The BGA China team wrote an update for clients on the mix of opportunities and challenges in China’s climate space. The update explored the impact of climate change on China and how the Chinese government and companies are reacting to it.

Context

After decades of rapid industrialization and emission-intensive economic growth, China is now facing an environmental crisis that threatens the livelihoods of its 1.4 billion people. China sees faster temperature and sea-level rise than most parts of the world, while regions across the country are frequently hit by natural disasters caused by climate change.

In response, China continues to outline a mix of domestic and international measures. Domestically, recent developments include a release of China’s action plan on reaching carbon peak by 2030 and a white paper on China’s policies. Internationally, headlines have been dominated by China’s commitment to not build new coal-fired power plants abroad.

Significance

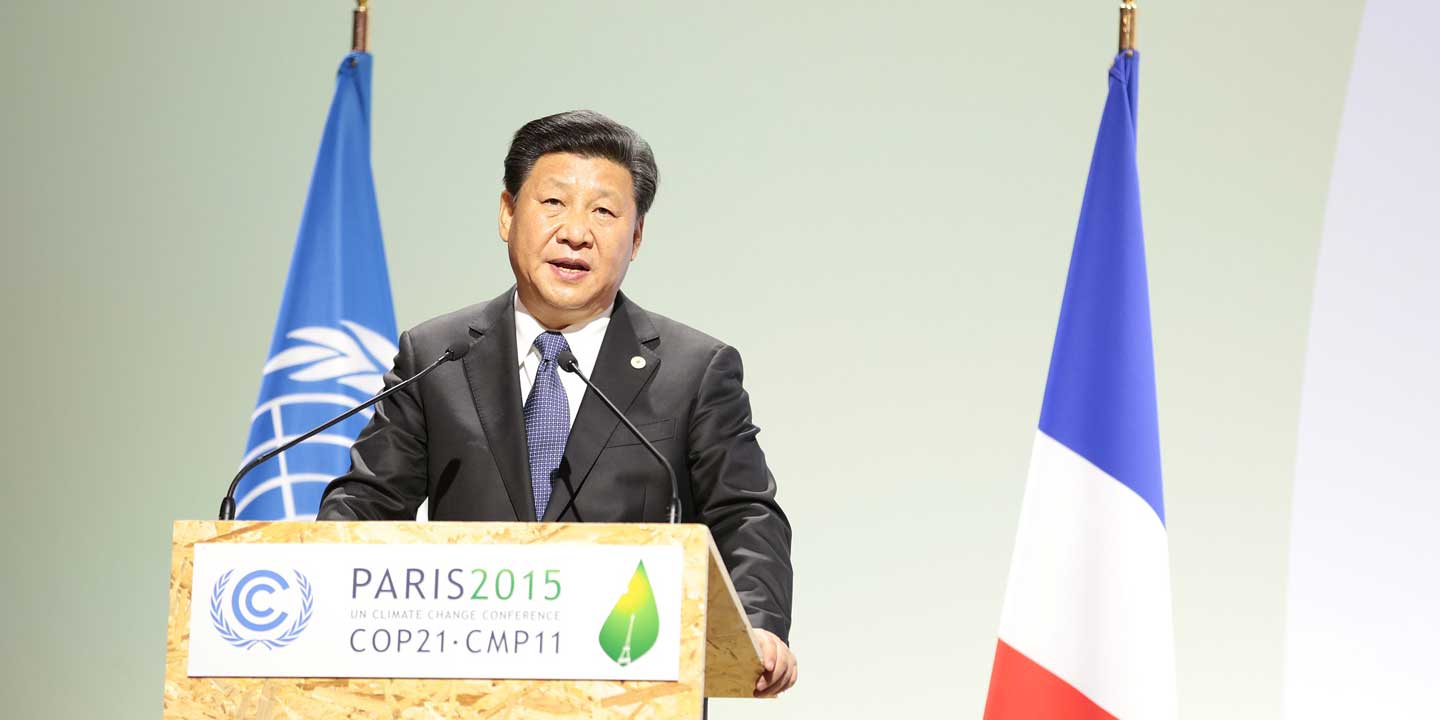

China’s government will need to address a gap between objectives and realities. While Chinese President Xi Jinping has announced China will reach its emission peak in 2030 and carbon neutrality by 2060, there is no indication of how Beijing, the world’s largest coal consumer, will achieve this. Thus far, China has neither set a target for coal consumption nor unveiled timeline for reaching its emission peak.

Beyond the government, private sector entities have important roles to play in China’s climate space. Encouraged by the government’s commitment and the vast investment opportunities ahead, capital from state-owned enterprises and private sector entities is pouring into environment-related sectors, such as renewable energy and electric vehicles.

Implications

Chinese policymakers will need to get past constraints as they pursue climate goals. China has run into short-term difficulties as it transitions to clean energy, which include maintaining adequate power supplies while restricting coal power generation as evidenced by a recent round of power outages.

There will continue to be pressure on the Chinese government to advance initiatives in the climate space, including in key areas like green financing. While China needs approximately $21.3 trillion over the next 40 years to achieve its carbon neutrality target, there are still few incentives for Chinese and international investors to buy green bonds, and these will need to be stepped up to boost private participation.

BGA will continue to keep you updated on developments in China as they occur. If you have any comments or questions, please contact BGA Advisor Eric Wang at ewang@bowergroupasia.com.

Advisor

Eric has over two decades’ experience in government affairs and public relations and currently serves as firm partner and managing director of Yuan Associates. He has worked with more than 80 clients in manufacturing, agriculture and food, consumer goods and service industries. Eric joined Yuan Associates in 2005 and become a partner and managing director in 2011. As managing director, he is responsible for comprehensive government affairs service for and management of clients. As a partner his responsibilities include overseeing the firm’s daily overall operations. Prior to joining Yuan Associates, Eric worked as an account manager for Euan Barty Associates ...

Read More