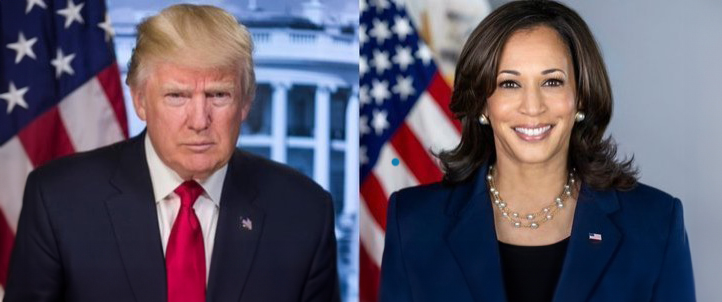

US Role in Indo-Pacific at Stake as Presidential Candidates Square Off in Heated Election

The U.S. presidential election is fast approaching, with the November 5 showdown just 15 weeks away from determining Washington’s future role in the Indo-Pacific. Following incumbent President Joe Biden’s withdrawal from the race, the battlelines have been drawn between Vice President Kamala Harris on the Democratic ticket and former President Donald Trump on the Republican ticket.

In what has been heralded as one of the most contentious elections in U.S. history, each candidate has articulated a distinct vision for the country’s future that will reverberate across the Indo-Pacific, affecting trade, multilateral commitments, climate and energy targets and security partnerships. Harris has pledged to continue many of the policies of the Biden administration and has assured regional partners of her resolve to stand by their side. Trump’s more inward-looking “America First” policy could again disrupt the status quo in the Indo-Pacific and has some of the region’s leaders on edge.

This update features analysis from several BGA experts on the specific policies of each presidential candidate, expounding on their implications for individual sectors and markets of interest to our clients. We also tease out the broader implications of a Trump and a Harris presidency for the Indo-Pacific and describe some scenarios that could unfold depending on whom is elected in November.

CLICK BELOW TO NAVIGATE TO A SPECIFIC SECTION OF THIS REPORT

Sector Implications

Enterprise Technology

| William Heidlage Senior Director Enterprise Technology |

Harris’ background as a prosecutor will be especially important as her administration seeks to defend the Biden administration’s agency-driven approach to supply chain diversification, export controls and outbound investment toward China in the context of the Supreme Court’s recent decision to reject the Chevron doctrine. This gave federal agencies deference in interpreting ambiguous statues. Technology companies could challenge the legal basis for the executive branch’s restrictions on their business in China, including the sale of advanced semiconductors and any future restrictions on the sale of compute services using those chips.

The vice president’s interests in artificial intelligence (AI) safety and ethics are already well-reflected in the Biden administration — the Department of Justice’s first chief AI officer is a former Harris adviser — and investors should expect a continuation of the global coalition approach. Harris has focused extensively on the risks associated with AI, particularly cybersecurity and bioweapons, maintains that voluntary commitments are not sufficient regulation and rejects the notion that regulatory protections conflict with innovation. A Californian, Harris has a donor base that includes a long list of technology business leaders.

A Trump administration, assuming the continuation of a Republican-controlled Congress, would more easily work with the legislative branch to codify many China-related restrictions into law, reducing the likelihood of a Supreme Court challenge. Trump has also expressed interest in more strictly applying tariffs to goods imported from China through third geographies, including Mexico and Southeast Asia, and investors should expect a Trump Office of the United States Trade Representative to expand the tariff regime from Trump’s first term, especially on electric vehicles and related technologies.

It is unclear whether a Trump administration would continue to invest in the AI Safety Institute network that the Biden administration launched with the United Kingdom, especially in the context of the Labour Party’s recent victory and potentially diverging from a second Trump administration in its approach. The Republican AI agenda is nascent but promises to be generally more liberal, repealing Biden’s executive order on AI and focusing on innovation and free speech.

Platform Technology

| Apoorva Kolluru Senior Director Platform Technology |

The leading candidates offer distinctly different visions for the future of tech regulation, particularly in areas such as antitrust enforcement and issues of content moderation. Harris, if elected, is expected to largely continue the Biden administration’s approach but with some potential shifts in focus and intensity.

