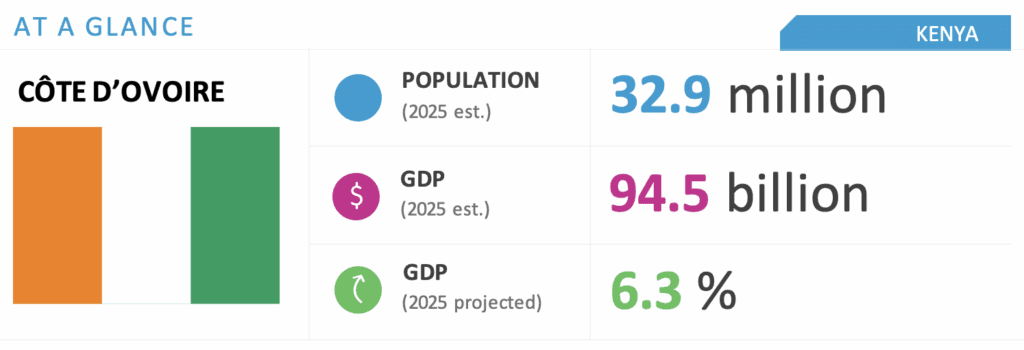

Côte d’Ivoire Offers Targeted Investment Opportunities Amid Tense Political Environment

WHAT YOU NEED TO KNOW

- The Ivorian economy remains one of the most dynamic in West Africa, with growth projected at 6.3 percent this year, driven by investments under the National Development Plan and the recovery of agriculture and industry.

- The country is entering a phase of political vulnerability in the run-up to the presidential election at the end of the year, in a climate marked by the exclusion of key figures and the risk of electoral contestation.

- Externally, the possible end of the African Growth and Opportunity Act (AGOA) and the rise of U.S. protectionism could affect Ivorian exports to the United States, particularly in the agricultural and textile sectors.

- The effects of climate change and international geopolitical tensions add a level of uncertainty to supply chains, price stability and the attractiveness of the business climate.

ON THE HORIZON

- The 2025 presidential, scheduled for October, will be a major test for the country’s stability. Signs of political polarization and possible contestation of the results could rekindle internal tensions. The level of participation and transparency of the process will be scrutinized by international observers and investors alike.

- The second half of the year will mark the final assessment of the implementation of the five-year national development plan. The results — particularly in industrialization, access to energy and improving the business climate — will partly determine the credibility of the next cycle of reforms and the confidence of donors.

- The U.S. administration will need to decide whether to renew AGOA or impose new tariffs on African countries. An unfavorable outcome could have a direct impact on Côte d’Ivoire’s textile, agricultural and manufacturing sectors, with implications for the balance of trade and margins of exporting companies.

- Côte d’Ivoire could come under renewed pressure concerning its electricity system, with rising tariffs and the risk of power cuts due to the dependence of hydroelectricity on unstable weather conditions. This could inflame social tensions and affect companies’ operating costs.

- The security situation in West Africa, particularly post-coup dynamics in the Sahel, migratory pressures and cross-border flows (licit and illicit), will continue to be closely monitored.

Côte d’Ivoire Market Overview and Forecast

Political Climate

Tense Presidential Election

Côte d’Ivoire is entering a major electoral phase, with the presidential elections scheduled in October. This could rekindle latent tensions despite the efforts to calm the situation that have been underway since 2022. The political dialogue initiated between the government and the opposition has enabled some progress to be made, but the probable exclusion of key figures from the political landscape — such as Thiam, Gbagbo and Soro — is fueling a climate of mistrust, and the anticipated low turnout could taint the legitimacy of the ballot. Although the local elections of 2023 took place without major violence, the signals remain ambiguous about the country’s capacity to organize a fully consensual ballot.

Regional stability remains fragile. Geopolitical tensions in the Sahel (Mali, Burkina Faso and Niger) and the return of military coups are putting pressure on the Economic Community of West African States region, potentially affecting border balances and migratory flows. These regional dynamics are an indirect political stress factor.

Macroeconomic Climate

Sustained Growth Under Scrutiny

The Ivorian economy boasts robust fundamentals. Growth is expected to reach 6.3 percent this year, slightly higher than in 2024, driven by a recovery in the primary (agriculture), secondary (mining and energy) and tertiary (services, logistics and trade) sectors. The mining and energy sectors, particularly the projects around the Baleine deposit, will be key drivers in the short term.

The trajectory of public finances is improving, with the budget deficit falling to 4 percent of GDP by the end of 2024. However, public debt stands at 59.5 percent of GDP, and debt servicing represents a worrying 84 percent of tax revenues, which could restrict budgetary margins, particularly in the event of an exogenous shock.

Inflation, down to 3.8 percent in 2024, should remain under control, subject to stable food and energy prices. However, successive increases in electricity tariffs in 2023-2024 (rising 10 percent in January 2024) will weigh on purchasing power and industrial competitiveness, especially because further tariff revisions cannot be ruled out.

Internationally, the major risk is the impact of an unfavorable renegotiation of the Africa Growth and Opportunity Act, which expires in 2025. This agreement grants 1,800 products from sub-Saharan Africa duty free access to the United States. The possible end of these customs preferences in September could affect Ivorian exports to the U.S. market, particularly in the agricultural and textile sectors. Coupled with a rise in global protectionism, this would constitute an exogenous shock for the balance of trade, already weakened by rising energy imports.

The effects of climate change continue to threaten agricultural production, particularly cocoa, coffee and cotton, making economic performance sensitive to climatic hazards.

Investment Environment

Targeted Opportunities in a Cautious Context

The investment environment remains generally favorable but requires heightened vigilance in the run-up to the presidential election. The Central Bank of West African States’ business climate indicator remained above the 100 threshold in 2024, but its downward trend reflects a gradual erosion of confidence among economic players.

The main areas of weakness are access to financing, particularly for small and medium-sized enterprises; high input costs (energy and logistics); weak local content and technical training; and industrial land constraints, despite zoning efforts.

The new Investment Code, revised in September 2024, introduced enhanced incentives for industrial projects in inland areas (zones B and C), particularly for small and medium-sized enterprises and local processing activities. The reform aims to improve territorial equity and stimulate investment outside Greater Abidjan. The extension of tax exemptions and the emphasis placed on social obligations (local employment, traceability, sustainability) should enhance the attractiveness of the framework.

The digital sector also represents a major investment driver, with a regulatory framework in the process of being structured, rapid expansion of mobile money and the emergence of regional digital ecosystems — notably in Abidjan, Bouake and Korhogo. However, risks remain, particularly in terms of weak cybersecurity, limited 4G coverage and ineffective use of digital tools.

Finally, investors will need to account for increasingly systemic climate risks, particularly in the agricultural, energy and logistics sectors. The Ivorian government is stepping up its green finance and adaptation initiatives, but dependence on external funding remains a bottleneck to the large-scale deployment of climate-resilient projects.

We will continue to keep you updated on developments in Côte d’Ivoire as they occur. If you have questions or comments, please contact BGA Senegal Senior Adviser Fabienne Diouf at fdiouf@bowergroupasia.com.

Best regards,

BGA Côte d’Ivoire Team

Fabienne Diouf

Senior Advisor, Senegal and Côte d'Ivoire