Trump Embraces Japan and Korea AI Tech Stacks and Investment Commitments on His Asia Swing

BGA Technology Senior Director William Heidlage and Managing Director for Global Trade and Economics Nydia Ngiow wrote an update to clients on new U.S. memorandums supporting AI technology stacks and investment in Japan and Korea.

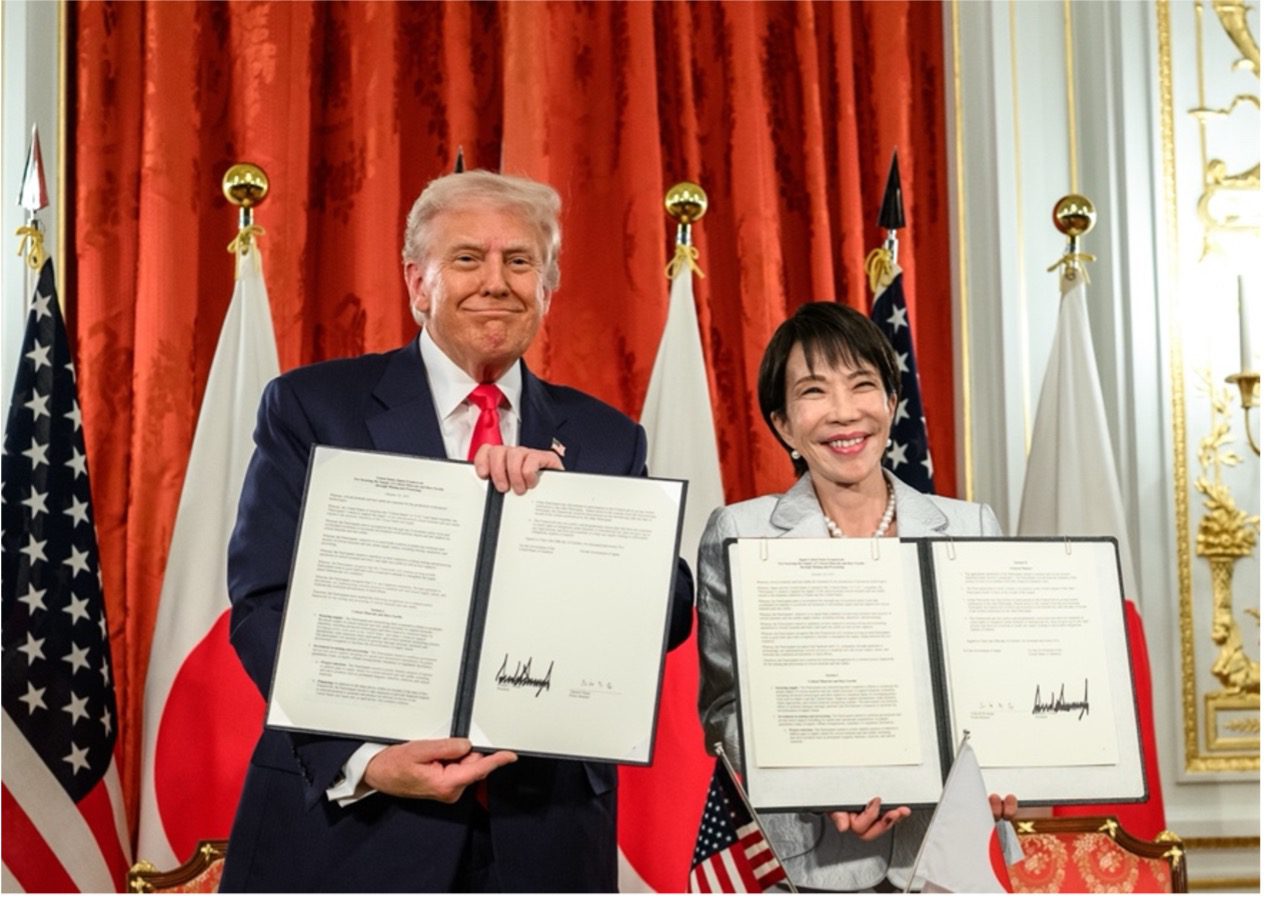

U.S. President Donald Trump signed two deals with Japan and Korea ahead of the Asia-Pacific Economic Cooperation (APEC) Leaders’ Meeting in Gyeongju, Korea, October 29 during a high-profile Asia tour with stops in Malaysia and Japan. The trip focused on strengthening partnerships and securing supply chains for critical minerals and advanced technology in anticipation of a key meeting with Chinese President Xi Jinping. Central to these efforts were the new technology prosperity deals signed with Japan and Korea.

