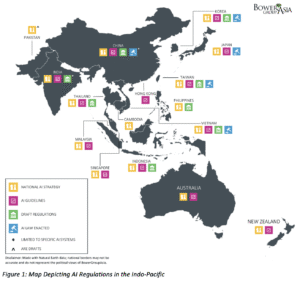

Adapting to Change: Evolving Trends in Consumer and Corporate Behavior

WHAT YOU NEED TO KNOW

- Private consumption has been a key driver of growth in recent years, but rising economic uncertainty is affecting consumer confidence. Consumer surveys indicate that consumers are trying to save money but still treat themselves with occasional splurges.

- Global supply chains are facing increasing stress due to geopolitical events. The new U.S. tariffs and the lingering threat of more have created uncertainty, transforming the viability of existing supply chain models. Key shipping channels are also facing geopolitical pressure. Conflict in the Middle East is ongoing, risking key shipping channels, while bellicose statements about the future of the Panama Canal put shipping companies on notice. Beyond tariffs, more policies in some parts of the world are promoting protectionism, national self-interest and a rejection of global economic integration.

ON THE HORIZON

- The U.S. economy has slowed, and some analysts are predicting a recession at some point based on the current trajectory. Inflation has tempered, but concerns about price increases from the tariffs eroded consumer confidence in the United States in the first half of the year. Even if the tariff pause holds, consumers will likely remain cautious. As the United States is the largest export market for many manufacturers in the Indo-Pacific, a recession would have knock-on effects for many countries in the region.

- Many countries are now looking to secure trade agreements with other economies to diversify export markets. The European Union has reinitiated suspended talks with several countries, including India, the Philippines, Thailand and Australia. Neighboring countries and regional blocs without existing trade agreements are also looking to secure new partnerships and build on existing trading patterns.

- The uncertainty of future tariffs has led to several cascading effects on corporate and consumer behavior. Some companies fast-tracked production and shipping to ensure tariff-free product stockpiles in the United States. As some companies scramble to get goods into the country, stock destined for other markets may experience shortfalls or — if the tariffs are implemented — a glut of products that are no longer viable for sale in the United States.

Sector Overview and Forecast

Macrotrend Monitor

Markets Across the Indo-Pacific Are Getting Older

China, Japan, Korea and Singapore are seeing a substantially aging population. While not at the same rate, other countries in the Indo-Pacific, such as India, Vietnam and Thailand, are also seeing the demographic shift toward an older population. A large part of this shift is due to increased life expectancy, which is in turn changing the age composition of workers and consumers in these markets. Their consumption patterns, tastes and preferences will evolve over time, and this group will become a more notable consumer segment in a number of markets in the Indo-Pacific.

Aging poses significant economic challenges for policymakers, such as potential slower growth as the workforce shrinks and increased fiscal pressures on social security. Addressing these dynamics before they fully emerge will be a priority for governments. A key difference in the outlook for people entering older age groups is the trend toward healthier aging; people may work longer, maintain activities and be focused on maintaining health. Aside from fiscal challenges, government policies will be introduced to assist and protect consumers as they experience cognitive and physical decline.

New Priorities

As populations age, consumer behavior will shift. Older consumers will likely prioritize health, convenience and value. They may be less inclined to experiment with new products and be more loyal to familiar brands. Consumers will also need a wide range of new products to either encourage healthier aging or manage some of the side effects of aging.

Older populations have spurred demand for health-conscious, easy-to-use and functional food and beverage products. Interest is growing in low-sodium, high-fiber and protein-enriched foods as part of an effort to maintain a healthier aging. Packaging that is easier to open or reseal will be needed for people with reduced dexterity, as will packaging with age-appropriate marketing and branding. Food and beverage companies are already responding by altering existing products and launching entirely new product lines aimed at older populations. Examples include nutrient-fortified beverages, specialized dietary supplements and ready-to-eat meals with portion control and simplified labeling.

With food products already tightly regulated, additional regulations will be needed to ensure safe products and accurate, nonexaggerated claims related to benefits. Health professionals will be important advocates for the kind of products that are suitable to support healthier aging and older populations.

Generations may be healthier today than previously, but they are not immune from the associated risks of aging. Preventative health can only go so far. Although many conditions can be managed better than before, some treatments, and the side effects, can be debilitating. More people will be spending more money on increased health care needs in the future.

Not all products are health-focused or primarily aimed at maintaining health. Fashion, wellness and personal care products tailored to customers with conditions such as aging skin, joint health, sleep apnea and incontinence are becoming increasingly prevalent on store shelves in Japan and China.

