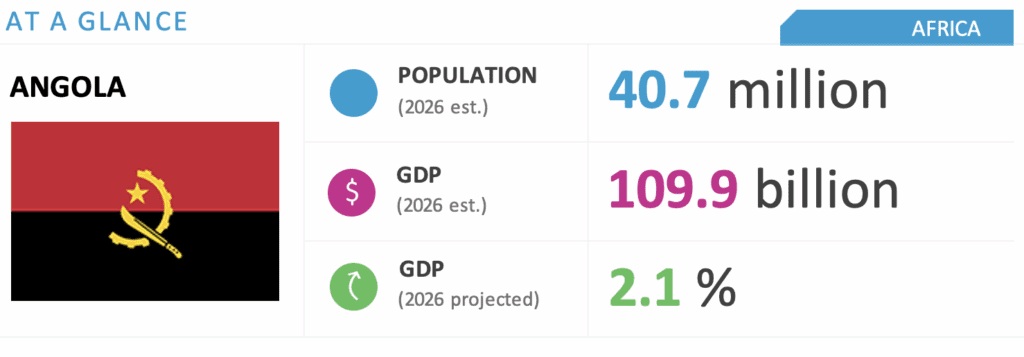

Angola Forecast: Political Instability, Economic Diversification and Lobito Corridor Investment

WHAT YOU NEED TO KNOW

- Angola is sub-Saharan Africa’s third-largest economy. The country is still heavily dependent on commodities, making it highly vulnerable to price shocks.

- At the same time, production volumes of hydrocarbons continue to decline because of the maturity of some of the most productive blocks and operational issues due to aging infrastructure.

- Angola’s economy is struggling to regain dynamism. Dependence on the oil and gas sector remains a challenge, with efforts to diversify the economy falling short of the country’s goals.

- Despite global trade disruptions and the shifting foreign policy priorities under U.S. President Donald Trump, Angola remains a strategic partner for the United States and is expected to attract U.S. investment.

ON THE HORIZON

- Angola hosted the African Union and European Union forum in November. This could offer an opportunity for Angola to serve as a regional platform for Africa-Europe cooperation, attracting investment, visibility and projects.

- New elections will be held in August 2027. Although a high level of government social spending is expected, oil production will decline and public tensions will increase due to a lack of job opportunities and high living costs.

- BGA expects that the People’s Movement for the Liberation of Angola (MPLA) will remain in power after the next elections. The current president, João Lourenço, is serving his second and final term. The party amended its statutes in late 2024 to allow for a separation of roles, meaning the party chairman and the country’s president could be different individuals. João Lourenço could remain MPLA chairman and choose one of his loyal aides to be a presidential candidate.

Angola Market Overview and Forecast

Political Climate

Political Instability Continues To Affect Political Landscape

Political instability will continue to affect Angola in the coming months. Fuel subsidy cuts and limited economic opportunities led to widespread public frustration and protests in July. Around 30 people died, and about 1,200 were arrested. BGA expects that the political environment will face challenges between 2026-2027, with opposition parties making more demands of the government.

Divergences are growing inside the MPLA as well. New figures are emerging to challenge the presidency of the party, including strong personalities such as Higino Carneiro, Fernando Dias da Piedade Nandó and Isaac dos Anjos. MPLA President Lourenço will face fierce opposition, because older members of the party are not satisfied with the current situation and positioning of the leadership.

BGA expects that the MPLA will retain power in the next elections. However, its popularity will likely continue to diminish, mainly due to its limited success in reducing inequality and creating jobs. The government’s program to reform the state and strengthen institutional capacity, which aims to address excessive bureaucracy and a lack of accountability, has fallen short of expectations.

Under Lourenço, tackling corruption has been a flagship initiative, but eradicating the culture of bribery has proven difficult. The government’s anti-corruption drive has therefore not yielded tangible results, with politically complex patronage networks difficult to dismantle.

Macroeconomic Climate

Foreign Policy and Economic Diversity

Angola’s foreign policy is largely guided by the need to attract investment to diversify the economy. Lourenço shifted the country’s foreign policy to be more U.S.-oriented and source more U.S. investment. So far, investment in the Lobito Corridor is one of the most critical projects in Africa, with financial support from Washington. The United States considers Angola to be a strategic partner, given its vast energy resources and its prime location as a potential export hub for critical minerals from Africa.

Meanwhile, oil and gas remains the most crucial sector of the Angolan economy, representing 29 percent of GDP, according to the African Development Bank. The value chain has gained additional traction with the start of operations at the new Cabinda refinery, which has a commercial initial capacity of 30,000 barrels per day after many years of delay.

Angola is becoming a regional player, with new U.S. companies entering the market. A $1.5 billion investment was signed with U.S. company Hydro-Link in mid-2025 to develop a transmission line from Angola to the Democratic Republic of Congo’s resource-rich areas.

Angola remains an oil economy, even as output has declined for several years. In September, Angola reached its lowest production in recent years, producing around 1.1 million barrels per day, down from 1.2 million in recent years. This will impact the sustainability of the government’s fiscal policy in the short term. BGA believes that the government will need to use fuel subsidies to cover the current situation.

Investment Environment

Key Ambassador for Investment in the Country

Lourenço has assumed the role of the leading ambassador of Angola’s economic goals, aiming to build trust among international investors. Nevertheless, the situation still has much room to improve. For example, PROPRIV, the government’s privatization program, has had only mixed results. From 2019-2022, 96 state-owned enterprises out of a target of 178 were privatized.

Angola’s investment environment is not particularly attractive, given perceptions of endemic corruption, a cumbersome bureaucracy and low corporate transparency.

We will continue to keep you updated on developments in Angola as they occur. If you have any questions or comments, please contact BGA Angola Senior Adviser Mário Almeida at malmeida@bowergroupasia.com.

Best regards,

BGA Angola Team

Mário Almeida

Senior Advisor, Angola