Navigating Indonesia’s Regulatory Complexity and Shifting Budget Priorities

WHAT YOU NEED TO KNOW

- President Prabowo Subianto began the year with approval ratings of around 80 percent. His early popularity has been driven by follow-through on campaign promises and moves like canceling a value-added tax hike.

- Prabowo in February launched Danantara, a new sovereign wealth fund taking over state-owned enterprises. Its investment arm is funded through major budget reallocations.

- Major bills on state-owned enterprises, mining and the military passed after just weeks of deliberation. This pace is unusually fast for Indonesia and is expected to continue.

- The stock exchange halted trading on March 18 for the first time since the pandemic following a sell-off tied to weak economic indicators and policy uncertainty.

- Indonesia was caught off guard by the 32 percent tariffs announced by U.S. President Donald Trump. Officials responded with a conciliatory approach, including plans to increase imports from the United States and offer some regulatory concessions.

ON THE HORIZON

- The 2026 state budget, the first fully drafted by the Prabowo administration, will be deliberated in August. A relatively prudent approach is expected, although large-scale social programs will remain a focus.

- A cabinet reshuffle, previously signaled for six months into the Prabowo term has been delayed, likely due to economic headwinds. It could still proceed should conditions stabilize.

- Indonesia will continue negotiating with the U.S. administration prior to the end of the 90-day freeze on additional tariffs. Talks have been constructive so far.

- Despite Prabowo’s recent pro-trade rhetoric, sweeping deregulation is unlikely during the forecast period. Both policymakers and domestic industries are highly reluctant to move away from protectionist policies.

Indonesia Market Overview and Forecast

Political Climate

Elite Inclusivity Drives Political and Social Stability

President Prabowo’s extreme inclusivity among elites, exemplified by the largest Cabinet since 1966, has contributed to one of the most stable political environments Indonesia has seen in recent years. This approach stands in contrast to the polarization observed in many democracies globally.

No significant opposition has emerged in the legislature, and major bills on state-owned enterprises, mining and the armed forces were passed within weeks. These timelines are far shorter than the months or even years seen under previous administrations. However, this pace has also limited opportunities for broader public consultation and industry engagement. Businesses should expect this pattern of muted participation and compressed timelines to persist throughout the forecast period.

Decentralized Regulatory Landscape Adds Complexity

Fragmented policymaking within the executive has been a defining feature of the administration’s first six months. This is driven in part by institutional changes, including the removal of presidential review for ministerial regulations, and by the absence of powerful coordinating figures who previously enforced discipline across the Cabinet. These changes have allowed ministers significant discretion to pursue their individual agendas.

As a result, policymaking authority is increasingly shaped by each minister’s political standing rather than proximity to the president. This marks a departure from dynamics under the previous administration and complicates government relations for businesses. Businesses have had to navigate a series of regulatory surprises, including the prolonged ban on the latest iPhone series due to local content issues, new restrictions on profit repatriation in the natural resources sector and abrupt age limits for digital platforms. Without stronger internal oversight mechanisms, the fragmented and often unilateral policymaking style will likely continue.

