The BGA China team wrote an update for clients on China’s expanding regulatory crackdown. The update spotlighted the background for the interaction and sieved out key insights for companies.

Context

China has been experiencing a regulatory crackdown in the past few months that stretches to almost every sector. At least 14 crackdowns are underway on business sectors and individuals as of September.

The focus of the crackdown is broad. The crackdown stretches to every sector, ranging from technology to after-school tutoring and gaming. This includes campaigns against certain market behavior such as monopolistic practices and “disorderly expansion of capital” as well as sweeping overhauls of some industries for social wellbeing.

Significance

The clampdown has quickly spread within firms in sectors such as tech and then also infringed into others as well. The stock market has been shuddering due to unexpected policy changes and uncertainty about what will come next. Press articles had surfaced suggesting that Beijing plans to get tough on more industries.

The spillover effects are key to watch. In its latest crackdown on September 24, China outlawed all financial transactions tied to cryptocurrency. Authorities have vowed to stamp out crypto trading and the mining of digital assets, threatening to punish those who partake in such activities and causing the prices of some major cryptocurrencies to crumble.

Implications

The lack of predictability in China’s regulatory and financial environment should serve as a warning to potential investors. Several waves of selling have hit Chinese stocks listed overseas since the start of the crackdowns, and the liquidity crisis of property giant Evergrande has raised concerns about systemic risk or even a potential Lehman Brothers moment during the 2008 Global Financial Crisis.

Things do not look to be getting better anytime soon. Beijing released a five-year blueprint on August 11 calling for more effective regulations, suggesting the crackdown will last for years and spill over into more sectors.

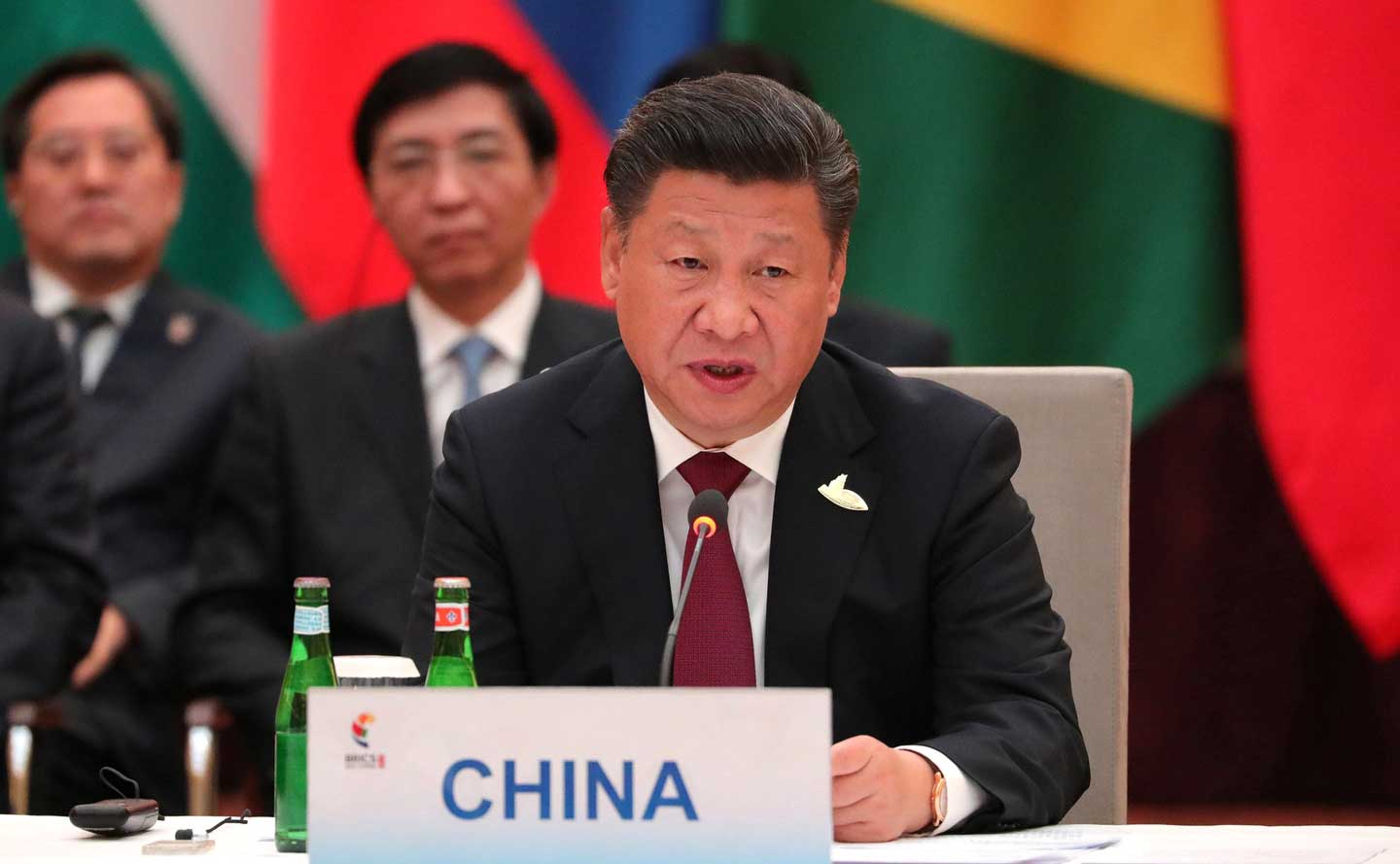

Not all industries are of equal concern. In a speech last year, Xi explicitly stated that the internet and services sectors are “nice to have,” but manufacturing is a “need-to-have” sector for the country. He believes that high-end manufacturing in sectors such as semiconductors, electric vehicles, commercial aircraft and telecommunications equipment should be leading the economy, not the internet.

BGA will continue to keep you updated on developments in China as they occur. If you have any comments or questions, please contact BGA Advisor Eric Wang at ewang@bowergroupasia.com.

Advisor

Eric has over two decades’ experience in government affairs and public relations and currently serves as firm partner and managing director of Yuan Associates. He has worked with more than 80 clients in manufacturing, agriculture and food, consumer goods and service industries. Eric joined Yuan Associates in 2005 and become a partner and managing director in 2011. As managing director, he is responsible for comprehensive government affairs service for and management of clients. As a partner his responsibilities include overseeing the firm’s daily overall operations. Prior to joining Yuan Associates, Eric worked as an account manager for Euan Barty Associates ...

Read More