Singapore Forecast: Building a Resilient, Sustainable and Innovation-Driven Economy

WHAT YOU NEED TO KNOW

- Prime Minister Lawrence Wong’s leadership, supported by his deputy, ensures steady economic and social policies, with a focus on inclusivity, workforce development and shared prosperity.

- Growth will moderate as external tailwinds fade, although tourism and professional services will be supported by long-term initiatives. This includes digital transformation across all sectors, which will be a key engine of growth.

- As trade and tariff pressures weigh on the economy, Singapore will continue to expand and diversify its strategic partnerships while pushing for a rules-based multilateral system.

- Evolving global tax changes may impact Singapore’s position as an investment hub, but the country will leverage its research and innovation ecosystems to offer opportunities in artificial intelligence (AI) and research commercialization.

- Energy security remains a strategic priority to enhance long-term resilience and position Singapore as a hub for energy-intensive sectors.

ON THE HORIZON

- With cybersecurity under heightened scrutiny following attacks on critical information infrastructure, Singapore is expected to operationalize and introduce subsidiary legislation under the Cybersecurity (Amendment) Bill to focus on enhancing threat detection, incident response and accountability for operators of critical systems.

- The Digital Infrastructure Act is expected to be tabled and passed in 2026, following earlier delays to accommodate the passage of the Online Safety (Relief and Accountability) Bill. The act will enhance the resilience and security of Singapore’s digital infrastructure and essential digital services, extending beyond cybersecurity measures to address a broader spectrum of resilience risks, including physical disruptions like fires and system failures.

- In response to the rise in vaping and abuse of the anesthetic etomidate, the government is expected to introduce more comprehensive, fit-for-purpose legislation to address emerging public health risks. This follows interim steps to classify etomidate under the Misuse of Drugs Act and reflects a broader effort to strengthen Singapore’s regulatory framework to safeguard public health.

Singapore Market Overview and Forecast

Political Climate

Policy Continuity Remains, Accompanied by Emerging Leadership

Prime Minister Wong signaled broad continuity in his governance approach, with a focus on strengthening social cohesion in his National Day Rally remarks in August. This is anchored in the principles of his landmark Forward Singapore initiative, which underscores inclusivity and shared progress.

Against the backdrop of fluctuating and uncertain trade tensions, Wong continues to rely heavily on Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong, who currently leads key economic initiatives such as the Singapore Economic Resilience Taskforce and the Economic Review Committee. Gan is also responsible for ensuring that Singapore will be able to seek the necessary exemptions for its priority exports, primarily for pharmaceutical products and semiconductors, from the United States. While Wong and Gan are heavily supported by the three coordinating ministers — K. Shanmugam, Chan Chun Sing and Ong Ye Kung — in the areas of national security and defense for the first two and social policies for the third, it is unlikely that any of the three will be elevated to deputy prime minister for the time being.

Meanwhile, new members of the Cabinet, including the acting ministers for transport and culture, community and youth — Jeffrey Siow and David Neo, respectively — will be under pressure to solidify their positions and seek promotions to become full ministers through fresh initiatives. This may be difficult, considering recent public transport breakdowns and the controversial gazetting of the late Minister Mentor Lee Kuan Yew’s home as a heritage park. The upcoming budget and ensuing Committee of Supply debates will be an important platform for them to articulate their priorities. Similarly, acting Minister-in-Charge of Muslim Affairs Faishal Ibrahim will be expected to advance engagement with Singapore’s Malay-Muslim community, which feels increasingly disillusioned and isolated from the ruling party’s policies.

Overall, businesses can expect a stable policy environment focused on supporting social progress and inclusive growth. As such, companies should continue to collaborate with their relevant ministries to update and introduce initiatives, such as advancing workforce development, that contribute to Singapore’s broader goals of shared prosperity and resilience.