Biden’s administration has pursued an unprecedented antitrust policy, spearheaded by Lina Khan at the Federal Trade Commission and Jonathan Kanter at the Department of Justice. At this stage, it is unclear whether a Harris administration would maintain this level of intensity in antitrust enforcement. Harris’ stance on technology antitrust has been notably ambiguous, often dodging questions about breaking up Big Tech companies. This ambiguity will be increasingly difficult to maintain now that she is facing self-proclaimed tech antitrust advocate in Republican vice presidential nominee J.D. Vance. This dynamic will likely push Harris to clarify her position on tech antitrust issues as the campaign progresses. Harris is expected to strengthen regulation around AI, prioritizing consumer privacy, cybersecurity and safety issues. She has also taken a firm stance on content moderation, misinformation and online harassment, advocating for stricter regulations to hold social media platforms accountable for harmful content.

In contrast, Trump’s potential return to the White House could signal a shift toward a more hands-off approach to tech regulation, likely easing pressure on tech mergers and acquisitions. This could benefit technology companies looking to expand their AI capabilities through startup acquisitions. However, Trump’s stance on social media regulation diverges from his generally deregulatory approach. During his previous term he pressured Congress to repeal Section 230, which protects social media platforms from liability for user-generated content.

Vance is a wildcard in the race. He praised Biden’s antitrust crackdown and has embraced Khan. Vance sees Big Tech as a threat to freedom of expression and has said it hinders job creation. His closeness to the venture capital industry has shown that he is interested in deregulating cryptocurrencies and AI. He has expressed concerns about the Biden administration’s efforts to regulate AI, saying the regulations provide an unfair advantage to tech giants that have vastly more resources to deal with bureaucracy.

Energy, Climate and Resources

| Bradford Simmons Senior Director Energy, Climate and Resources |

The two candidates’ energy and climate policy platforms are among the most diametrically opposed issue areas heading into the 2024 election. A potential Harris administration would seek to build on the most consequential legislative and policy agenda for climate in a single presidential term, advancing the Bipartisan Infrastructure Law (BIL), the CHIPS Act and the Inflation Reduction Act (IRA) implementation to leverage clean energy industrial expansion as a vessel for domestic industrial rejuvenation and emission reductions. This inclination toward continuity is the result of the outstanding, unresolved implementation guidelines for some of the IRA’s most significant tax credits and unspent budget outlays from the BIL, CHIPS and IRA. It is also due to the unprecedented, condensed period that the Harris campaign will need to establish policy aspirations that resonate with the electorate.

Internationally, a Harris administration would seek to maintain a mantle of leadership in climate ambition, particularly in advance of 30th U.N. Climate Change Conference (COP 30) in 2025, which requires Paris Agreement signatories to update nationally determined contributions to extend through 2035. COP 28’s Global Stocktake revealed existing and projected greenhouse gas emission stocks to be incompatible with preserving 1.5- and 2-degree Celsius temperature change scenarios, which would lead a Harris administration to aggressively pursue enhanced ambition from the world’s highest emitters with a particular focus on India, China and other emission-intensive developing Asian economies.

Pressure would mount in a Harris presidency to address carbon leakage as a mode of ensuring U.S. industrial competitiveness and improve the efficacy of demand-pull policies for low- or zero-carbon products, particularly around hard-to-abate industrial sectors like steel, aluminum and concrete. Such solutions will require a degree of compatibility with other emerging trade measures, including carbon border adjustments and climate clubs, which will lead to more intensive consultations with climate and geopolitically aligned Asian partners in India, Korea, Japan and Australia.

A second Trump administration would seek to reverse many of the climate- and energy-related policies inherited from the Biden administration. Although the fate of the IRA remaining statutorily intact relies more on congressional election outcomes than which party resides in the White House, a Trump administration would likely wield discretionary rulemaking authorities to dilute the legislation’s impact and roll back complementary “stick” provisions such as the Environmental Protection Agency’s more stringent fuel economy standards and power plant emission guidelines.

However, the growth of IRA-driven energy investments ($265 billion and counting, including large sums from Asian energy conglomerates) and the disproportionate share of those manufacturing dollars flowing to Red states will present a complex set of incentives and dynamics internal to the Republican Party that may drive a less hostile approach to the IRA than early Trump campaign rhetoric would indicate. Reflecting these dynamics, Trump moderated his approach toward electric vehicles (EV) during recent campaign events and even signaled potential openness to Chinese EV producers investing in the United States.

