Angola Navigates Commodity Dependence and Diversification Challenges

WHAT YOU NEED TO KNOW

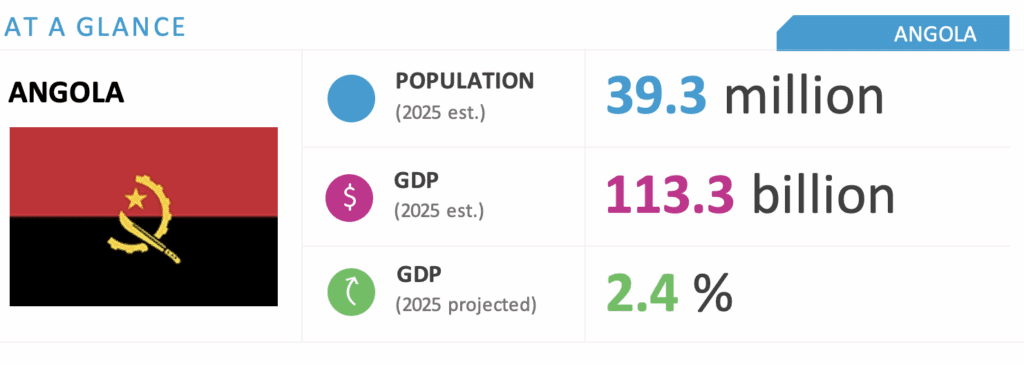

- Angola is sub-Saharan Africa’s third-largest economy; however, it remains a commodity-dependent exporter, leaving the country vulnerable to price shocks. Diversification is happening slowly, and hydrocarbons still account for about 50 percent of GDP and 90 percent of exports.

- President Joao Lourenco and the People’s Movement for the Liberation of Angola (MPLA) won the 2022 legislative election with a reduced majority, but they are well-positioned to win the elections in 2027.

- The government projected the annual budget with an oil price of $70 per barrel, and in the first quarter of 2025, the average price was around $75 per barrel.

- Angola is experiencing a demographic transition. In the coming years, the government will need to prepare the country for significant population growth due to improved medical treatments and lower child mortality rates.

ON THE HORIZON

- Angola’s medium-term growth prospects are positive; however, the country remains reliant on oil, with hydrocarbons being the main economic driver. The government has found it challenging to implement the political reforms needed to advance diversification.

- Real GDP growth will remain strong throughout the forecast period, driven by an uptick in oil production alongside nonoil sector growth, particularly in the gas and mining subsectors.

- Global trade uncertainty will impact oil prices. Given Angola’s reliance on oil exports, the government will need to reassess its annual budget.

- In December, inflation in Angola was around 27.5 percent year over year, down from the high of 31.1 percent year over year seen in July. The inflation forecast for 2025 is set to slow down, averaging 23.5 percent year over year.

- In June, Angola will host the U.S.-Africa Business Summit and is expecting several U.S. companies to attend. BGA expects Angola to deepen its investment ties with the United States as Washington seeks to expand its footprint in Africa.

Angola Market Overview and Forecast

Political Climate

Political Volatility on the Horizon

Angola has a young population with an average age of 16. Therefore, the political stability the country has had in the last few years might be threatened by high living costs, an increase in certain forms of poverty and job creation.

The MPLA, the social democratic party that has been in power since independence in 1975, is expected to win the next elections in 2027. However, its majority in the National Assembly will likely be smaller compared to the last elections. Every election in Angola — whether legislative or presidential — comes with political volatility, and the lead-up to the 2027 elections are no exception.

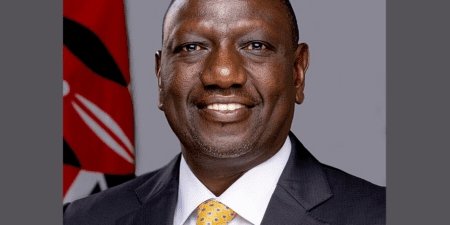

President Joao Lourenco has not said whether he will seek a third term as president in 2027. Nevertheless, BGA does not foresee this possibility, because the MPLA lacks the two-thirds parliamentary majority required to amend the constitution and remove the two-term presidential limit.

Angola has very close relations with Russia and China; however, Lourenco and his government have made some changes and deepened their ties with Western countries. The United States has pledged $250 million for the Lobito Corridor, a planned railway line linking Zambia and the Democratic Republic of the Congo to Angola, which will provide a strategic route for exporting minerals to Western countries via Lobito Port. This could be an important lifeline for Washington and the U.S. technology sector given China’s restrictions on critical mineral exports to the United States in the past and ongoing efforts to tighten export controls.

Macroeconomic Climate

Resilient Economy

The economy is projected to grow 2.4 percent in 2025, lower than initially forecast and far below the 4.5 percent GDP growth in 2024. This decrease is due to anticipated declines in oil prices expected this year.

The government is planning to increase the fiscal expenditure in 2025 to support economic growth. This year’s budget has been set at $38 billion, representing a 40 percent increase from the 2024 budget. Nevertheless, the International Monetary Fund (IMF) forecasts an economic loss due to the impact of U.S. tariffs and domestic energy production policy, which led to a depreciation in oil prices. The IMF also projects a slight depreciation in the value of the kwanza, Angola’s currency, against the euro and dollar.

To overcome the current situation and preserve the purchasing power of public sector workers, the government is planning a 25 percent increase in public sector salaries. Despite the country’s high inflation rate, high levels of consumption have stimulated the economy.

Angola’s economic expansion is expected to remain robust throughout the forecast period. This will be driven by growth in the nonoil sector, particularly in gas and mining, as well as increased oil output due to government reforms (leaving the Organization of the Petroleum Exporting Countries) and incentives to attract foreign investment. The ongoing development of oil and gas projects, alongside infrastructure projects, will support growth from 2025-2029. Additionally, further expansion in diversification policies, such as those in the agricultural, diamond and tourism sectors, will also contribute to growth. A combination of factors, such as monetary policy loosening from 2026, will support private consumption and a rise in hydrocarbon production, bolstering growth. Growth is therefore expected to average around 3-4 percent from 2025-2029, up from an average of 0.8 percent over the past five years.

Investment Environment

Angola’s Foreign Policy Shift: Attracting Investment Through Strategic Alliances

Angola’s foreign policy is primarily guided by the need to attract investment to diversify the economy. Lourenco has made this one of the cornerstones of his second term. Still, Angola continues to balance its broad policy of nonalignment with attempts to maintain its historical ties with China and Russia while strengthening its relations with the West.

Angola is one of China’s largest trading partners in Africa and the largest recipient of Chinese loans on the continent. Tense relations between the United States and China will therefore put Angola in the spotlight on the African continent.

With the Lobito Corridor investment, Europe and the United States will have the opportunity to increase their investment in the Angolan market, taking advantage of the policies to attract foreign investors and the strategic route to export minerals. Additionally, Angola signed bilateral investment agreements in February, in which France committed to invest $473 million in Angola’s security and its agricultural and clean energy sectors.

We will continue to keep you updated on developments in Angola as they occur. If you have any questions or comments, please contact BGA Angola Senior Adviser Mário Almeida at malmeida@bowergroupasia.com.

Best regards,

BGA Angola Team

Mário Almeida

Senior Advisor, Angola