The memorandums with Japan and Korea are nearly identical in structure and scope. Both are focused on accelerating artificial intelligence (AI) development and adoption. They cover collaboration in research security, 6G technologies, pharmaceutical and biotechnology, quantum computing and space exploration while aligning “pro-innovation” technology standards and promoting online child safety mechanisms.

Fundamentally, both promise the collaborative promotion of U.S., Korean and Japanese AI technology stack component exports — the core objective for the Trump administration, which remains focused on increasing U.S. exports globally. They also more closely align Japan’s and Korea’s industrial policy spending with U.S. strategic goals toward China.

The memorandum of cooperation with Japan is modestly more expansive, including collaboration on Open and AI-RAN network standards and fusion energy, but notably does not reference advanced manufacturing explicitly, unlike the deal with Korea.

Rare earth element supply chain security was another major theme of the Asia swing, contextualizing the two technology prosperity deals within broader technology supply chain promotion from the ground up. Under the U.S.-Japan framework, the two countries agreed to establish a mechanism for identifying and implementing rare earth projects, with the flexibility to involve third countries as needed. Earlier, the United States announced agreements with Malaysia, Thailand and Australia.

The United States will deepen collaboration with Malaysia and Thailand on critical minerals supply chain development and expansion while promoting trade and investment in critical mineral resource exploration, extraction, processing and refining, manufacturing and recycling and recovery. Australia and the United States will mobilize government and private sector support through guarantees, loans and equity, finalization of offtake arrangements, insurance and regulatory facilitation to establish a more robust market for rare earth elements and expand Australia’s role as a leading supplier of critical minerals beyond China. See BGA’s analysis on the rare earth deal with Australia and the broader Agreement on Reciprocal Trade with Malaysia.

In addition to the two technology deals with Japan and Korea, as well as progress on broader trade deals that look toward market access, commitments and tariffs, Washington confirmed with Tokyo and Seoul their plans to invest in the United States. Japan confirmed plans for up to $550 billion in U.S. investments, and Korea reiterated commitments tied to its $350 billion pledge. These initiatives, their participants and figures — which stretch beyond the technology sector — are by no means final. It will be important to closely monitor how these projects evolve.

Ahead of APEC, multinational companies pledged to invest $6 billion in Korea, including what Korean President Lee Jae Myung described as “the largest-ever greenfield investment in Korea’s history” by AWS.

These commercial, trade, rare earths and technology prosperity deals built up to Trump’s meeting with China’s Xi October 30, which served as the strategic capstone to the U.S. president’s Asia trip on the sidelines of the APEC Leaders’ Meeting. That meeting produced a deal to reduce U.S. tariffs on Chinese goods and delay the application of export restrictions on advanced chips to an expanded entity list. China committed to crack down on fentanyl precursor exports to the United States, delay export restrictions on rare earth elements and resume purchases of U.S. soybeans.

These engagements highlight ongoing efforts by the United States across bipartisan administrations to strengthen technology ties with key allies, promote standards alignment in emerging sectors and enhance supply chain resilience for critical minerals and advanced components in ways that embrace industrial policy and promotion of strategic commercial sectors. Industry stakeholders may see new opportunities in 6G infrastructure, biotech resilience and rare earth-processing technologies in addition to the opportunities in cloud and semiconductors that have been realized since Trump first took office in 2016. Regulatory harmonization with Japan and Korea on AI and data localization will also be an area to watch. These frameworks will likely influence global norms, including the proceedings of the AI Summit in India in February 2026.

We will continue to provide updates on technology developments. If you have any questions, please reach out to BGA Senior Director William Heidlage or Managing Director for Global Trade and Economics Nydia Ngiow.

Best regards,

BGA Technology Team

William Heidlage

Senior Director