Taiwan Tariff Tracker | August 1, 2025

The BGA Taiwan team, led by Senior Adviser Rupert Hammond-Chambers, wrote an update to clients on the U.S.-Taiwan tariff deal.

Context

- The White House on July 31 announced a 20 percent tariff on Taiwanese goods, which will take effect August 7 in a simple list format. The Taiwanese government emphasized that this tariff rate is temporary because negotiations with the United States have not yet been concluded. The final tariff rate will be presented in a joint statement after the negotiations are completed.

- The final phase of negotiations will address the Section 232 investigation concerning semiconductors and Information and communication technology products, meaning they will remain exempt from the reciprocal tariff until the investigation concludes.

Significance

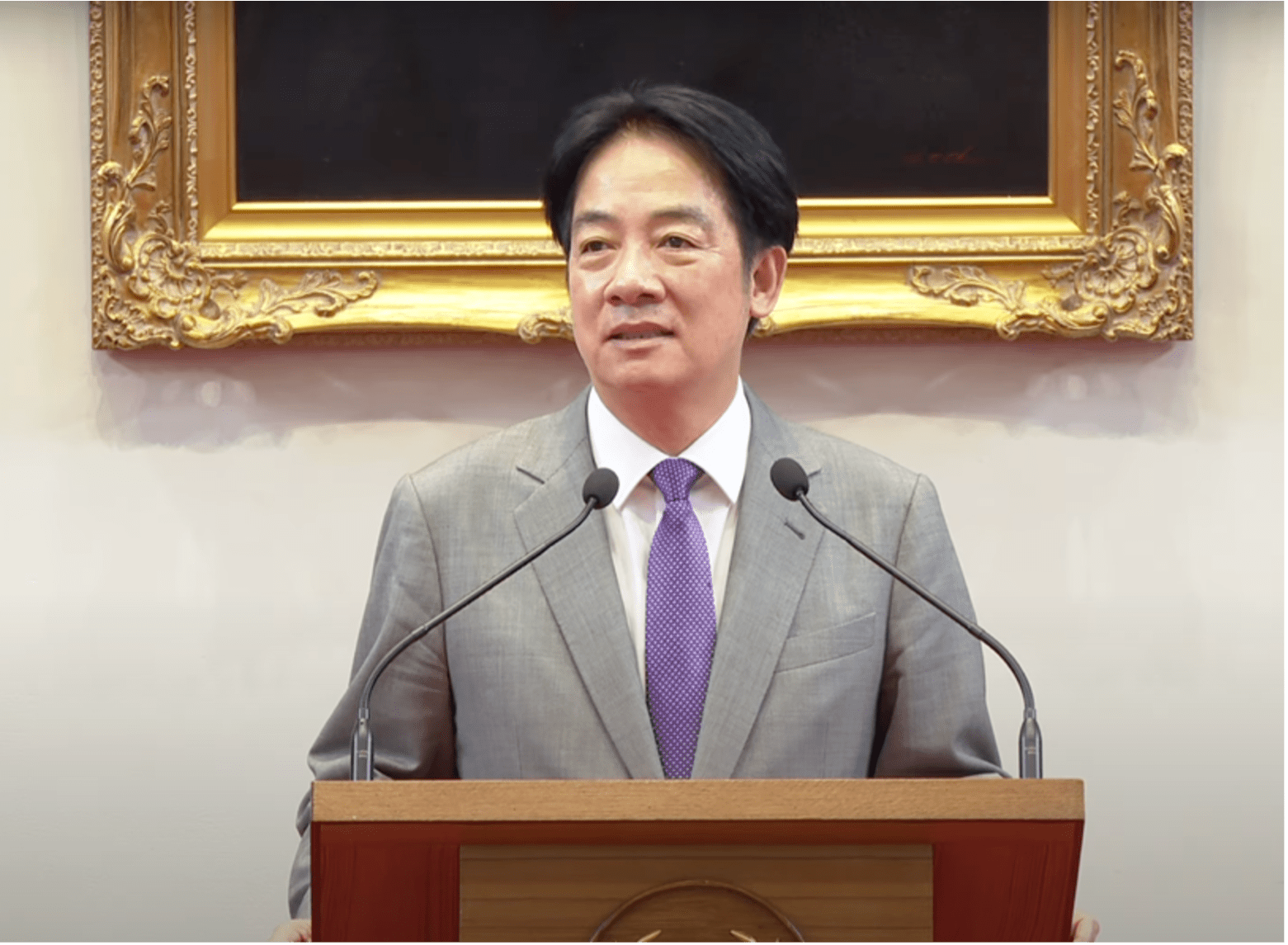

- Taiwan President Lai Ching-te emphasized that Taiwan is committed to deepening economic cooperation with the United States, focusing on national and industrial security. Technical consultations have been completed, and only the final summary meeting remains to negotiate the tariff rate.

- Industries expressed concern that Taiwan’s 20 percent tariff is higher than most rates in Southeast Asia and 5 percent higher than the rates imposed on Japan and Korea, fearing it will weaken Taiwan’s competitiveness and put pressure on supply chain adjustments. They are calling for export transformation subsidies, operational loans and support to enhance U.S. storage and service mechanisms.

Implications

- The current 20 percent tariff, although reduced from the initial 32 percent Trump announced April 2, still puts Taiwan at a competitive disadvantage compared to Japan and Korea’s 15 percent tariffs, especially given that the New Taiwan dollar has appreciated by about 10 percent in recent months. Large enterprises like Taiwan Semiconductor Manufacturing Company have sufficient competitiveness and bargaining power to pass the cost onto customers, so tariffs and exchange rate fluctuations have a smaller impact. In contrast, small and medium-sized manufacturers, which often operate on fixed processing fees, have tariffs borne by the brand owners, but exchange rate fluctuations can directly affect their cost structure and pricing ability, leading to a more significant and negative impact.

- Regarding the special budget, the Executive Yuan is expected to use this opportunity to revisit the issue of the NTD 10,000 (US$335) cash distribution in the legislature, potentially pushing the opposition parties to remove this provision and redirect the budget to industries impacted by reciprocal tariffs. Additionally, the electricity price subsidy will likely become a point of contention again. These disputes may delay the disbursement of subsidies to businesses, reducing Taiwan’s ability to respond quickly and effectively.

We will continue to keep you updated on developments in Taiwan as they occur. If you have any comments or questions, please contact BGA Rupert Hammond-Chambers Managing Director at rupertjhc@bowergroupasia.com.

Best regards,

BGA Taiwan Team

Rupert Hammond-Chambers

Senior Advisor

Rupert is an expert on Taiwanese political and economic issues and additionally brings a special focus on defense and security within BGA. Rupert concurrently leads the U.S.-Taiwan Business Council, where he was elected vice president in 1998 and president in 2000. Prior to 1994, he served as an associate for development at the Center for Security Policy, a defense and foreign policy think tank in Washington, D.C. Rupert is a member of the board of The Project 2049 Institute. He is also a trustee of Fettes College and is a member of the National Committee on United States-China Relations. Rupert ... Read More

×