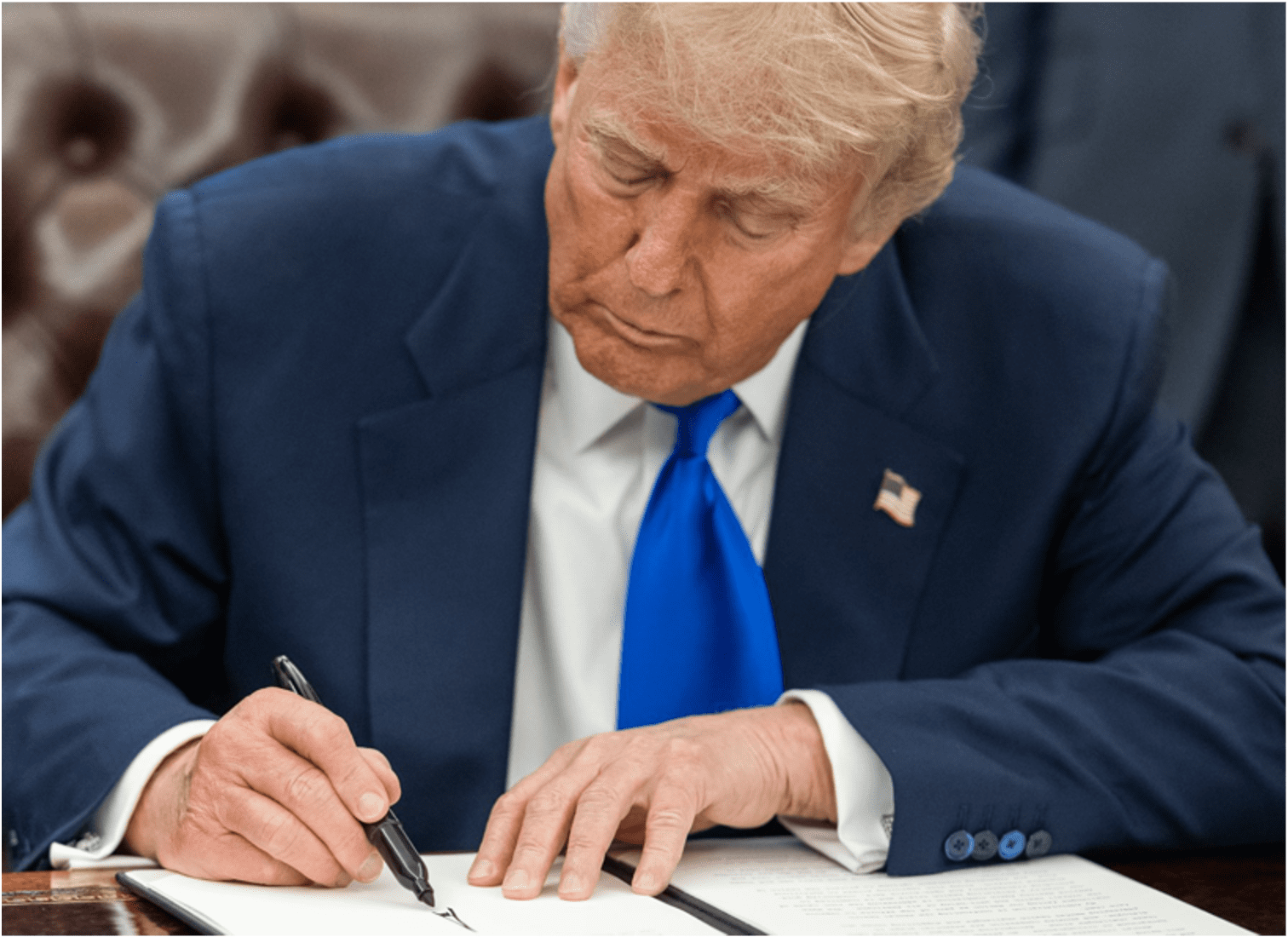

Indo-Pacific Considers New US Tariff Threat

The Indo-Pacific remains actively engaged in trade negotiations with the United States following U.S. President Donald Trump’s announcement of new tariff rates in letters sent to various countries since July 7. Although tariff rates have mostly stayed the same — even increased in some cases — discussions continue, with many government officials from the region either already in the United States or scheduled to arrive in the coming days.

Publicly, countries have expressed cautious optimism that upcoming negotiations and revised trade proposals may result in more favorable tariff rates in the months ahead. At the same time, they are also accelerating efforts to diversify their export markets and industries, strengthen their domestic economies and pursue opportunities with more nontraditional trading partners.

Given the latest announcement that the European Union faces a 30 percent tariff, this constantly evolving environment underscores the need to closely monitor tariff developments and potential shifts in trade policy. Companies should continue to prepare for continued uncertainty in the near term, including the possibility of sudden policy changes. As they evaluate supply chain resilience and exploring alternative markets, they should continue to proactively engage policymakers to ensure their interests are represented in the ongoing discussions.