Macroeconomic Climate

Singapore’s Growth Set To Moderate as External Tailwinds Fade

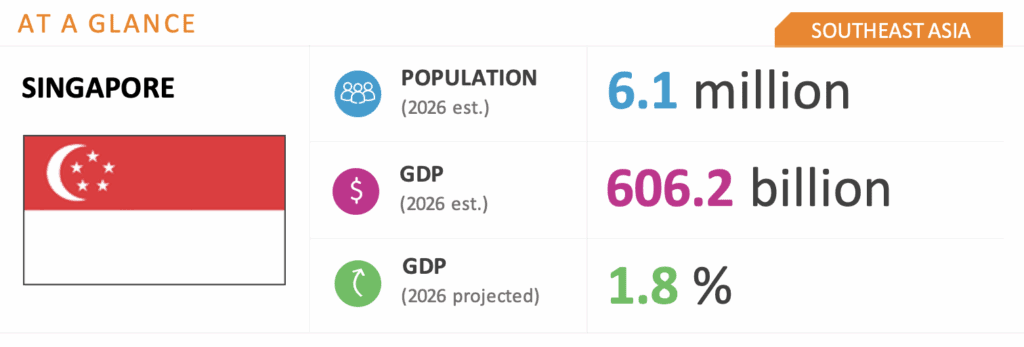

Although recent U.S. trade agreements with regional neighbors have eased some tensions from reciprocal tariffs, uncertainty over sectoral tariffs and other measures remain. Against this backdrop, Singapore’s economy is projected to slow in the first half of 2026 with the Monetary Authority of Singapore forecasting moderated GDP growth estimated to be 1.5-2 percent. This reflects the delayed effects of tariff-related adjustments and their spillover on real economic activity.

Singapore is also looking to recalibrate its long-term economic strategy to strengthen global competitiveness with recommendations from the Economic Review Committee due in mid-2026. This will likely include a stronger focus on trade diversification and strengthening regional supply chain linkages to mitigate tariff-related risks. It is also expected to guide the next phase of digital transformation, particularly in enabling small and medium-sized enterprises (SMEs), representing 99 percent of firms in Singapore, accelerate their adoption of AI and advanced technology solutions. Companies’ increased digital uptake is expected to boost growth in information and communications as well as professional services, alongside continued investment in AI infrastructure amid the global AI boom.

However, growth in manufacturing and trade-related sectors will likely ease following earlier front-loading in response to tariffs. Consumer-oriented sectors such as retail and food and beverage may also experience slower growth as household spending moderates after the temporary boost from government cash vouchers. The Singapore Tourism 2040 roadmap, which aims to triple MICE (meetings, incentives, conferences and exhibitions) tourism receipts by 2040 and expand attractions, will nonetheless help bolster the sector’s resilience by sustaining visitor arrivals.

The Monetary Authority of Singapore projects core inflation to ease in the near term before rising gradually, estimated at 0.5 to 1.5 percent in 2026 as cost pressures normalize. Nevertheless, risks remain, with geopolitical supply shocks potentially lifting costs while weaker than expected growth could keep inflation subdued.

Investment Environment

Singapore Continues Toward a More Resilient, Sustainable and Innovation-Driven Economy

With domestic and multinational enterprise top-up taxes already implemented under the Base Erosion and Profit Shifting (BEPS) 2.0 Pillar Two, the Group of Seven’s proposed “side-by-side” solution exempting U.S.-parented groups may result in higher tax rates for non-U.S.-parented companies. Singapore indicated that it will review its BEPS 2.0 approach once there is greater international clarity, but this differential treatment may prompt firms to reassess their regional footprint and explore neighboring markets.

The forthcoming Research, Innovation and Enterprise 2030 plan, likely to be unveiled in early 2026, will reinforce Singapore’s competitiveness by deepening national research and development investments in applied AI, cross-sector collaboration and stronger research commercialization. The focus on public-private partnerships and innovation ecosystems will likely spur more corporate laboratories, testbeds and regulatory sandboxes, creating opportunities for companies to co-develop solutions with local research institutions and startups for regional and global markets.

In parallel, Singapore remains committed to sustainable growth aligned with its net-zero emissions target by 2050. It will contract more than 2 million tons of nature-based carbon credits from Ghana, Paraguay and Peru, for delivery from 2026-2030. Singapore’s advancement of alternative energy paths, such as biomethane, hydrogen and ammonia and the exploration of next-generation nuclear technologies, are expected to enhance energy security, manage costs and support sustainable growth, particularly for energy-intensive sectors. The establishment of dedicated nuclear teams amid ongoing reorganization within the Energy Market Authority and the National Environment Agency underscores Singapore’s long-term energy and sustainability agenda.

We will continue to keep you updated on developments in Singapore as they occur. If you have any comments or questions, please contact BGA Singapore Managing Director Nydia Ngiow at nngiow@bowergroupasia.com.

Best regards,

BGA Singapore Team

Nydia Ngiow

Managing Director, Global Trade and Economics