US Trade Policy Shifts Focus to Pharmaceuticals and Furniture

BGA Managing Director for Global Trade and Economics Nydia Ngiow and Director for Health Care Yeh Cher Low wrote an update on the shifting focus of U.S. trade policy to pharmaceuticals and furniture.

Context

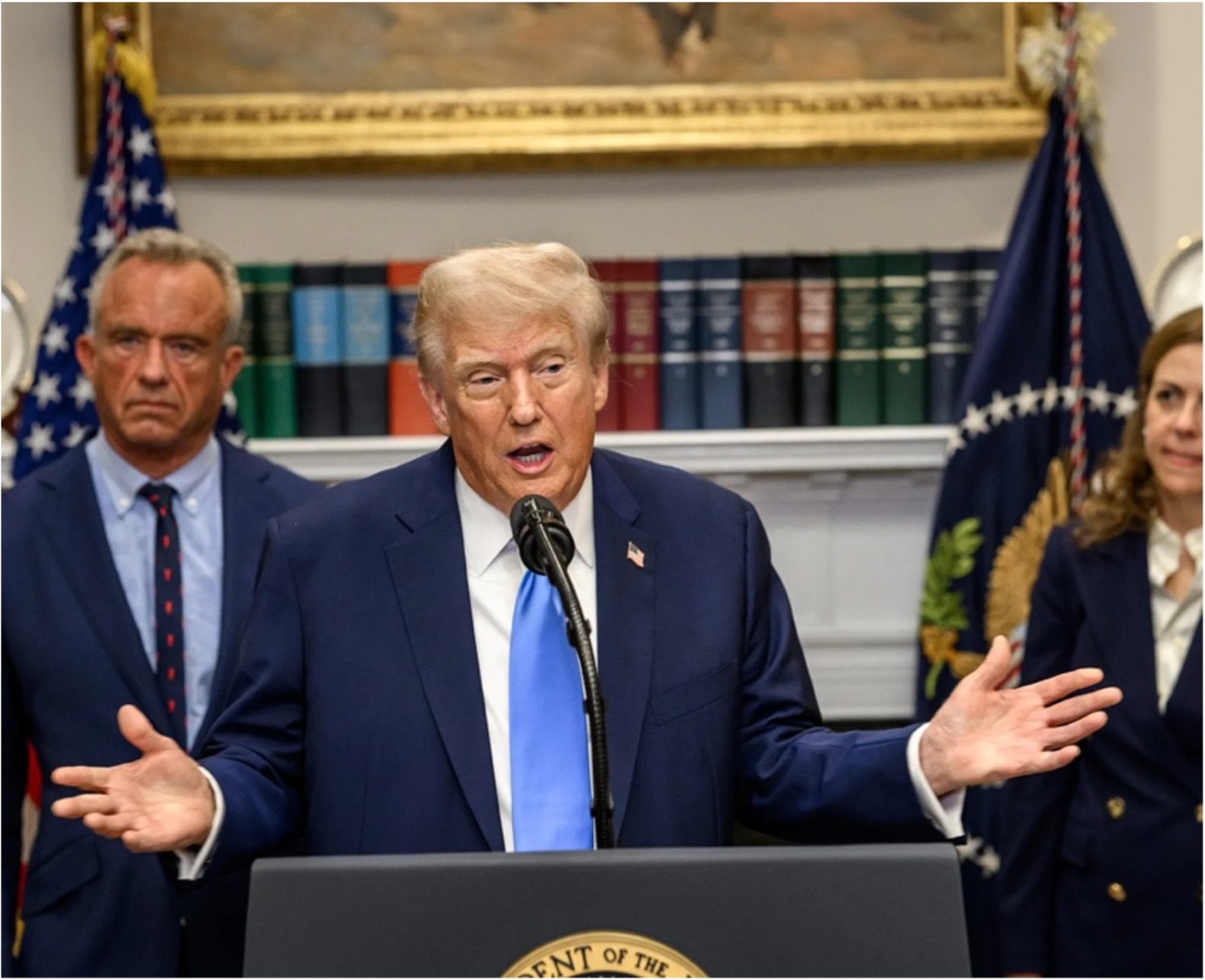

- U.S. President Donald Trump announced September 25 that beginning October 1, all branded and patented pharmaceutical imports into the United States will face a 100 percent tariff unless the manufacturing company has already broken ground on a plant in the United States. This measure, framed as part of a broader push to onshore pharmaceutical manufacturing, exempts generic drugs.

- Based on initial statements, the immediate impact will likely exempt Big Pharma because top global pharmaceutical companies already maintain manufacturing operations in the United States. Instead, the burden will fall more heavily on the small and medium-sized enterprises that work closely with and supply Big Pharma but lack the capacity to invest in U.S. production. While there will likely be questions over implementation, the effect will primarily be felt in patented drug flows, sparing the generic supply chain that underpins U.S. drug affordability. Asian branded innovators may face limited pressure given their relatively small export volumes to the United States.

- Trump announced the following in addition to the pharmaceutical tariffs:

- A 50 percent tariff on imported kitchen cabinets, bathroom vanities and associated products.

- A 30 percent tariff on upholstered furniture.

- A 25 percent tariff on foreign semitrucks.

Significance

- With the exemption of generics, the new tariffs should avoid disruptions to India’s and China’s dominant role in supplying low-cost medicines and active pharmaceutical ingredients. However, it is still unclear how this would be implemented and how customs authorities will differentiate between generics and branded or patented pharmaceutical products when both would still be categorized under the same harmonized system codes. Questions remain about whether only the drugs manufactured in the United States will be exempt or if everything in companies’ portfolios will be exempt provided that there is some amount of manufacturing in the United States.

- Exposure to European exporters will also be limited, because the U.S.-EU trade deal announced in July ensures that the combined tariff rate on EU-originating pharmaceuticals, semiconductors and lumber will not exceed 15 percent. It is not immediately clear whether Trump’s announcement would alter any of the above terms. Deals with Japan and the United Kingdom also include provisions that cap tariffs for specific products, including pharmaceuticals.

- The top 20 global pharmaceutical companies all maintain manufacturing operations within the United States.

Implications

- It remains to be seen if Trump will impose minimum requirements for onshoring investment and local production capacity in addition to those on building manufacturing plants in the United States. If so, it will likely violate prohibitions on performance requirements, which was a key feature in the U.S. free trade agreements with Australia, Korea, Singapore and in its bilateral investment treaties.

- The New York Times is reporting that the Trump administration may soon propose a regulatory process forcing drugmakers to cut U.S. prices to the lower levels in other wealthy countries. This was based on a notice posted on a federal website that was deleted and then republished, referring to a “proposed rule” and a global benchmark for efficient drug pricing model.

- The framing of this measure suggests parallels with other industries under Section 232 investigations, particularly semiconductors. Companies will most likely need U.S.-based manufacturing to secure tariff exemptions for semiconductors, particularly given Trump’s earlier comments in August, shifting the effectiveness of traditional government-to-government dialogues. In this environment, advocacy from Fortune 500 CEOs may carry greater weight with the administration. For small and medium-sized enterprises, a multi-pronged strategy — working through larger partners, industry associations and supportive governments — will be essential in navigating this period.

BGA is monitoring these developments closely. If you have any questions, please reach out to BGA Managing Director for Global Trade and Economics Nydia Ngiow or Health Care Director Yeh Cher Low.

Best Regards,

BGA Global Trade and Economics Team

BowerGroupAsia

×