Political and Economic Forecast | H1 2026

Below is an introductory letter from BGA President and CEO Ernie Bower on the company’s latest half-yearly regional forecast, circulated to clients and prospects to help inform their planning for the upcoming months.

Dear colleagues,

As we prepare to begin 2026, our world has changed. And it is never going back to the way it was. The Indo-Pacific and Africa, along with the rest of the world and their private sectors, are working desperately to understand what’s changed, what impact these changes will have on their interests and to determine how to adapt.

The three core drivers of our new landscape are U.S. President Donald Trump’s economic and foreign policy, the evolving U.S.-China rivalry and the new age of artificial intelligence (AI.)

BGA’s first half 2026 report examines these trends and explores their short to medium-term impact at regional and country levels. Ours is a deep dive into the countries we work in on your behalf, including 27 countries across the Indo-Pacific and our first six countries in Africa. We include a special report on the explosive expansion of trade and investment between Asia and Africa, and the increasingly close connections on regulatory and policy development between these current and future pillars of growth for the global economy.

Over the course of 2025, tariff actions and shifting trade policies have rippled through economies and supply chains, challenging assumptions that once underpinned global commerce. U.S. tariffs — imposed under emergency powers and other statutes — have not only disrupted long-standing norms but accelerated trends that were already underway: the acceleration of multipolarity, diversification to manage trade risk and the race to dilute reliance on traditionally dominant markets, especially the United States. Even as the Supreme Court weighs the legality of these measures, businesses and governments cannot afford to wait. Tariff-driven disruption is now a structural reality.

In response, most countries are accelerating free trade agreements, digital economy frameworks and regional integration initiatives to restore stability. The Association of Southeast Asian Nations (ASEAN) has pushed forward with upgrades to its agreements with Australia, New Zealand and China, while its negotiations for a Digital Economy Framework Agreement (DEFA) aim to harmonize rules for data flows, e-commerce and digital identity. Africa is advancing its own digital trade protocols under the African Continental Free Trade Area (ACFTA). These moves reflect a determination to build alternative platforms for predictability, yet fragmentation persists and has increased. Diverging standards on trade, digital rules, sustainability and industrial policy risk creating a patchwork of rules that will make it harder for companies to navigate and plan.

The U.S.-China relationship remains a defining driver of change. Though a fragile truce in late October paused escalation, underlying tensions endure—especially around technology and critical minerals. U.S. Section 232 investigations into semiconductors and pharmaceuticals are already reshaping global production networks and complicating cooperation with partners. China is deepening its outreach to ASEAN and Belt and Road Initiative (BRI) partners, reinforcing its gravitational role as center for trade and investment. Beijing’s forthcoming 15th Five-Year Plan signals a push for advanced manufacturing and standard setting, seeking to align economic development with security imperatives while expanding its influence across the global south.

India’s evolving role deserves special attention. It is, in our view, the keystone country to focus on for the next decade and beyond. Long seen as a balancing power, India is now positioning itself as a leader of fast-growing global economies. It is an option to consider in the context of U.S.-China competition. India saw this era coming. It is championing inclusive growth, digital governance and resilient supply chains. Its role in engaging both the United States and China, leading the BRICS developing nations grouping, prioritizing Africa, partnering with the Middle East through the India-Middle East Corridor and ensuring stability in the India Ocean are important signposts to watch. For companies, India’s trajectory offers both opportunity and complexity: a market of scale, a hub for technology and a voice that increasingly matters in global rule making.

Technology and energy supply chains illustrate the depth of these shifts. The United States has pursued technology prosperity deals with Japan and Korea to strengthen supply chains for advanced components, even as semiconductor imports face scrutiny under Section 232. Should tariffs be imposed, global production networks could be disrupted, slowing progress on AI and digital governance frameworks. Meanwhile, Asia is asserting leadership in shaping responsible AI norms, with India and ASEAN poised to influence global standards. Companies must track these developments closely, as regulatory harmonization — or lack thereof — will shape market access and innovation trajectories.

Energy and critical minerals add another layer of strategic complexity. U.S.-led agreements with Australia, Japan and ASEAN on rare earths and clean energy supply chains aim to reduce dependence on China, but they also introduce new competitive pressures and geopolitical alignments. Countries adhering to U.S.-anchored frameworks will gain preferential access to financing and markets, while others seek to balance Chinese and Western offers to maximize national value. This dynamic will intensify competition for resources and investment, reinforcing the need for companies to integrate geopolitical risk assessments into their sourcing strategies.

Financial markets and consumer sectors are not immune. While direct tariffs have spared financial services, the sector faces effects from higher costs, market volatility and slower growth driven by trade tensions. Consumer goods companies must contend with evolving sustainability regulations, extended producer responsibility mandates and fragmented compliance regimes across jurisdictions. These trends underscore a broader reality: trade policy is no longer a siloed concern but a cross-cutting factor influencing every sector, from technology and energy to finance and consumer markets.

Collective responses to global trade disruptions are emerging, but their effectiveness will depend on sustained political will and institutional capacity. Regional frameworks such as ASEAN’s DEFA, Africa’s digital trade protocol and plurilateral initiatives on supply chain resilience represent important steps toward mitigating uncertainty. Yet, the proliferation of bilateral deals — often negotiated under duress — risks entrenching a tiered system of trade governance that could exacerbate fragmentation. For businesses, this means navigating a world of overlapping obligations, where compliance is not merely a legal requirement but a strategic differentiator.

In 2026, a confluence of economic and geopolitical forces will continue to test the resilience of institutions, businesses and governments. The interplay of tariffs, technology competition, resource security and regional flashpoints underscores a fundamental truth: the era of compartmentalized risk is over.

Success for both governments and companies in this environment will hinge on agility, deep insight and decisive action. Winners will develop the ability to integrate trade strategy with geopolitical foresight, regulatory intelligence and operational agility.

At BowerGroup, we are confident our approach to providing you with unmatched local expertise along with client-driven regional foresight will continue to provide premium value. Our expansion to Africa is an investment in the future, and it is already paying dividends to our companies and to our company. Our core values are putting people first, providing unmatched value to our clients and the countries we work in and building ethical trust.

Thank you for your continued trust and collaboration. We look forward to expanding our work together in 2026 and beyond.

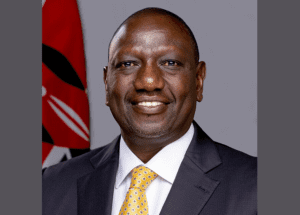

Sincerely,

Ernest Z. Bower, President and CEO, BowerGroupAsia

Ernest Z. Bower

President & CEO