Economic Strength Belies Political Decay

WHAT YOU NEED TO KNOW

- The political climate remains in flux as the government under Prime Minister Paetongtarn Shinawatra navigates coalition tensions, a potential Cabinet reshuffle and mounting pressure to deliver on economic promises amid geoeconomic and geopolitical headwinds. At the same time, she is striving to assert leadership and maintain legitimacy.

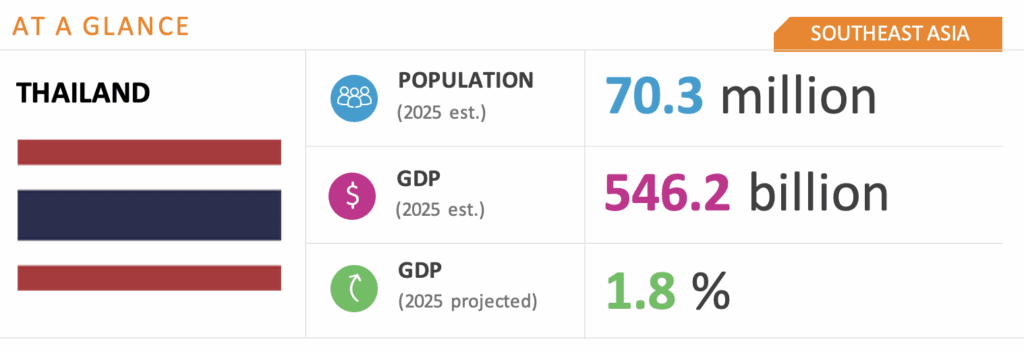

- Thailand’s GDP growth forecast has been cut from 2.9 percent to 1.8 percent in view of the global trade adversity on exports, particularly the upcoming U.S. reciprocal tariffs. Nonetheless, relative economic stability is on track, buttressed by fiscal space and a resilient financial system.

- The Board of Investment reported $33 billion in foreign direct investment in 2024, led by the digital, electrical and electronics and automotive sectors. To sustain momentum through 2025, the government targets gains from manufacturing diversification, offshoring from China and domestic mega investment projects.

ON THE HORIZON

- Despite global uncertainty, the political landscape is expected to remain stable, with the ruling coalition maintaining fragile cohesion amid internal squabbling. A Cabinet reshuffle may be in the offing to consolidate public support and reinforce the government’s focus on domestic priorities. Notwithstanding Cabinet horse-trading, policy directions should remain on course, with continued emphasis on growth-driven initiatives such as the casino-centered Entertainment Complex Act, diversification of export markets and investment relocation into Thailand from U.S.-China trade spats.

- The macroeconomic outlook for the remainder of 2025 permits cautious optimism. Policies are focused on trade expansion, tourism promotion and fiscal support, including a possible increase in the public debt ceiling upward to 70 percent of GDP to finance stimulus packages. Monetary policy easing is anticipated later in the year to help revive the sluggish economy, especially as a new central bank governor takes office.

- The government will advance mega infrastructure projects to boost Thailand’s competitiveness as a regional investment hub. This includes expected enforcement of the Southern Economic Corridor Act by the end of the year to oversee the land bridge project, with bidding in 2026. Construction of Map the Ta Phut Port is also set to begin in 2025 to expand liquefied natural gas capacity.

Thailand Market Overview and Forecast

Political Climate

New Cabinet Presides With Fragile Stability

The coalition government led by the Pheu Thai (PT) party faces mounting political pressure against the backdrop of geoeconomic and geopolitical uncertainties. Economic headwinds from the U.S. tariffs and global trade tensions, coupled with PT’s lackluster flagship policies, have challenged efforts to restore the already strained economy. As Prime Minister Paethongtarn faces increasing scrutiny over her qualifications and leadership, the ruling PT appears to be in a politically weakened position compared to its coalition partner Bhumjaithai (BJT), which has strategically rebranded itself as a pro-establishment party to attract conservative voters. In response, PT will double down on its populist playbook to regain broader electoral support as the country navigates its geopolitical position and its economic reliance on both the United States and China in the disrupted global supply chain.

Government Coalition Endures Internal Rifts

The rift between the PT and BJT has widened due to disagreements over policy differences on the entertainment complex scheme, cannabis legalization, ownership and encroachment of public land and constitutional amendments. Despite these tensions, BGA expects the coalition government’s composition and cohesiveness to hold because PT and BJT have more at stake being in rather than out of power. As Paetongtarn appears increasingly embattled, while her father Thaksin Shinawatra’s overshadowing role is more conspicuous, there will likely be efforts by BJT and establishment forces to replace her with BJT leader Anutin Charnvirakul. But PT holds a large margin of parliamentary forces over BJT and will likely prevail. However, PT’s numbers in Parliament could be strengthened if two dozen of the 44 lawmakers from the opposition People’s Party are banned on constitutionally ethical grounds for trying to change the royal defamation law. Yet BJT has sufficient support in the lower house, the Senate and the conservative establishment to remain in the coalition.

