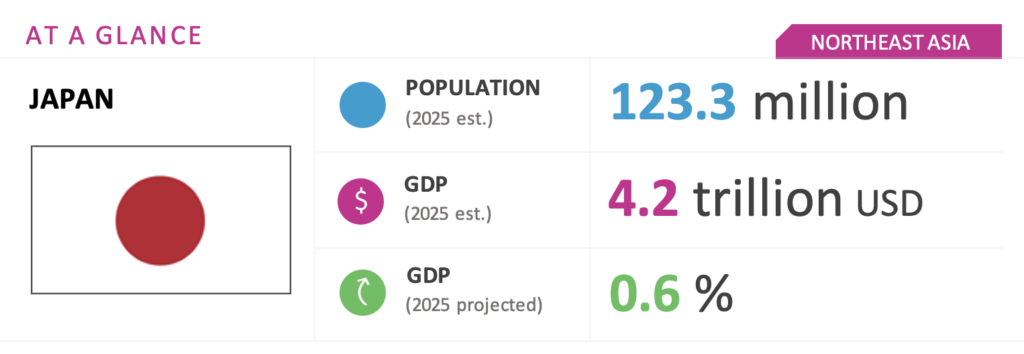

Japan Forecast: Bold Digital Investments Balance Cautious Monetary Policy

WHAT YOU NEED TO KNOW

- Prime Minister Shigeru Ishiba’s Cabinet suffers from low public approval, despite passing this year’s budget. Although the government is actively engaging in U.S. trade talks, voters are concerned about inflation and tax burdens. Subsidies continue, but promised tax cuts remain unfulfilled.

- Even if the Liberal Democratic Party (LDP)-Komeito coalition suffers a significant loss in the July upper house election, prompting a change in LDP leadership, the LDP is still expected to remain the largest party in the chamber. This will help preserve a measure of political stability.

- Japan’s economy is expected to recover moderately in 2025, supported by wage growth and government stimulus. However, uncertainty around U.S. trade policy poses risks. Export declines and inflation continue to weigh on consumer spending, while real wage growth remains limited despite nominal increases from spring labor negotiations.

ON THE HORIZON

- This summer’s upper house election will see 124 of the 248 seats contested. The LDP-Komeito coalition needs to win 51 seats in July to maintain its majority. While this is not a particularly high bar given recent election results, past failures serve as a cautionary tale.

- The World Expo 2025 in Osaka runs through this fall. July 19 is designated as the United States National Day, and there is growing anticipation within the Japanese government that U.S. President Donald Trump may attend. The following day, July 20, is the most likely date to hold the upper house election. An Ishiba-Trump summit on the eve of the vote is seen by some as a potential boost for the LDP.

- The Bank of Japan is considering additional rate hikes while closely monitoring economic and price trends. However, with growing uncertainty in the global economy, the next rate hike is expected to be a difficult decision. Some financial market stakeholders now view an additional rate hike within the year as unlikely.

- Japan is set to finalize a major c for artificial intelligence (AI), semiconductors and data centers by late 2025. With more than JPY 10 trillion ($69.5 billion) in public funding expected, the initiative aims to enhance industrial competitiveness. Given strong bipartisan support, policy planning will likely proceed regardless of the upper house election outcome.

Japan Market Overview and Forecast

Political Climate

Japan’s Political Trajectory Depends On Price Hike Response

Japanese politics will be heavily influenced by the outcome of the House of Councilors election, which will likely be held July 20. Two key questions will shape the direction of the political landscape: under what conditions the ruling LDP enters the election and how the political situation will unfold thereafter.

Despite leading a minority coalition in the House of Representatives, the Ishiba Cabinet succeeded in passing the 2025 national budget in time for the start of the fiscal year. However, a Nikkei poll in April showed the Cabinet’s approval rating had fallen to a record-low 33 percent, indicating that effective Diet management has not translated into public support. On the diplomatic front, the Ishiba administration has taken a proactive stance in trade negotiations with the United States in response to additional tariffs imposed by the Trump administration. Even if Ishiba strikes a successful deal with the United States, it will likely have limited political impact unless it produces “surprising” results that resonate with voters, such as the full removal of retaliatory tariffs. This is because voters are currently more focused on day-to-day economic concerns, particularly price hikes and the tax burden. Structural measures to address rising prices are expected to be the defining issue of the 2025 upper house election.