Bangladesh

Senior Adviser

BGA Bangladesh

President Trump sent a letter to Bangladesh Chief Adviser Muhammad Yunus July 7 indicating a new tariff rate of 35 percent on Bangladeshi exports to the United States. The announcement came two days before the president’s previous deadline to impose a 37 percent tariff on Bangladesh. Trump said negotiations will remain open until the new tariff rate takes effect August 1.

The news came as a shock to Bangladeshi officials, who were under the impression that the proposed tariff rate could be deferred for one year. The announcement has also led to concerns among the business community. Some buyers have hinted that Bangladesh’s exporters should share some of the tariff burden, and big importers have postponed their orders until the tariff issue is settled.

Bangladeshi officials immediately engaged with U.S. authorities and signed a nondisclosure agreement June 12. Several rounds of high-level negotiations took place in Washington, D.C., in the last week of June, and drafts were exchanged. Subsequently, Bangladesh Adviser for Commerce Sheikh Bashir Uddin joined the negotiating team for a three-day talk with U.S. trade representatives July 9.

Seeking lower tariff rate in line with what has been negotiated with Vietnam, Bangladesh requested special consideration given its status as a least-developed country. Officials also conveyed that it would be difficult to comply with some of Washington’s conditions and expressed their intention to reach an agreement within the World Trade Organization’s framework.

At the same time, Bangladesh will increase imports from the United States, including purchases of Boeing aircraft, liquefied natural gas and wheat.

Bangladesh’s commerce adviser held a meeting with his U.S counterpart July 11 to seek a lower tariff rate. The adviser briefed the media July 14 in Dhaka that the talks are still ongoing, and he expected a “rational” solution. The concern in Dhaka is that any tariff rate higher than the one agreed with Vietnam may erode Bangladesh’s competitive edge in ready-made garment exports, which constitute about 95 percent of the country’s exports to the United States.

Cambodia

Managing Director

BGA Cambodia

In a letter Trump sent to Prime Minister Hun Manet July 7, U.S. tariffs on Cambodian goods will be set at 36 percent, a reduction from 49 percent (the rate imposed on April 2) to 36 percent. This marked one of the sharpest cuts among the countries receiving similar letters. Cambodian officials expressed gratitude to Trump and reaffirmed their readiness to resume talks before the August 1 deadline. Deputy Prime Minister Sun Chanthol July 8 said that the 36 percent rate is not final, and the door remains open for continued cooperation, especially regarding the 11,414 harmonized system code lines for U.S. exports to Cambodia. Chanthol said he had emailed the U.S. trade representative, saying that his delegation was ready to either travel for negotiations or engage virtually to further reduce its tariff rate.

The government has reassured manufacturers and investors and urged them to remain calm, affirming that the government will protect their interests and continue to promote a favorable investment environment. Phnom Penh is working to improve trade efficiency through reduced production, logistics and transportation costs to attract investment and is expanding export markets through new trade agreements. Cambodia is also actively diversifying its economy beyond garments by developing its emerging industries and tourism sector. A high-level meeting on July 16, led by Hun Manet, is expected to further advance efforts to boost agricultural exports to China while expanding access to existing markets and broadening diversification beyond traditional partners. Cambodia attracted 396 investment projects worth $6 billion in first half of the year, generating more than 270,000 jobs. The Ministry of Labor said tariffs will not drive major buyers away, because relocation involves significant costs and infrastructure challenges.

Indonesia

Managing Director

BGA Indonesia

Indonesia is set to face a 32 percent tariff, unchanged from Washington’s original proposal, despite negotiations that at various points appeared to be well received by U.S. counterparts.

President Prabowo Subianto has yet to issue a public statement but is maintaining a conciliatory approach. Coordinating Minister for Economic Affairs Airlangga Hartarto, who has been leading Indonesia’s response, flew directly to Washington, D.C., from the BRICS summit in Brazil following the announcement. He has since met with U.S. Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer. Airlangga is reported to have advanced a more expansive critical minerals proposal as part of Indonesia’s offer, which he claims attracted U.S. interest. The prospect of a zero percent tariff, still the official target just a week ago, now appears increasingly distant, particularly in the absence of a fundamental shift in Indonesia’s negotiating strategy.

Separately, the Minister of State Secretariat, which provides support to the president, has hinted that Prabowo may meet Trump, although details remain sparse. He also expressed hope that the United States would “seriously consider” Indonesia’s latest proposal.

Japan

Managing Director

BGA Japan

In response to Trump’s announcement of a 25 percent tariff on Japanese imports, Prime Minister Shigeru Ishiba, speaking at an election campaign rally, declared, “Even with an ally, we must assert ourselves. We will not be pushed around,” signaling a strong stance.

The government’s primary concern is the potential impact on Japan’s automotive sector. Mazda, which exports most of its U.S.-bound vehicles from Japan, is seen as particularly vulnerable. Nonetheless, the company has announced it will not raise prices on its new SUVs in the United States, reflecting confidence in its cost-reduction efforts and ability to remain competitive.

Unlike the bilateral trade frictions of the 1980s, the current tariffs are part of a broader initiative targeting multiple countries, which has given Japanese companies some relief. Some automakers even argue that paying tariffs is more manageable than facing export quotas. The cool responses from the political and business circles indicate their awareness that more concrete diplomatic outcomes are taking place behind the scenes.