Macroeconomic Climate

Growth Forecast Downgraded Amid Softening Demand

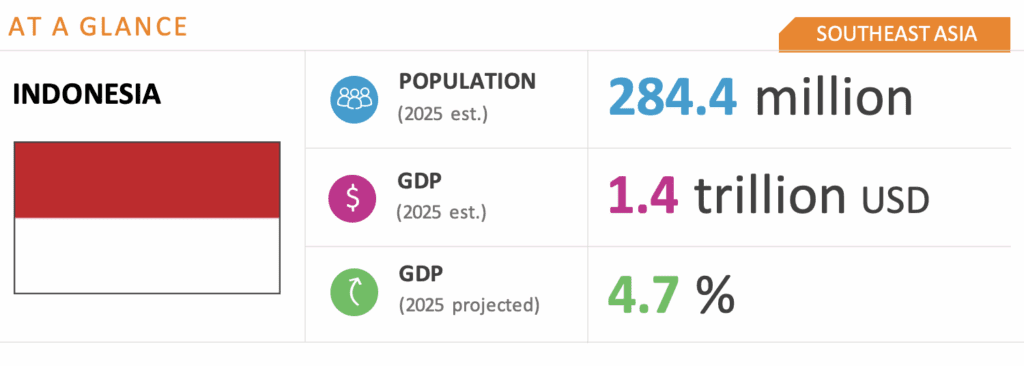

Indonesia’s GDP growth forecast for 2025 was revised twice in the first half of the year, settling at 4.7 percent — down from the initial estimate of 5.1 percent. Even before the U.S. tariff announcement, observers noted persistent structural pressures on Indonesia’s middle class and, by extension, domestic consumption — the country’s primary growth engine.

The share of jobs considered to be middle class has fallen to single digits in the past five years. Unlike in many other upper-middle-income economies, most new employment in Indonesia continues to be concentrated in the informal sector, which accounts for 60 percent of the workforce. In the first quarter of the year, loan growth slowed, a brief period of deflation occurred and retail activity and Eid travel volumes declined significantly. Automobile sales dropped nearly 9 percent year on year. These indicators suggest a weakening in consumer confidence, even though Indonesia remains one of the more optimistic consumer markets globally.

Programs such as free school meals and subsidized housing may offer support, but their macroeconomic impact will likely be gradual. Businesses targeting middle- and lower-income segments should plan for continued price sensitivity and uneven demand across sectors and regions.

Budget Execution Reflects Shifting Priorities

The Prabowo administration’s decision earlier this year to reallocate nearly a tenth of government spending to fund Danantara, a newly established sovereign wealth fund, raised concerns among investors. The administration’s growing reliance on large-scale state-led initiatives, including the free meals program and a target to build three million homes annually, has prompted questions about whether Indonesia is shifting away from the fiscal prudence that has underpinned its macroeconomic credibility for the past two decades.

While economic fundamentals remain sound and these programs hold medium- to long-term promise, investors have taken note of the fluid nature of their financing and implementation along with a shift away from familiar priorities such as infrastructure. The proposed 2026 budget, due in August, is expected to offer greater clarity and a more consistent signal of the administration’s fiscal and policy direction — one that will likely remain relatively prudent but constrained by tighter fiscal space compared to previous budgets.

Investment Environment

Selective Liberalization, Continued Industrial Policy

Indonesia’s response to U.S. tariff measures has been pragmatic. The government signaled a willingness to increase select imports, particularly in energy and agriculture, and ease regulatory requirements in targeted sectors such as local content rules in technology. However, officials remain reluctant to pursue broad deregulation, despite initial hopes following Prabowo’s pro-trade remarks. Economic policy continues to reflect long-standing preferences for import substitution and selective industrial planning. This is expected to continue shaping the investment climate in the second half of the year.

Deal-by-Deal Approach Continues, With Broader Reforms on Hold

The administration has expressed strong interest in attracting more foreign direct investment but has focused on a “dealmaking” approach. Rather than pursuing systemic investment climate reforms, it has favored tailored incentives for individual firms and specific projects. High-profile project delays and cancellations in the battery sector, a priority industry, reflect not only challenging market conditions but also concerns about coordination and policy delivery.

Although investment appetite remains, with absolute foreign direct investment inflows continuing to rise, investors are seeking reassurance that large-scale state-driven programs will not come at the expense of the next generation of structural reforms introduced under the 2020 Job Creation Law. These include efforts to ease trade restrictions, rationalize local content rules and reduce reliance on blanket import controls. However, such reforms are not currently a government priority and are unlikely to advance in the near term.

We will continue to keep you updated on developments in Indonesia as they occur. If you have any questions or comments, please contact BGA Indonesia Managing Director Douglas Ramage at dramage@bowergroupasia.com.

Best regards,

BGA Indonesia Team

Douglas E. Ramage

Managing Director