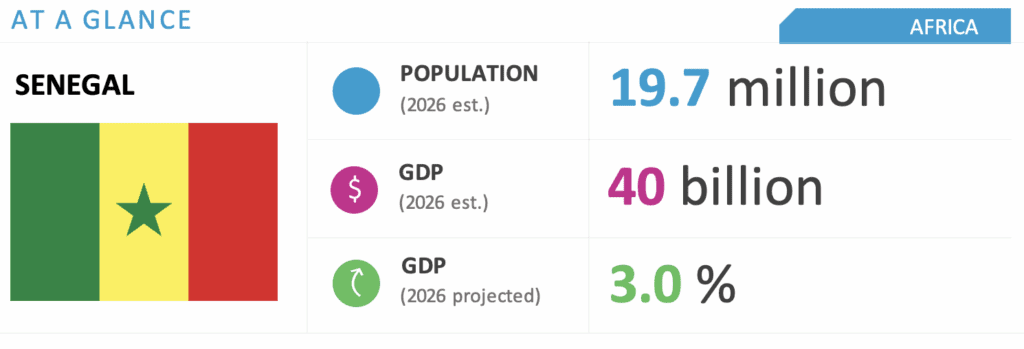

Senegal Forecast: Reform Continuity, Robust Growth and PPP-Driven Sectoral Investment

WHAT YOU NEED TO KNOW

- The administration under President Bassirou Diomaye Faye continues to implement a reform-oriented agenda emphasizing economic sovereignty, transparency and institutional strengthening. The International Monetary Fund’s (IMF) recent staff visit underlined that Senegal’s economy remains resilient in 2025, while stressing the importance of continued improvements in debt management, fiscal institutions and governance to sustain growth and investor confidence.

- Senegal is experiencing material fiscal pressure: public debt and debt-service costs have risen sharply, limiting the government’s fiscal headroom and its ability to launch large, state-funded priority projects. Recent reporting and official analyses highlight that debt-service obligations are absorbing an increasing share of public resources.

- Given tight budgetary space, authorities are prioritizing public-private partnerships (PPPs) as the pragmatic route to deliver infrastructure and public services while preserving fiscal flexibility. PPPs are expected to be the main vehicle used to advance large projects in the first half of 2026.

- Growth remains elevated due to the start of hydrocarbon production, stronger agricultural activity and public-private investment, though headline figures vary across institutions. Multilateral projections point to continued solid growth into 2026, although with risks tied to fiscal sustainability and external price volatility.

ON THE HORIZON

- IMF staff have encouraged continued improvements in fiscal institutions and debt management to sustain growth.

- The speed of tendering, financing terms and local-content clauses are critical for the rollout of PPP pipelines in energy, transport and industrial zones.

- Fiscal deficit trajectory, sovereign bond and yield developments in West African Economic and Monetary Union markets, inflation and reserve buffers will serve as important macro indicators.

- Contract transparency will involve monitoring how oil and gas cash flows are allocated between debt service, capital expenditures and recurrent spending.

Senegal Market Overview and Forecast

Political Climate

Reform Continuity With Pragmatic Fiscal Management

The government under President Diomaye is expected to maintain a steady reform trajectory while adopting a pragmatic fiscal stance. Political continuity and the stated reform priorities provide predictability for investors, yet the fiscal reality will constrain large-scale, solely publicly funded programs. Policymakers are expected to prioritize projects that can be advanced under PPP frameworks or externally financed structures that limit immediate pressure on the budget. This approach preserves investment momentum while addressing fiscal constraints highlighted by the IMF.

Investors should expect increased PPP announcements and competitive tendering. They should also anticipate stronger scrutiny on local content, governance and contract transparency. Clients are advised to engage early in PPP dialogues, ensure compliance and governance safeguards and prepare for more exacting procurement and due-diligence processes.

Macroeconomic Climate

Robust Growth, Constrained Fiscal Space

Macroeconomic momentum remains favorable, driven by hydrocarbons, a recovering agriculture sector and investment activity that increasingly leans on private financing. However, the government’s fiscal capacity is constrained. Rising debt-service commitments reduce discretionary spending and limit the scope of direct public investment, pushing the authorities to favor PPPs and targeted fiscal consolidation measures. Continued support from multilateral institutions (notably the IMF) will be important to restore full market confidence.

Inflation has moderated recently but remains sensitive to food and energy price shocks; monetary conditions regionally will shape financing costs for private projects.

The Treasury will prioritize debt-service management, arrears clearance and limited, high-impact capital projects delivered via PPP or donor/bilateral financing, until public finances show clearer improvement.

Hydrocarbon Production

The Sangomar oil field, jointly developed by Australia’s Woodside Energy and Senegal’s Petrosen, exported 3.8 million barrels of crude oil in April. The output for 2025 is forecast to reach between 30.5-34.5 million barrels, exceeding earlier estimates. Output in 2026 is expected to remain strong.

The Sangomar field, which began operating in mid-2024, is the country’s first offshore oil development project. Its strong output has moved Senegal into the ranks of leading African oil producers.

Senegal’s oil and gas revenues are expected to reach CFA 753.6 billion ($1.3 billion) from the Sangomar oil field and the Greater Tortue Ahmeyim liquid natural gas project. This gas project, jointly developed by Mauritania, began production in 2024.

Investment Environment

PPPs as the Operational Pivot, With Targeted Sector Focus

Investment opportunities remain attractive but will be channeled through partnership models that reduce immediate public spending. Priority sectors include energy (power generation, grid and gas-to-power), on- and off-shore oil and gas services, agro-processing (value-adding and storage), logistics and selected infrastructure where private finance can be mobilized.

Opportunities in upstream services, midstream logistics, power generation and renewable integration exist in the energy and hydrocarbons sectors. PPP and concession structures and service contracts will dominate large project delivery.

Demand for local processing capacity and cold-chain logistics is growing in the agricultural industry and manufacturing. Projects with clear demand contracts and off-take agreements will be prioritized by financiers.

Private investment in hospitality and urban infrastructure (waste, water and mobility) will be sought through blended finance and PPP vehicles.

Operational risks and mitigants include administrative complexity, land and permitting delays, and commodity-price exposure. These can be mitigated with structured PPP contracts (clear risk allocation), insurance and guarantees (under the Multilateral Investment Guarantee Agency, which is part of the World Bank Group and other multilateral partners) and robust local partnerships.

We will continue to keep you updated on developments in Senegal as they occur. If you have questions or comments, please contact BGA Senegal Senior Adviser Fabienne Diouf at fdiouf@bowergroupasia.com or Adviser Aminata Dia at adia@bowergroupasia.com.

Best regards,

BGA Senegal Team

Fabienne Diouf

Senior Advisor, Senegal and Côte d'Ivoire