Indo-Pacific Forecast | H2 2025

Below is an introductory letter from BGA President and CEO Ernie Bower on the company’s latest half-yearly regional forecast, circulated to clients and prospects to help inform their planning for the upcoming months.

Dear friends and colleagues,

The world is being reshaped at a pace we have not witnessed in recent history. U.S. President Donald Trump is driving much of this change with his radical plans for restructuring the global economy and addressing what he sees as urgent national security issues. Many of the changes we are witnessing are a significant acceleration of changes that were already underway. Trends such as anti-globalization, growing multi-polarity in geopolitics, aggressive protectionism, vast redesigning of global supply chains, increasing U.S.-China tensions, the rise of India’s role in the global economy and the weakening of the Association of Southeast Asian Nations (ASEAN) are examples.

In this context, I am pleased to share BGA’s regional forecast for the second half of 2025. We publish this report semiannually to help you anticipate new challenges and seize emerging opportunities in the Indo-Pacific and Africa for the half year ahead.

This installment features insights and intelligence from BGA’s 235 people working on the ground in more than 32 markets in the Indo-Pacific and Africa. Our analysts evaluate the regional and country trends and make predictions to provide insight you can use to plan and navigate in these challenging geopolitical and economic times.

I am thrilled to let you know this update includes insight into the five countries we now cover in Africa with our new colleagues in Angola, Côte d’Ivoire, Senegal and South Africa, building on the inaugural Kenya section in the last forecast.

Africa will play an increasingly important role in the world economy due to its favorable demographics, strategic resources and growth potential. The continent will become even more deeply integrated into the global marketplace as these advantages converge and multiply. Countries are seeking to diversify and develop new trading partners, and this is driving heretofore unseen levels of trade and investment between Asia, Africa and the Middle East. Europe’s role is also being elevated in new trade patterns.

Disruptions to global trade are underway following the abrupt implementation of the Trump administration’s “America First” policy and imposition of “reciprocal tariffs” — since temporarily paused — on many of the markets covered in this forecast.

The initial rates could be devastating for export-oriented economies like Vietnam, Cambodia and Bangladesh, smaller trade-dependent countries and African countries under the African Growth and Opportunity Act, which may not be renewed when it expires in September.

Even for countries that have escaped with comparatively lower baseline tariffs, the impact of U.S.-China trade disputes will recreate significant and cascading effects. This includes weakened Chinese demand for goods and services and potential Chinese dumping in ASEAN and other Indo-Pacific markets. Although recent trade discussions between U.S. and Chinese officials in Geneva temporarily lowered tariff rates and suspended nontariff countermeasures, there are no guarantees that this ceasefire will persist.

Many countries are already seeking negotiations with the U.S. Trade Representative and the Treasury and Commerce departments to mitigate the impact of Trump’s trade measures on their economies. Proposed concessions include reductions in tariffs and nontariff barriers against U.S. exports. Countries are also exploring buying more airplanes, liquefied natural gas, agricultural products and military equipment from the United States to reduce their trade surpluses. But the outcomes will be case dependent, with much hinging on what each country can offer. Whatever the results, policy instability and global restructuring are forcing a reevaluation of corporate strategies and investment decisions.

The Trump administration’s “America First” outlook and preference for bilateral dealmaking mark a stark break from the post-World War II global economic order, but Indo-Pacific economies are taking steps to ensure that Trump does not single-handedly upend the system. As chair of ASEAN, Malaysia is leading a unified response to promote rules-based trade. However, Malaysia’s position on the Israel-Palestine conflict and its overtures to Beijing put it in a challenging position with Washington.

Across the region, governments are taking different approaches to attract investment to make up for possible losses to trade and investment with the United States. In Indonesia, the Prabowo administration has sought to lure investment through dealmaking as opposed to systemic investment climate reforms. Other countries have elected to liberalize their investment environment. China is relaxing regulations to attract foreign capital, Taiwan is enhancing its investment policies and Cambodia is positioning itself as a dynamic, reform-driven investment destination. Malaysia’s new investment incentive framework is due to launch in the third quarter. In Thailand, Vietnam and Sri Lanka, the development of major infrastructure projects will remain a priority as the countries seek to boost regional connectivity and become regional investment hubs.

Casting itself as a bulwark against protectionism, China has sought to boost trade cooperation with countries in the region while exploring pathways to expand into Europe. This dynamic will likely deepen the wedge in the U.S.-China relationship and further inflame geopolitical tensions. As always, middle-power countries in the Indo-Pacific will be forced to balance their ties with each superpower while seeking new security and trade partnerships to narrow their exposure to risk.