To date, LDP-led governments have primarily relied on subsidies to counter the price hike. For example, in April, the government decided to provide a JPY 10 ($0.07) per liter subsidy in response to soaring gasoline prices. However, the gasoline tax cut that Ishiba agreed to last year with opposition parties — lowering the total tax from JPY 53.8 ($0.37) to JPY 28.7 ($0.20) per liter — has yet to be implemented. Likewise, the administration has not clearly addressed the proposal from its coalition partner Komeito to temporarily reduce the consumption tax. Although the government’s cautious approach to tax cuts may be understandable in light of fiscal discipline, it also hands the opposition a potent line of attack in the lead-up to the election.

This summer’s election will see 124 of the 248 upper house seats contested. The LDP-Komeito coalition currently holds 140 seats in the chamber, 74 of which (61 from the LDP and 13 from Komeito) are not open seats. Thus, winning 51 seats in July would allow the coalition to maintain a majority. Although this is not a particularly high bar in light of recent election results, past failures serve as a cautionary tale.

If the LDP suffers major losses, calls for Ishiba to step down would be unavoidable. In that case, the party would likely seek to form a broader coalition under new leadership, potentially expanding beyond Komeito. Nonetheless, given the small number of seats contested, the LDP is expected to remain the largest party in the upper house, portending a relatively stable post-election political landscape.

Macroeconomic Climate

Moderate Recovery Clouded by Expanding US Tariff Concerns

Japan’s economy is expected to continue its moderate recovery, supported by wage growth, expanded capital investment and government economic measures, but global trade uncertainty could hinder growth prospects. In its April 2025 outlook, the International Monetary Fund (IMF) projected Japan’s real GDP growth rate at 0.6 percent for the year. Although this represents a recovery from 0.1 percent in 2024, the impact of potential U.S. tariffs remains a provisional assumption at this stage. Notably, Japan tends to experience more pronounced negative effects during global economic slowdowns than other countries, particularly through a decline in automobile exports.

In its latest Outlook for Economic Activity and Prices released May 1, the Bank of Japan (BOJ) lowered its forecast for real GDP growth to 0.5 percent for this fiscal year and 0.7 percent for fiscal year 2026 —down 0.6 and 0.3 percentage points, respectively, from its January projections. The consumer price index (excluding fresh food) is currently hovering in the low 3 percent range, driven in part by a sharp rise in rice prices. This has placed pressure on private consumption, which is a key pillar of domestic demand. There are also growing concerns that the decline in exports may accelerate going forward. While the BOJ offers an optimistic view, saying that “nominal wages are expected to continue rising significantly following the results of this year’s spring labor-management negotiations and are likely to increase further,” real wage growth adjusted for inflation remains low. This raises a valid concern that households may cut back on spending to protect their livelihoods.

Investment Environment

Investment Framework for AI, Chips and Data Centers Taking Shape

The BOJ is expected to proceed cautiously with further interest rate hikes, but speculation remains among experts that a rate increase could come as early as July or September in an effort to curb inflation. Within the government, there are voices suggesting that a yen exchange rate of around JPY 135 per U.S. dollar would be desirable to improve the energy trade balance. Over the medium term, the policy interest rate will likely be raised gradually toward Japan’s neutral rate range, which the IMF estimates at around 1.5 percent. Nevertheless, Japan is expected to remain within a low interest rate range compared to other advanced economies.

In the latter half of 2025, active discussions are expected around major policy incentives aimed at enhancing competitiveness in cutting-edge and high value-added sectors such as AI, semiconductors and digital technologies. To meet the rising demand for AI, the government plans to compile a strategy by June to geographically decentralize large-scale data centers. This includes a focus on the structure of government subsidies for hyperscalers, including foreign firms.

To secure financial backing for these large-scale projects, the government has already submitted legislation during the current ordinary Diet session. The bill, which is expected to pass, establishes a legal framework for massive financial support schemes for AI and semiconductors. Attention is focused on how the Ministry of Economy, Trade and Industry and other agencies will allocate public funding — set at an unprecedented scale exceeding JPY 10 trillion ($69.5 billion). In addition, with an eye on the upper house election in July, political parties are expected to unveil their campaign pledge around June. During the 2024 general election, the LDP emphasized startup support, biopharmaceutical development and the growth of the health care industry, though the party’s proposals lacked specificity. The extent to which these investment promotion measures will be enhanced is expected to be a key point of contention.

Kiyoaki Aburaki

Managing Director