Fragile Trade Truce, Strategic Moves to Attract Foreign Investment

WHAT YOU NEED TO KNOW

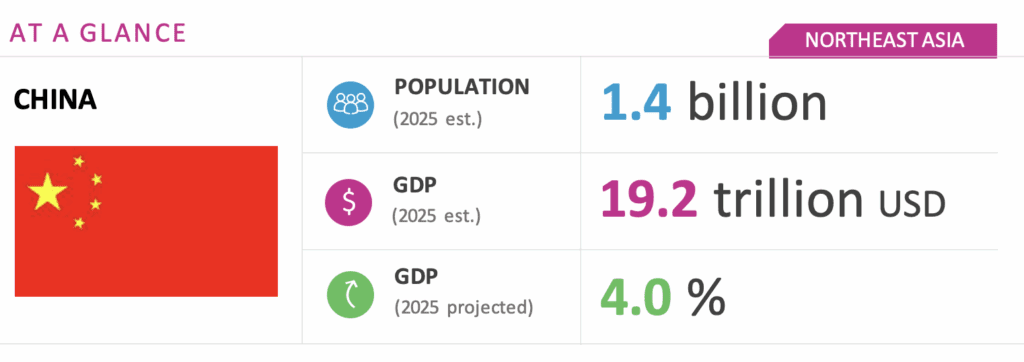

- China’s GDP growth projection was downgraded from 4.6 percent in January to 4 percent in April. The revision underscores long-term concerns about policy uncertainties amid ongoing trade tensions with the United States and sluggish domestic consumption, deflationary pressure and sinking property sector.

- Chinese President Xi Jinping has continued his extensive anti-corruption campaign, resulting in the removal of several high-ranking officials, particularly within the defense sectors. The latest is the suspension of Gen. He Weidong, a vice chair of the Central Military Commission, in April. This demonstrates Xi’s power within the party and his intention to use personnel changes to ensure party control, especially amid current domestic uncertainties and economic shocks.

- Technological innovation remains central to China’s policy agenda. The “Artificial Intelligence (AI) Plus” initiative aims to expand emerging industries, transform traditional sectors and drive digital economy innovation. China also recognizes domestic demand as a long-term strategy to stabilize and rebalance growth amid global trade uncertainty, calling for earlier and stronger macroeconomic policy implementation.

ON THE HORIZON

- Beijing and Washington reached a trade truce in London June 12, following up on discussions in Geneva May 11. Tariff levels are now set at 10 percent for U.S. goods to China and 55 percent for Chinese goods to United States, but this has not been confirmed and could plausibly change. Beijing’s nontariff countermeasures, including export bans on key rare earths and magnets, will be suspended, and Chinese students will be allowed to attend U.S. colleges and universities.

- The government has continued to implement more policies as part of its first quarter stimulus package to stabilize the economy. However, trade tensions have led to concerns about the adequacy of the stimulus.

- The 15th Five-Year Plan (2026-2030) will likely be finalized during the Fifth Plenum of the Central Committee, expected later this year. It is expected to be innovation driven and consumption led, with a focus on deeper structural reforms to address demographic challenges, external pressures and the slowing economy. However, the postponement of the Fourth Plenum makes the timing of the plan’s release uncertain.

China Market Overview and Forecast

Political Climate

Two Sessions: Core Policy Agenda Remains Unchanged with Economic at the Forefront

IThis year’s “two sessions,” the annual meetings of the National People’s Congress and the Chinese People’s Political Consultative Conference, concluded in March. No surprise changes were announced in the government’s narratives and policy directions; sustaining economic growth remains a central goal. To achieve this, China will increase the stimulus packages aimed at expanding domestic consumption and support “new productive forces” through technological innovation.

China’s national security and foreign policies are also largely unchanged. The defense budget was increased 7.2 percent, consistent with last year and in line with growth trends over the past decade. China’s foreign policy agenda continues to oppose power politics and protectionism while remaining committed to global engagement through initiatives such as the Belt and Road Initiative.

Scaling Back in the Indo-Pacific

China has adopted a more measured approach in the Indo-Pacific this year, avoiding direct conflicts to offset challenges from trade disputes. Seen through this lens, Beijing’s recent action over Sandy Cay in the South China Sea is a routine signal against Balikatan, the annual Philippines-U.S. military drill, not an attempt to escalate tensions. At the same time, China and Indonesia have deepened security cooperation in the South China Sea despite their long-standing maritime disputes.