Geopolitical risks remain a fixture of this forecast. Recent fighting between India and Pakistan could escalate into a broader war between the two nuclear-armed states despite the best efforts by both sides and international mediators to contain hostilities. Myanmar teeters on the brink of collapse from a raging civil war that could spread into neighboring countries and destabilize the region. Though beyond the scope of coverage, the conflicts between Israel and Palestine and Russia and Ukraine have had a polarizing effect on many Indo-Pacific states, which have felt compelled to choose sides. This has in some cases led to the deterioration of ties between countries in the region.

China continues to have a moderating influence on countries that are home to some of the region’s flashpoints. Beijing is trying to tamp down North Korean aggression and prevent spillover from the Myanmar conflict. But its actions in the Taiwan Strait and South China Sea present additional risks.

As ever, natural disasters and climate change pose significant risks to livelihoods, business operations and supply chains, as the devastation from Myanmar’s recent earthquake palpably demonstrated. Trump’s preference for fossil fuels and dismissal of climate change will force Indo-Pacific countries to adapt their energy strategies. But the adoption of green technologies continues apace due to technology uptake and consumer demands that are accelerating renewable energy deployment.

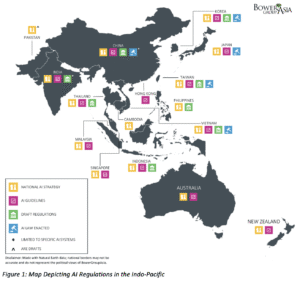

U.S. tariffs on semiconductors are expected to disrupt technology supply chains as companies look to minimize political risks and reduce their dependence on China. The administration is also expected to introduce more stringent artificial intelligence (AI) technology rules to block China’s access to emerging technologies. Conversely, China’s dominance of the critical minerals supply chain and tightening export controls on rare earth elements are opening new opportunities for other markets in the Indo-Pacific — particularly Indonesia, Pakistan and countries in Africa.

Despite manifold challenges, opportunities remain as companies look to diversify their supply chains and bring more manufacturing to the United States. But stakeholders will need to adapt and innovate to maintain a competitive edge and stay ahead of the curve. Agility will be a core trait of companies that succeed during this transition.

This is also true for technologically ascendant countries like Singapore, which is recalibrating its innovation agenda to meet evolving investor expectations, and Japan, which is establishing a legal framework for massive financial support for AI and semiconductors.

Recent elections in Australia, India, Singapore and Sri Lanka have resulted in victories for the incumbent parties, highlighting a broader trend of political stability in the region. The biggest outlier in this context was the impeachment of President Yoon Suk-yeol in Korea. Elections to replace him will be held June 3.

Still, previously unthinkable political shifts are taking place, albeit incrementally. In Singapore, the opposition’s performance suggests that a two-party system is becoming increasingly likely. South Africa’s African National Congress lost its parliamentary majority last year for the first time in the history of the country’s democracy, forcing it to join a governing coalition. These developments underscore the electorate’s demands for increased accountability as voters become more politically engaged and better informed.

Within the next year, national polls will likely take place in Bangladesh, Japan, Myanmar and New Zealand. In Africa, Angola, Côte d’Ivoire and Kenya will also hold elections. These will serve as referendums on the incumbents’ performance and gauge the public’s appetite for change.

Expect nothing short of a turbulent forecast period, marked by abrupt and sometimes volte-face changes. The Indo-Pacific’s dynamism, its greatest asset, will be a lodestar through the chaos. For Africa, its demographic dividend and its relative resilience will serve it well looking into the next two decades.

Our clients are recalibrating strategies, and to do that well in this new world, high fidelity at a local level is a necessary input to retooling global plans. BGA sits in the center of that process as a trusted partner.

While many firms in our sector are disappearing due to consolidation and others are being forced to price services at high levels to fund private equity and other buy-out partners, BGA stands apart. We remain committed to quality, building on the strongest local presence across the Indo-Pacific, and we are now creating that same local capability in Africa’s most important markets. We are family owned, committed to our clients and the countries where we work and building for the long haul.

My team and I are delighted to be at your service and to help you understand the regional trends that will define the next six months. We hope you use this forecast to guide your decisions and secure winning business outcomes.

Thank you for your consideration and support.

Sincerely,

Ernest Z. Bower, President and CEO, BowerGroupAsia

Ernest Z. Bower

President & CEO