Marketing and Brand Strategy Adjustments

The aging demographic requires rethinking marketing strategies. Traditionally, the most valuable consumers for advertisers are those aged 18-34. Youth-focused advertising campaigns may no longer be the best investment. Instead, brands are tailoring their messaging to highlight independence and well-being. A large portion of advertising has shifted to social media and online platforms, but older populations typically do not have the same rate of technological uptake. Nevertheless, the generational digital divide will close with time due to cohort replacement. Traditional channels of television and print will still have some role to play, but older consumers who may not be as digitally native are gradually becoming more tech-savvy.

Companies must also navigate cultural nuances across the Indo-Pacific. While Western markets may emphasize individualism and lifestyle in older age, Asian cultures often prioritize family, tradition and intergenerational care. Successful branding in this context may involve highlighting the role of products in maintaining vitality, supporting family caregiving and upholding heritage and quality.

How They Buy

Amid the push for companies to direct consumers to online platforms, the existing older population is traditionally associated with in-person shopping habits. In-person shopping may be preferred to maintain routines and social interaction, but issues such as mobility limitations and convenience have encouraged older consumers to use online platforms for groceries, health products and household goods. Uptake was accelerated during the COVID-19 pandemic.

Other technological innovations, such as digital wallets and the shift away from cash, are also growing among the older population. Increased familiarity with smartphones and user-friendly apps has encouraged more seniors to use digital wallets and mobile payment services. However, concerns about security and data privacy remain, with transnational criminal groups now targeting consumers around the world. Companies taking online transactions will likely be pressured to adopt more security requirements from governments and consumers, young and old.

Policy Implications

New regulations are inevitable for new products. Consumer safety will be front of mind for governments with consumer and packaged goods specifically targeting older populations, particularly any product that has or claims to have direct links to health outcomes. The recent regulations for baby and child formula products provide some insights into how age specific products may be regulated. Differing requirements across the region will also likely be a feature. Although pharmaceutical products are subject to stricter requirements that are more likely to be harmonized, some product types may see different regulatory requirements across the region.

Subsector Highlight

Clothing

The Indo-Pacific’s clothing and garments sector is being disrupted by trade uncertainty, changing consumer expectations and regulations to improve environmental and labor standards. A cornerstone of the economic growth for several countries in the region, clothing exports are now being reshaped by shifting sourcing patterns, government interventions and sustainability-led compliance requirements.

Trade dynamics are complicating the operating environment and not just with U.S. tariffs. Corporate efforts to “de-risk” global supply chains, primarily through diversification, is an ongoing issue. Countries such as Vietnam, India and Indonesia benefited when companies relocated manufacturing from China, but that move has shifted U.S. attention to specific sectors in these countries, particularly clothing and garments. Despite this shift, China is still a major player in clothing and has homed in on the next wave of consumer preferences with ultra-fast fashion. Companies are using artificial intelligence to identify and foster fashion trends with support from efficient production and direct-to consumer channels. This has enabled firms to be at the forefront of constantly evolving trends, and the sector has thrived despite China’s extended producer responsibility and green manufacturing policies.

A key regulation gaining traction is the tightening of environmental and waste management standards in textile production. India is expanding its extended producer responsibility policy, requiring major brands to take accountability for post-consumer plastic waste. Starting July 1, all plastic bags and multilayered packaging in the country must include a barcode or QR code. China’s Ministry of Ecology and Environment is rolling out stricter discharge permits for dyeing and finishing operations under its 2025 green manufacturing road map.

The sector is also seeing a rise in mandatory sustainability and traceability disclosures. Japan is developing garment labeling standards requiring the clear identification of recycled fibers, the country of origin and the carbon impact. Korea’s Ministry of Environment is consulting on new guidelines for lifecycle labeling, including energy and water use. In Singapore, regulators are assessing proposals to strengthen enforcement against unverified sustainability claims, with a focus on fast fashion retailers.

Labor reforms are also being introduced. In major manufacturing hubs, governments are introducing more transparency in wage structures and the digital tracking of working hours. Bangladesh’s new Labor Code (effective in September) mandates public reporting of factory audits, and Cambodia is testing factory compliance in partnership with international brands. These regulatory measures are largely driven by the growing emphasis on ethical sourcing from global buyers and the European Union’s forthcoming Corporate Sustainability Due Diligence Directive, which is prompting Indo-Pacific producers to align with higher standards.

For the remainder of the year, companies operating in the clothing space will face continued pressure to improve supply chain transparency, adhere to stricter environmental and social standards and align with national and international sustainability frameworks. This will take place against a backdrop of shifting regulatory requirements in global trade. As companies eagerly await favorable outcomes for trade negotiations between the United States and production hubs, engagement with host governments is essential to understand the best opportunities for existing supply chain models.

We will continue to keep you updated on developments in the consumer packaged goods (CPG) sector as they occur. If you have comments or questions, please contact BGA Director Alex Jones at ajones@bowergroupasia.com.

Best regards,

BGA CPG Team

Alex Jones

Director