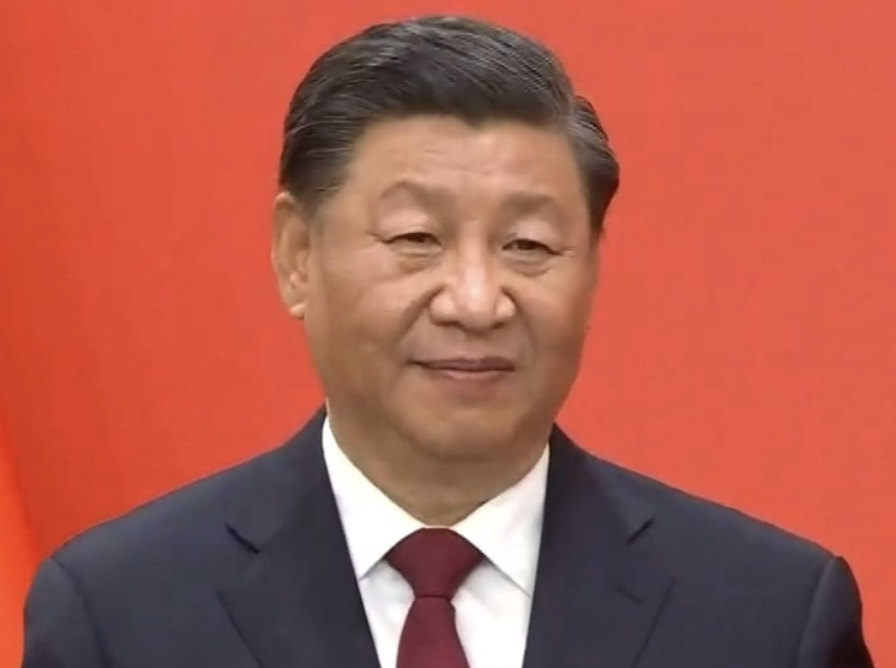

Chinese Communist Party (CCP) General Secretary Xi Jinping addresses journalists at the Great Hall of the People in Beijing, Oct 23, 2022.

Photo Credit: Wikimedia Commons (link)

The BGA China Team, led by Senior Advisor Haiying Yuan, wrote an update for clients on the outcomes of China’s “two sessions” meeting.

Context

- China’s two sessions refers to two annual government and party meetings that take place in March: The National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC). The NPC is China’s top legislative body and its main function is to pass laws and policies that guide the country’s development and governance.

- There currently are five main priorities for China’s economic development:

- Increasing domestic demand.

- Building a modern industrial system with higher supply chain resilience and security.

- Supporting private investments and strengthening the state-owned economy.

- Making greater efforts to attract foreign investment.

- Preventing major economic and financial risks.

Significance

- The meetings reaffirmed the policies set during last October’s 20th National Congress of the Communist Party of China (NCCPC), which had a strong focus on high-quality economic development and strengthening China’s technological, supply chain and food and energy security resilience.

- These meetings also marked the beginning of Xi Jinping’s second decade as leader of both the Communist Party of China (CPC) and the Chinese state. Unlike in previous years, the major personnel announcements, economic development targets and even restructuring of key government agencies and functions were unsurprising. Nor do they represent an ambitious new agenda compared with the priorities of the government under Xi over the last 10 years.

Implications

- The meetings saw the establishment of the National Financial Regulatory Administration (NFRA), a milestone for China’s financial regulatory mechanism reform. NFRA will be a very powerful government agency overseeing all financial sectors except the stock and securities markets.This move is crucial given the increasing risks of debt in the housing sector and local governments, and the uncertainty in global financial markets in light of the developing financial and banking crisis in Europe and the United States.

- The government promises to continue improving market access to China, particularly for modern service sectors, and to ensure full implementation of national treatment for foreign investors. The overall business environment for foreign companies is expected to improve; however, there is still uncertainty given the tension between China and the United States and on how the government will balance “development” with “security” issues in foreign investment policies.

BGA will continue to keep you updated on developments in China as they occur. If you have any comments or questions, please contact BGA Advisor Eric Wang at ewang@bowergroupasia.com.

Advisor

Eric has over two decades’ experience in government affairs and public relations and currently serves as firm partner and managing director of Yuan Associates. He has worked with more than 80 clients in manufacturing, agriculture and food, consumer goods and service industries. Eric joined Yuan Associates in 2005 and become a partner and managing director in 2011. As managing director, he is responsible for comprehensive government affairs service for and management of clients. As a partner his responsibilities include overseeing the firm’s daily overall operations. Prior to joining Yuan Associates, Eric worked as an account manager for Euan Barty Associates ...

Read More