Asia-Pacific Forecast H2 2021

Below is an introductory letter by BGA President and CEO Ernie Bower on the company’s latest half-yearly Asia-Pacific Forecast, circulated to our clients to help inform their planning for the coming months.

A year and a half into the war on Covid-19, and as we approach the one-quarter mark of the 21st century, Asia continues to develop into its role as the world’s growth engine. It also is expanding its destiny to drive global trends through both its economic heft and its growing geopolitical preeminence. However, Asia is not one story, not one country. In fact, the pandemic and its impact have exacerbated differences, making them sharper, harder to reconcile or ignore. Those differences, whether they be in the area of effectiveness of response to Covid-19, geopolitical competition, economic recovery or political evolution (or devolution, as may be the case), will define risk and reward in the second half of this year and beyond.

Savvy corporate planners are anticipating additional game-changing events. Being prepared for change means investing in institutional agility. The core elements include the following: retaining market specific expertise, promoting global innovation, investing in resiliency and diversity, and managing challenges locally while betting big on mid- to long-term opportunities in the region.

Some countries are well on the road to economic recovery. Vietnam’s newly-appointed Politburo and leadership believe they are still be on track to achieve their target GDP growth rate of 6.5 percent in 2021. New Zealand’s Prime Minister Jacinda Ardern has said she may lead a trade and promotional delegation to Australia in early July to boost ties with trans-Tasman partners as business confidence recovers.

Yet the path to recovery may not always be linear. The abrupt cancelation of the World Economic Forum meeting in Singapore – amid uncertainty over Japan’s summer Olympic and Paralympic Games – and the brutal new Covid wave ravishing India, a key node in the global vaccine supply chain, are reminders of how even countries which initially handled the pandemic well can hit sudden unexpected bumps along the road.

This diverse picture intensifies the focus on disparities within and among countries. The pandemic has already shown signs of worsening economic inequality and impeding democratic and economic reform in countries such as Pakistan and Indonesia and put the spotlight on the extreme variations in vaccine access between developing and developed nations. Such fissures are being probed by other countries seeking geopolitical advantage, most obviously China and the United States, but certainly not limited those two large countries.

This complex and diverse landscape will be shaped by several consequential, and notably predictable, national developments in the second half of 2021. Apart from upcoming elections later this year in Japan and Mongolia, countries such as the Philippines, South Korea, Papua New Guinea and likely Australia will be gearing up for national polls in 2022. And the United States will face mid-term elections that could have results in Congress that could disrupt the new Biden administration’s ambitious plans.

As India, Nepal, Singapore and other countries have demonstrated in the last several months, the unexpected and unpredictable changes may wreak even more havoc on economic and political developments in the next six months.

Diversity can also breed new levels of cooperation and present opportunities. Patterns of wider regional collaboration will take shape towards the end of the year as the summit season hits Asia. President Joe Biden has hosted his counterparts Prime Minister Yoshihide Suga and President Moon Jae-in in Washington and will likely travel to the Indo-Pacific for the first time as president. Multilaterally, apart from the ASEAN and APEC meetings hosted by Brunei and New Zealand respectively, the focus will also be on the U.N. Climate Summit in Glasgow where new targets could be announced, including by China which remains the world’s biggest emitter.

The environment for companies will continue to be challenging at the country level. While countries will loosen pandemic-driven restrictions to promote investment and economic activity, more regulation can be expected in specific sectors such as data flows in countries like India, Thailand and Vietnam. There is also likely to be increased scrutiny on environment, social and corporate governance (ESG) risks stemming from developments such as alleged human rights abuses and labor practices and their links to global supply chains. More and more, consumers and interest groups are driving these concerns, and demanding both companies and governments take action.

Geopolitically, apart from flashpoints such as the Taiwan Strait, the South China Sea, and India-Pakistan tensions, top of mind will be the situation in Myanmar, with the country’s post-coup future in the balance as Southeast Asia’s newest developing market of a decade ago slumps back into pariah status and refugees and displaced populations like the Rohingya try to find a place to survive. Tensions could also flare up again on the Korean Peninsula if North Korea reverts to its provocative behavior.

U.S.-China competition will continue to influence the agenda in nearly every sector and forum. The Biden administration may have inserted more stability into the U.S.-China relationship, but it has also retained a tough approach to Beijing across the board including on tariffs, coercion against American allies and domestic human rights violations.

Yet opportunities also lie ahead as the quest for economic recovery stimulates a search for new ideas to boost growth and investment. We have already seen governments focusing incentives and resources on certain target sectors, be it manufacturing in India and Indonesia, semiconductors and future connectivity in Japan and Taiwan, clean energy in Singapore and South Korea, agriculture in Nepal and Fiji or e-commerce in Malaysia and Cambodia.

Cross-border collaboration is also heating up in some areas. The global semiconductor shortage has reinforced Taiwan’s centrality in supply chains and stimulated thinking in countries including Japan and the United States about increasing competitiveness in this space. The Quad, comprised of Australia, India, Japan and the United States and set for its first in-person summit meeting this year, holds promise for ground-breaking cooperation in healthcare and global standards-setting on critical and emerging technologies.

Innovation will also be shaped by regional events. As more countries ratify the Regional Comprehensive Economic Partnership (RCEP), pressure will grow on others including Washington to step up on trade, even if it means starting sectorally with digital or climate agreements. China’s interest in joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) trade agreement and continued inroads on the digital yuan will further intensify work by other countries working on central bank digital currencies, which could reshape the region’s payments landscape.

These developments will reinforce Asia’s role as the most important region in world economic activity, but will also command new focus and resources from global companies as they move to position themselves for growth in Asia for the next quarter of the century. Local knowledge, global vision and institutional agility and resilience will be the characteristics of companies that succeed in this diverse and fast-moving region.

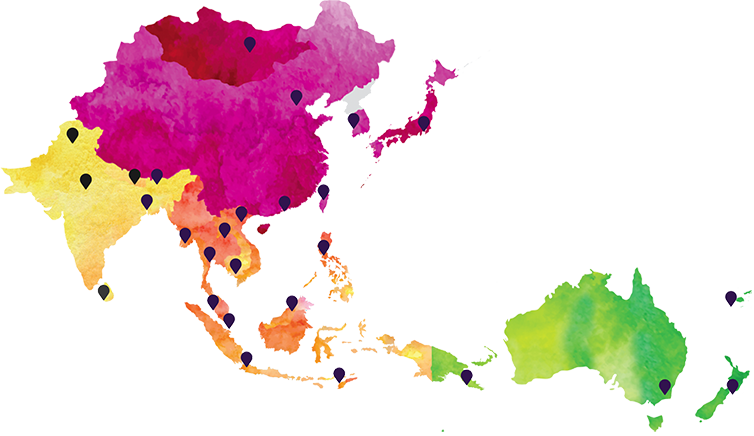

My team and I are deeply honored to be working with you and your colleagues. We will continue to heed our own advice and expand our investment across our 24 offices around Asia. We’ve recruited and trained an incredible team that is well prepared to continue to serve you at the national level, as well as anticipate trends and development globally and regionally.

Finally, please stay safe and secure as we work together to overcome the pandemic and its devastating impact. We look forward to seeing you even more often, and hopefully that includes being with you in person where and when we are able, in the second half of the year.

Sincerely,

Ernest Z. Bower,

President and CEO, BowerGroupAsia

Ernest Z. Bower

President & CEO