A second Trump term would lead to renewed efforts to ease environmental regulations and open acreage for oil and gas development and an immediate repeal of the liquified natural gas export pause, a policy of concern to major Asian importers, is assured. But as the Trump-to-Biden transition demonstrated, that policy turbulence has not thwarted prolific U.S. oil and gas production from continuing to achieve historically high output. Trump officials would halt all climate-mitigation-geared international and diplomatic efforts and would either withdraw from the Paris Agreement or cease constructive engagement with the U.N. process.

A Trump administration would align with other major hydrocarbon producers and climate laggards in multilateral groupings to stall initiatives geared toward climate ambition and erode relative consensus over the past four years among major economies. In place of Indo-Pacific energy and climate initiatives such as the Just Energy Transition Partnerships, the administration would focus on energy exports and natural gas demand stimulation to address trade imbalances (see trade section below). Lone areas of continuity would be promotion of civil nuclear exports and nuclear market development in Asia and reducing dependencies on China in critical material supply chains.

Financial Services

| Chi-Jia Tschang Senior Director Financial Services |

Harris has maintained a low profile in the current administration’s financial policies, but she has taken a tough stance on banks and voted against deregulation during her time as attorney general of California. Analysts believe Harris will continue with the Biden’s administration’s direction on banking and financial services regulations. The Biden agenda has adopted and proposed rules cracking down on bank fees, nonbank lenders and medical debt providers; required greater transparency from hedge funds; increased the amount of capital banks must hold; and led enforcement actions against cryptocurrency firms. Harris led a Consumer Financial Protection Bureau initiative in 2023 to make changes to the Fair Credit Reporting Act, which would remove medical debt from consumer credit reports.

In comparison, Trump’s approach would lean toward deregulation and a hands-off approach toward the sector. Trump would likely be more friendly to business interests and extend the corporate tax cuts signed in his first term that are set to expire next year. However, his running mate J.D. Vance is known for being critical of financial elites, criticizing tax breaks and being a proponent of cryptocurrency. Trump said that if he were elected, he would end the “hostility” the crypto industry has faced in the Biden administration. Tougher rules in the United States could be set aside for policies that make it easier for stablecoins to enter financial markets, like letting regular commercial banks host and issue stablecoins.

Health Care

| Yeh Cher Low Director Health Care |

Health care is poised to be a pivotal issue in the upcoming U.S. presidential election. The future of the 2010 Affordable Care Act (ACA), commonly known as Obamacare, will be at the center of the debate. Trump has once again vowed to repeal and replace this legislation. Both Trump and Harris are committed to curbing medical and pharmaceutical inflation, although their approaches diverge. Harris, mirroring Biden’s approach, advocates for federal price negotiations, while Trump champions greater transparency. The contentious issue of abortion will also starkly divide the candidates along party lines, with Harris promising to safeguard abortion rights. Ultimately, decisions on this issue will be left to individual states and courts.

A second Trump term would bring profound changes to the health care sector. Trump aims to dismantle the Affordable Care Act, potentially reducing subsidies for policyholders and cutting federal Medicaid funding. His administration would likely halt Medicare price negotiations and promote industry-wide pricing transparency. Although Trump’s stance on abortion is ambiguous, his Supreme Court appointments were instrumental in overturning Roe v. Wade, paving the way for further restrictions.

Trump’s legacy includes the enactment of the No Surprises Act, which shielded patients from unexpected medical bills and enforced hospital price transparency. The Right to Try Act under Trump sought to provide terminally ill patients with access to experimental treatments. Overall, a Trump administration would emphasize health care choice and transparency while reducing federal oversight, aligning the sector with conservative principles and priorities.

Harris has been a staunch advocate of Biden’s health initiatives, pushing for lower prescription drug prices and supporting a gradual transition to a single-payer health care system. Harris would uphold Biden’s commitment to federal price negotiations, exemplified by the cap on insulin costs at $35 a month and initiating price negotiations on widely used drugs.

The vice president is a vocal proponent of reproductive rights and maternal health, focusing on combating bias against Black women in health care and expanding the Affordable Care Act to enhance coverage and secure permanent federal subsidies. She is committed to health equity and broader access for all Americans. Her proactive stance on reproductive rights includes strong opposition to the Supreme Court’s decision to overturn Roe v. Wade and advocacy for nationwide abortion access. Harris’ emphasis on maternal health highlights efforts to address systemic biases and improve health care outcomes for marginalized communities. Her approach represents a progressive vision aimed at increasing federal involvement and ensuring equitable health care access across the nation.