Cabinet Reshuffle Looms

A minor Cabinet reshuffle is expected to take place in mid-2025, which would allow PT to recalibrate its strategy, policies and personnel to boost waning public support. The shake-up timeline will be elaborately planned to avoid political nuances and incidents that could undermine the government’s stability ahead of the 2026 fiscal budget votes and national responses to U.S. tariffs. Economic ministries under PT’s control are targeted for a rejig, but policy directions will likely remain consistent.

The parliamentary session will reopen July 3-October 30 with the possibility of passing the Entertainment Complex Act and the Amnesty Bill despite political and societal resistance.

Macroeconomic Climate

Growth Slows Under External Pressure and Uncertainty

Thailand will move through the forecast period with cautious optimism, facing external challenges while maintaining stable fundamentals. The International Monetary Fund revised the GDP forecast to 1.8 percent from 2.9 percent, reflecting the impact from the global trade uncertainties on exports, which could either grow by 0.3 percent or contract by 1 percent depending on negotiations over the proposed 36 percent U.S. reciprocal tariff. The situation could prompt new fiscal support to mitigate the impact on export-reliant small and medium-sized enterprises, alongside progress on negotiating the tariff rate with the United States to preserve market access for Thai exports. This could pave the way to further open the Thai market to U.S. agricultural and energy imports through the removal of existing trade barriers. The government is also expected to accelerate ongoing free trade negotiations to expand export destinations, prioritizing a deal with the European Union to offset the anticipated revenue loss from exports to the United States. Although investors are shifting toward lower-risk assets such as gold, Thailand will maintain economic stability due to its strong fiscal position and stable financial system along with continued efforts to promote tourism through market diversification.

Fiscal measures are poised to take center stage, with a potential expansion of the public debt ceiling to 75-80 percent of GDP — up from the current 70 percent ceiling, with year’s end debt expected to reach 65.5 percent — to enable increased government borrowing to buffer the economy. The rollout of the remaining phases of the THB 10,000 ($300) Digital Wallet policy — an electoral promise — may face delays, despite the government’s persistence in completing the project, if funds are redirected to address more urgent economic concerns stemming from U.S. tariffs. A reduction in interest rates is expected later in the year as an additional measure to stimulate the stagnant economy. Given these challenges, the government has limited room to maneuver, which could lead to a slow recovery.

Investment Environment

Government Pushes Investment Growth by End of 2025

The Board of Investment remains committed to maintain similar growth of more than 1 trillion THB ($29.7 billion) in foreign direct investment as last year, prioritizing bio-circular green industries, electric vehicles and parts, semiconductors and advanced electronics, the digital sector and the international business center. As part of its investment strategy, the government is advancing key projects, including the Entertainment Complex, which may progress during the forecast period despite legislative delays from coalition tensions. The Southern Economic Corridor Act, which supports a land bridge project across the southern peninsula, is expected to take effect by the end of the year, with public-private partnership bidding slated for 2026. Additionally, new economic corridors approved by the Cabinet aim to boost growth in high-potential northern and northeastern regions.

The government continues to invest in logistics development projects, including a three-airport rail link and a regional rail link (Thailand-Laos-China), which are expected to be in service by 2030. Airport expansion plans are also underway, with upgrades to Suvarnabhumi and Don Mueang airports alongside the development of new airports in Phuket, Chiang Mai and U-Tapao, reinforcing Thailand’s ambition to become a regional aviation hub. Port infrastructure is progressing well, with Laem Chabang Port Phase 3 expected to be completed by 2034 and construction of the Map Ta Phut Port set to begin this year.

Thailand is emphasizing negotiations over retaliation in response to the U.S. tariff policy, aligning with the Washington’s “friend-shoring” strategy. While this approach may lead to delayed investment decisions, it also presents opportunities such as manufacturing diversification and offshoring from China to Southeast Asia. To enhance Thailand’s attractiveness, additional incentives may be considered. At the same time, measures may be introduced to prevent the country from being used as a transshipment hub or manufacturing base for Chinese-origin goods.

We will continue to keep you updated on developments in Thailand as they occur. If you have any comments or questions, please contact BGA Thailand Managing Director Teerasak “Art” Siripant at tsiripant@bowergroupasia.com.

Best regards,

BGA Thailand Team

Teerasak Siripant

Managing Director