Trade Diversification in Action: EU-Indonesia Comprehensive Economic Partnership Agreement and FIT Partnership

BGA Managing Director for Global Trade and Economics Nydia Ngiow wrote an update on the EU-Indonesia comprehensive economic partnership agreement (CEPA) and the Future of Trade and Investment (FIT) Partnership.

Context

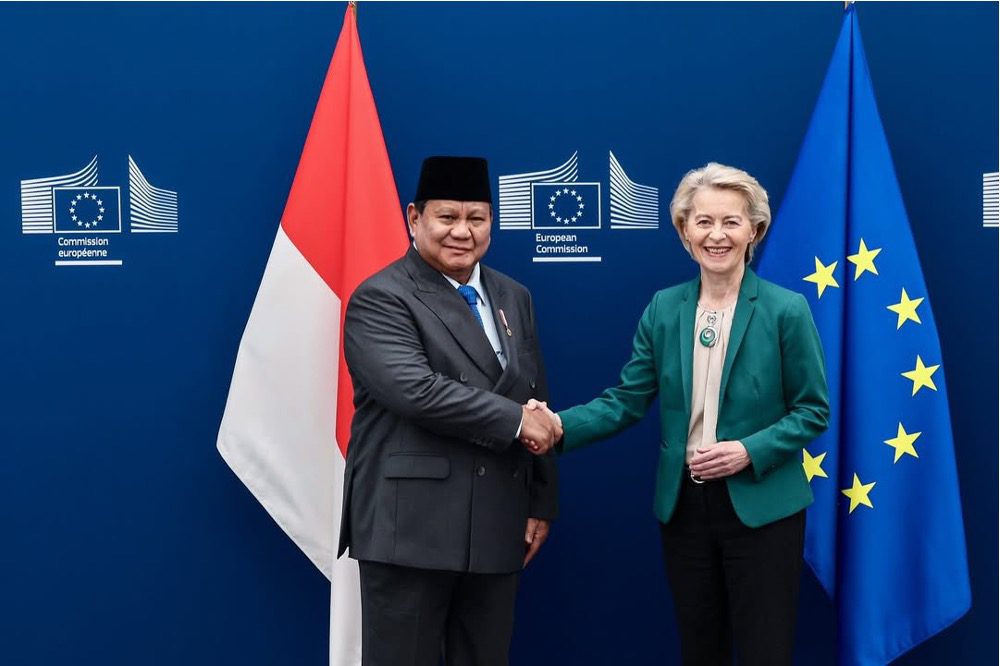

- The European Union and Indonesia concluded negotiations on their long-standing CEPA and plan to sign it next week, underscoring both sides’ determination to accelerate efforts in diversifying and reducing their reliance on both the United States and China. European Trade Commissioner Maroš Šefčovič is scheduled to travel to Jakarta to sign the agreement with Indonesia’s coordinating minister for economic affairs, Airlangga Hartarto, who had previously signaled a September 23 signing date. The deal builds upon the political agreement reached between European Commission President Ursula von der Leyen and Indonesian President Prabowo Subianto on July 13 in Brussels.

- The FIT Partnership was established September 16 to support open and fair trade. Fourteen countries belong to the partnership: Brunei, Chile, Costa Rica, Iceland, Liechtenstein, Morocco, New Zealand, Norway, Panama, Rwanda, Singapore, Switzerland, the United Arab Emirates and Uruguay. Members share a belief in international trade and its role in driving prosperity, enabling growth and innovation as well as building resilience against economic shocks. They have agreed to work together to “develop solutions-oriented initiatives to strengthen the rules-based trading system.”

Significance

- The CEPA will cover 21 areas of cooperation in line with a typical free trade agreement, including trade in goods and services, investment, customs procedures, digital trade and sustainable growth. Given the precedence of the EUSFT and EVFTA, ratification could take at least a year, although Jakarta expressed hope that the EU could accelerate the process so the deal could take effect by late 2026 or 2027. Indonesia’s ratification process will likely take one to two months.

- The CEPA deal, once ratified, is expected to boost Indonesian exports to the EU by up to 50 percent due to lower tariffs and nontariff barriers and attract more investment in key sectors such as electric vehicles, semiconductors, renewable energy and palm oil processing.

- Singapore’s Ministry of Trade and Industry described the FIT Partnership as “agile and informal” and nonbinding. Members are expected to collaborate on the strengthening of supply chains, the removal of nontariff trade barriers, the facilitation of investment and the adoption and integration of emerging technologies. It will also promote dialogue between public and private stakeholders to help businesses navigate an increasingly complex and digital global environment. The ministry is hopeful that this will catalyze innovation that can be translated to the multilateral level and strengthen the World Trade Organization.

- Singapore will host the first FIT Partnership ministerial meeting on the sidelines of the Bloomberg New Economy Forum in November, with members agreeing to work toward endorsing concrete initiatives to be announced at the meeting. BGA sources indicate that Malaysia will soon join.

Implications

- For companies, the EU-Indonesia CEPA highlights a broader trend: governments are putting in place new alternative trade and investment frameworks designed to spread risk, secure supply chains and open new markets. This is not only about strengthening ties with external partners like the EU, but also about the growing web of agreements within the Association of Southeast Asian Nations (ASEAN) and regional frameworks — such as ASEAN’s Digital Economy Framework Agreement and negotiations with Canada — that expand opportunities across Southeast Asia.

- Companies should expect more initiatives like the newly launched Future of Trade and Investment (FIT) Partnership with smaller, like-minded countries across Asia and within ASEAN as governments look to recalibrate their external economic strategies and build alternatives in response to global uncertainties. In this shifting landscape, partners like the EU, which were previously regarded as difficult due to prescriptive rules on data, environment and health, are increasingly being viewed as stable and reliable counterparts as the global economic landscape continues to shift. Still, companies must prepare to meet the higher standards embedded in these agreements, which will be particularly demanding for resource-based industries.

If you have any questions or comments, please contact BGA Managing Director for Global Trade and Economics Nydia Ngiow, BGA Indonesia Manager Kenneth Ponggawa and BGA Malaysia Senior Analyst Ahmad Mohsein Azman.

Best regards,

BowerGroupAsia

Nydia Ngiow

Managing Director, Global Trade and Economics

Nydia brings over a decade of experience working at the forefront of international affairs and international trade issues in the Asia-Pacific, with the majority of her career prior to BGA spent working for the Singapore government. Nydia most recently managed the China Program at the American National Standards Institute (ANSI) in Washington, D.C., where she brought together technical, business and policy leaders to find solutions to issues affecting U.S.-China trading relations to strengthen U.S. market access in China. She provided member organizations with coverage of policy and reform issues, and furthered ANSI’s relationships with counterpart organizations in China. Positioned in ... Read More

×