for Malaysia’s export outlook given that the United States is Malaysia’s largest export destination. Currently, Malaysian exports to the United States are valued at MYR 22 billion ($5.2 billion) and account for up to 12 percent of Malaysia’s total exports. At this stage, however, Malaysia has not secured any exemptions or lowered tariffs for several key export sectors, including pharmaceuticals, medical devices and semiconductors.

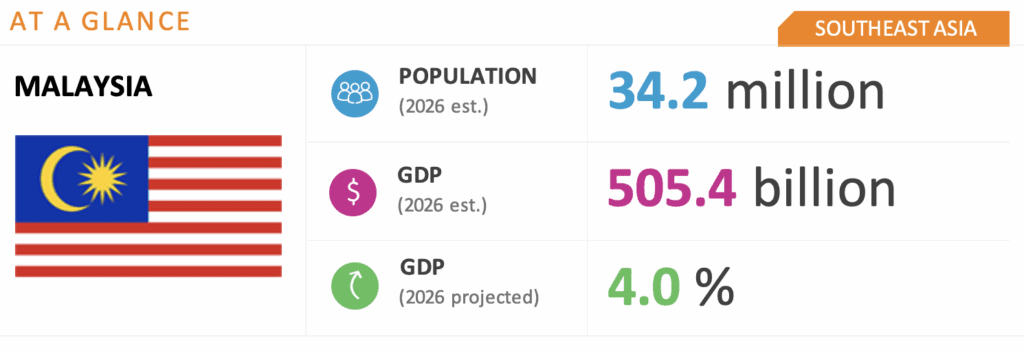

Malaysia’s economic growth in 2026 is projected to remain moderate amid slower global demand and external headwinds, with the International Monetary Fund and the World Bank forecasting GDP expansion of around 4-4.1 percent. The Ministry of Finance projects a comparable trajectory of 4-4.5 percent, underpinned by robust domestic demand, stable labor market conditions and continued public and private sector investments.

Inflation is expected to remain contained within the 2-3 percent range. Although the government expanded the sales tax and rationalized RON95 fuel subsidies in the second half of 2025, these fiscal reforms were scaled back from their initial proposals to avoid drastically increasing pressure on the cost of living. Apart from the announced implementation of a carbon tax for specific sectors and an increase in excise duties for tobacco and alcohol, no further introduction or expansion of consumption taxes are expected in 2026 as the government nears the election cycle.

Investment Environment

Malaysia Recalibrates Incentives To Encourage High-Income Jobs and Spillover Effects

Malaysia’s medium-term 13th Malaysia Plan (2026-2030), launched in July, reinforces Malaysia’s aspiration to become a digital, AI and renewable energy hub. The plan focuses on building the necessary supporting infrastructure, developing high-skilled talent and attracting high-value investments in these sectors. Malaysia is already on track to achieve 40 percent renewable energy capacity by 2035 and 70 percent by 2050 under the National Energy Transition Roadmap.

To achieve these aspirations, the government will roll out the New Investment Incentive Framework in the first half of 2026. The framework will be fully implemented in the manufacturing sector in the first quarter of 2026, followed by the services sector in the second quarter. The framework will introduce a new evaluation mechanism to grant incentives, ensuring that better incentive rates are given to investments that generate high-income jobs and economic spillover effects for less-developed regions.

Malaysia’s rare earths industry will also be in the spotlight in the coming months. As part of the U.S.-Malaysia trade deal, Malaysia agreed to eliminate rare earth element export quotas to the United States and restrictions on the sale of rare earth magnets to U.S. companies. Aside from the United States, Malaysia is already advancing talks with China to establish rare earth processing facilities. Similarly, Japan has expressed interest in the cooperative development of Malaysia’s rare earth elements, critical minerals and other mineral-related sectors.

To advance decarbonization efforts, Malaysia will introduce a carbon tax in 2026 targeting energy-intensive sectors such as steel, cement and energy. The carbon tax is part of Malaysia’s effort to decarbonize key industries, potentially generating MYR 3 billion ($710 million) in government revenue. This would then be reinvested into green innovation funds and programs.

We will continue to keep you updated on developments in Malaysia as they occur. If you have any comments or questions, please contact BGA Malaysia Deputy Managing Director Sadiq Nor Azlan at msadiq@bowergroupasia.com.

Best regards,

BGA Malaysia Team

Sadiq Noor Azlan

Deputy Managing Director