Defense

| Anh Hoang Director Defense |

In a second term, Trump would likely continue prioritizing military and strategic competition with China and Russia, enhancing military capabilities and developing technologies to counter these potential adversaries. Given the Biden administration’s broadening of nuclear deterrence to include responses to cyberattacks and other nontraditional threats, a second Trump term might see continued development of new nuclear capabilities and advocacy to expand the conditions under which nuclear weapons could be used.

Under the Trump administration, the National Security Strategy in 2017 adopted a very pragmatic approach by putting America first. It called for a total military modernization and the reversal of previous decisions to shrink the armed forces. This was evidenced by the $700 billion National Defense Authorization Act Trump signed to boost the U.S. defense industry and create more jobs at home. Trump’s first term saw significant increases in defense spending, enhanced troop readiness and created the U.S. Space Force. A second term would likely continue these trends, focusing on modernizing equipment and investing in technologies like AI, hypersonic weapons and cyber capabilities to maintain a technological edge over potential adversaries.

Trump’s “America First” stance may lead to a reinstatement of isolationist policies, with a potential reduction in U.S. involvement in international alliances. Trump’s unilateral decision-making style would likely continue in a second term, potentially straining alliances with abrupt policy changes or withdrawals from prior U.S. commitments. A second Trump term would likely reinforce many of the defense and national security policies from his first term. The approach could be marked by increased assertiveness toward potential adversaries, the further erosion of traditional military alliances and a continuation of a focus on domestic over international priorities.

Trump recently said Taiwan should compensate the United States for the costs associated with its defense. The AUKUS (Australia-United Kingdom-United States) defense pact, which focuses on technology and security collaboration, aligns well with Trump’s preference for business-like transactions. Under his leadership, the United States would likely continue to support AUKUS because it is not a traditional alliance but a mutually beneficial arrangement in which all members contribute financially.

Trump’s explicit characterization of the Quadrilateral Security Dialogue (the “Quad”) between Australia, India, Japan and the United States as a counterbalance to China would likely continue if he wins a second term. His administration might push Quad allies to take a more confrontational stance against Beijing and advocate for enhanced technology and cybersecurity cooperation to curb China’s progress.

Under a Harris administration, the United States would likely continue the Biden administration’s China policy by employing a dual strategy of confronting China’s aggressive actions, particularly in the Indo-Pacific and the South China Sea, while encouraging cooperation on global issues such as climate change. Harris shares Biden’s security outlook on the Indo-Pacific and Taiwan and has previously denounced Beijing’s human rights abuses in Hong Kong and Xinjiang province.

A Harris administration would be expected to prioritize bolstering U.S. alliances and international partnerships. Her administration would likely emphasize the importance of the North Atlantic Treaty Organization (NATO), reaffirm commitments to other key allies and advocate for cooperative approaches to global challenges. Her focus on multilateralism reflects her belief in U.S. leadership through collaborative efforts rather than unilateral action.

A Harris administration is expected to balance defense spending with other priorities, given her record of opposing significant budget increases while supporting strategic capabilities and partnerships during her tenure as a senator from California. Harris’s focus on human rights and ethical considerations in foreign policy could lead to continued criticism of abuses in China and North Korea and integrating these concerns into broader national security strategies. She would likely maintain U.S. involvement in global conflicts and crises, supporting democratic values and countering aggression, especially in Ukraine and the Middle East. Given the importance of transformative technologies and cybersecurity, Harris might prioritize advancements in these areas, investing in emerging technologies to address new threats.

Under a Harris administration, support for the AUKUS defense pact would be expected to continue with the goal of keeping China at bay and maintaining regional maritime security, building on the foundation laid by the Biden administration. Similarly, the United States under Harris’s leadership would likely continue to elevate cooperation with the Quad in alignment with the Biden administration’s Indo-Pacific strategy. Priorities would include ensuring open trade routes, countering Chinese naval provocations and enhancing maritime cooperation among Quad nations. Harris would likely advocate for coordinated policies on health security, economic recovery and technological advancements to address challenges posed by China’s influence.