Geopolitically, the situation around Taiwan is easing as the U.S. focus shifts to the Middle East, and China’s growing military capacity reshapes regional dynamics. Foreign Minister Wang Yi’s emphasis on “Taiwan, province of China” at the United Nations precludes “two Chinas” or “one China; one Taiwan,” signaling a possible move away from “one country; two systems.”

Territorial issues remain a priority for China, but geoeconomic headwinds, particularly since the start of April, are now occupying most of the government’s attention. Although continually engaged in “gray-zone” operations towards Taiwan, China has refrained from direct actions.

Macroeconomic Climate

Navigating a Challenging Trade Environment

In its latest signal of macroeconomic stewardship, China’s top leadership pivoted from broad policy signaling to a focused push on executing already announced tools to stabilize growth amid mounting global and domestic pressures. At a recent Politburo meeting, officials emphasized the urgent need to speed up the rollout of fiscal and monetary instruments. This includes expediting the issuance and deployment of government bonds and implementing rate cuts and reserve requirement reductions “when appropriate” — language that has translated into concrete policy action. The People’s Bank of China on May 7 announced a 10-basis point cut to the benchmark seven-day reverse repo rate and a 50 basis point reduction in the bank reserve requirement ratio, effective May 15. These moves are expected to inject around CNY 1 trillion ($138.4 billion) into the banking system.

The Politburo reiterated its commitment to drive consumption as a pillar of recovery. Alongside an expansion of trade-in subsidy programs for durable goods, officials are signaling greater interest in stimulating services consumption — potentially via direct incentives for sectors like travel, dining and leisure. Meanwhile, firms adversely affected by the ongoing trade conflict will benefit from increased access to subsidized credit and partial unemployment insurance rebates to ease cost pressures.

Beijing is seeking trade cooperation with other countries to diversify risk. Xi’s visits to Vietnam, Malaysia and Cambodia in April underscore this trend. China is also expanding its presence in the European market, its second-largest importer. Beyond high-level discussions to address trade disputes and enhance economic cooperation, China is reforming its labor practices in response to the European Union’s tightening of trade compliance standards. Beijing aims to align its labor practices with international expectations and maintain access to EU markets.

Chinese e-commerce companies have also launched multibillion-dollar initiatives to help exporters pivot to domestic markets. Their efforts aim to mitigate the impacts of the de minimis exemption. However, their success will depend on the effectiveness of government measures to boost domestic consumption.

Beijing and Washington reached a trade truce in London June 12, following earlier discussions in Geneva May 11. Tariff levels are now set at 10 percent for U.S. goods to China and 55 percent for Chinese goods to United States, but this has not been confirmed and could plausibly change. China also agreed to suspend its nontariff countermeasures, including its ban on rare earth exports and magnets. Nevertheless, there are no guarantees that the deal will last or that tensions will reignite.

Investment Environment

Relaxing Regulations To Attract Foreign Investment

Since 2020, China has been easing restrictions on foreign investment, but inflows have stagnated due to economic and geopolitical factors, impacting China’s manufacturing outlook. Recognizing the importance of foreign investment for long-term stability, China’s State Council released the 2025 Action Plan for Stabilizing Foreign Investment in February, reaffirming its commitment to a more attractive and equitable business environment, particularly in the industrial and service sectors.

The expansion of market access for strategic sectors such as semiconductors, AI and renewable energy aligns with China’s broader goals of technological self-sufficiency and industrial upgrading. The growth of pilot programs in telecommunications, biotechnology and education is also expected. At the same time, China is lifting restrictions on domestic loans for foreign enterprises to encourage the establishment of regional headquarters and research and development centers.

The action plan emphasizes improving regulatory transparency and clear operational guidelines to stabilize the Chinese market, with the aim of strengthening confidence and attracting long-term investment. It aims for the better protection of intellectual property rights and coordination between national and local governments. Foreign mergers and acquisitions procedures will also be simplified to boost deal flow and cross-border collaboration.

China’s broader strategy includes integrating foreign investment policies into national development priorities, which will likely be reinforced in the upcoming 15th Five-Year Plan. Nevertheless, foreign investors remain cautious while practical challenges, including regulatory opacity; rising compliance costs related to labor and environmental, social and governance standards; and geopolitical risks, persist. Success will depend on how well these reforms are implemented throughout the country.

We will continue to keep you updated on developments in China as they occur. If you have any comments or questions, please contact BGA Adviser Eric Wang at ewang@bowergroupasia.com.

Best regards,

BGA China Team

Eric Wang

Advisor