Trade

| James Carouso Senior Adviser |

Harris would likely continue the Biden policy of “trade for the middle class.” This translates into continued industrial policy favoring domestic manufacturing through subsidies and tax advantages, especially for products associated with semiconductors and the green energy transition. No new free trade agreements are expected. However, the trade policy pillar of the Indo-Pacific Economic Framework could be quickly agreed after the election given that it is largely completed, and it would be politically preferable to have it done as far before midterm elections as possible. Given Harris’ northern California home and links to Silicon Valley funders, a digital trade agreement could be forthcoming. Trade tensions with China are not expected to ease and could increase depending on events in Ukraine, the Taiwan strait and South China Sea. A Harris administration could potentially support World Trade Organization reform.

Should Trump be elected, the Republican platform, which was essentially dictated by Trump, would commit to “protect American workers and farmers from unfair trade.” This includes “supporting baseline tariffs” of at least 10 percent “on foreign-made goods” alongside a vow to “secure strategic independence from China” through a 60 percent tariff on all Chinese imports. The impact on Asian trade with China from such policies could be significant, especially for China’s suppliers of raw and semiprocessed materials such as Indonesia and Australia. Given Trump’s transactional approach, the 10 percent universal import tariff could be waived for nations with which the United States has a trade surplus or could achieve such. Currently, only Australia and Hong Kong have a trade deficit with the United States. Support for international bodies such as the World Trade Organization would further erode with no alternative offered.

| Amb. Scot Marciel Senior Adviser |

A Trump administration is much more likely than a Harris administration to take retaliatory action against countries such as Vietnam that either have large bilateral trade surpluses with the United States or are seen as reexporting Chinese-made products to the United States. Trump’s potential imposition of widespread tariffs could well lead trading partners, including China, to retaliate with similar tariffs, directly affecting U.S. exports and damaging the global economy.

Another major difference could be in support for infrastructure projects abroad, particularly in clean energy. While the first Trump administration supported the BUILD Act and other measures to help U.S. companies compete for such projects, his rejection of climate change means he would be unlikely to support funding for major programs like the Just Energy Transition Partnerships in Indonesia and Vietnam. With Trump’s transactional mindset, any willingness to provide support for other infrastructure projects could be tied to specific political, strategic and economic asks of potential recipient countries, such as when his administration tied potential Development Finance Corporation funding to Indonesia to Jakarta’s willingness to recognize Israel. A Harris administration is more likely to continue Biden’s current approach of supporting funding for clean energy and other projects, although its ability to deliver actual funding remains in question.

| Amb. C. Lawrence Greenwood Senior Adviser |

Generally, Japanese leaders believe they can handle a second Trump administration as adeptly as they did the first, even in the absence of former Prime Minister Shinzo Abe. However, some are concerned about unpredictable action from Trump, particularly on North Korea and Taiwan. Trump will be looking for big foreign policy wins, and Japanese officials are concerned he may be willing to trade the withdrawal of troops from South Korea for a weak nuclear deal with the North. Another possible point of friction could be China policy. Although currently closely aligned, Japan may balk at even tougher export controls on China under a Trump administration, particularly since Japanese industry has more to lose than U.S. companies. That lack of alignment, combined with large Japanese trade surpluses with the United States and an uncertain leadership transition in Japan, could lead to friction in the overall relationship.

If you have any questions or comments, please contact the individual experts who wrote each section or BGA Head of Research Murray Hiebert at mhiebert@bowergroupasia.com.

Best regards,

BowerGroupAsia

BowerGroupAsia

Subscribe to Asia Street

Insights & News

Malaysia Tariff Tracker | July 10, 2025

The BGA Malaysia Team, led by Senior Director Sadiq Noor Azlan, wrote an update to …

Sadiq Noor Azlan

Sadiq Noor Azlan

Angola Navigates Commodity Dependence and Diversification Challenges

WHAT YOU NEED TO KNOW ON THE HORIZON Angola Market Overview and Forecast Political Climate …

Mário Almeida

Mário Almeida

Indo-Pacific Recoils From New US Tariff Announcements

The BGA Global Trade and Economics Team, led by Managing Director Nydia Ngiow, wrote an …

Nydia Ngiow

Nydia Ngiow

At BowerGroupAsia, we are committed to

delivering result-oriented solutions for our clients

We have proven track record of helping the world’s top companies seize opportunities and manage challenges across the dynamic Indo-Pacific region.