Korea

Managing Director

BGA Korea

In response to the latest U.S. tariff threats, Korea is working to reframe the conversation beyond narrow trade imbalances ahead of what it sees as an extended window for negotiations. Seoul proposed a “package deal” linking trade with broader alliance contributions, including Korea’s liquefied natural gas purchases, investments in the United States and defense and security cooperation, notably in shipbuilding.

According to National Security Adviser Wi Sung-lac, who visited the United States for discussions from July 6-7, Korea’s proposals were made in a meeting with U.S. Secretary of State Marco Rubio, who expressed partial agreement. Wi noted that trade talks with Washington have made significant progress, with both sides now aligning their positions after identifying key issues. This marks progress from President Lee Jae-myung’s July 3 comment that priorities had yet to be defined.

Although no date has been set for a summit between Presidents Lee and Trump, Seoul is pushing for early top-level engagement to steer negotiations toward a balanced outcome.

At home, the government met with major exporters July 9, including Samsung Electronics, Hyundai and SK Hynix, to gather industry input on challenges posed by potential tariffs and overseas regulatory hurdles. In parallel, it pledged to take all necessary steps to improve the fundamental competitiveness of domestic companies.

Malaysia

Senior Director

BGA Malaysia

President Trump’s letter informing Malaysia of the increased tariff rate caught the government by surprise, despite internal acknowledgement that its proposed concessions may not be satisfactory to the United States. Trade Minister Tengku Zafrul Tengku Abdul Aziz acknowledged that the situation had not panned out as intended, but he believed the delayed implementation window and good relations with U.S. counterparts would allow more space for negotiations as both countries work towards finding an amicable solution.

Prime Minister Anwar Ibrahim raised the issue of reviewing the tariff rate at his meeting with U.S. Secretary of State Marco Rubio, who was in Kuala Lumpur for the ASEAN foreign ministers’ meeting. Rubio reaffirmed support towards ASEAN, saying the United States has no intention of abandoning the region, noting that multiple Asian countries are still conducting bilateral talks on their tariff rates.

However, Washington remains adamant on its demands, which may not be easily addressed or met by Malaysia. This includes requirements to improve regulatory compliance on agricultural, trade, labor and environmental issues, alongside improvements in market access and technology security. It remains to be seen if such demands, which include “red lines” that Malaysia is unwilling to cross, can be resolved as Malaysian negotiators continue to deliberate with their U.S. counterparts.

Tengku Zafrul reiterated that Malaysia will prepare for all possible scenarios resulting from the outcome of the negotiations. Malaysia maintains its neutral position as it seeks to expand economic collaboration with other trade partners, including BRICS, which may become another point of contention in the country’s relationship with the United States.

Internally, the Malaysian Central Bank adjusted its overnight policy rate to 2.75 percent in anticipation of future geoeconomic uncertainties. The impending imposition of U.S. tariffs and the corresponding impact on the Malaysian economy will remain a hotly debated issue as Parliament convenes at the end of July.

Philippines

Managing Director

BGA Philippines

In response to the increased tariff rate on Philippine goods from 17 percent to 20 percent, Philippine Ambassador to the United States Jose Manuel Romualdez said that the Philippines plans to further negotiate a reduction. Secretary Frederick Go, the special assistant to the president for investment and economic affairs, together with Department of Trade and Industry (DTI) Secretary Cristina Roque and Undersecretaries Ceferino Rodolfo and Allan Gepty, headed Washington, D.C. the week of July 13. Go clarified that the trip had already been scheduled before the U.S. tariff decision was announced.

Go expressed a commitment to continue negotiations with the United States in good faith to pursue either a bilateral comprehensive economic agreement or a free trade agreement. He added that most of the country’s top exports to the United States, particularly semiconductors and electronics, remain exempt from the new tariffs due to U.S. national security and supply chain priorities.

Despite the increase, the 20 percent tariff is still the second lowest in the region, next to Singapore’s 10 percent. The DTI noted that while it recognizes U.S. concerns about trade imbalances and efforts to strengthen domestic manufacturing, global supply chains are now highly interconnected, underscoring the importance of constructive engagement to address trade issues.

Thailand

Managing Director

BGA Thailand

Thailand received a letter from the Trump team confirming the imposition of a 36 percent tariff on Thai exports to the United States, effective August 1. Although the rate matches the figure previously announced, the letter signaled that negotiations could still proceed if Thailand adjusts its trade posture, particularly by expanding access for U.S. agriculture, financial services, telecommunications and defense-related procurement. The Federation of Thai Industries estimates that the tariff could result in export losses of THB 800 billion to THB 900 billion ($22.2 billion to $25 billion). Separately, the University of the Thai Chamber of Commerce projects that if tariffs between 25-36 percent are enforced from August through the end of the year, exports may shrink by THB 200 billion ($5.5 billion) and up to THB 400 billion to THB 600 billion ($11.1 billion to $16.7 billion).

Deputy Prime Minister Pichai Chunhavajira reaffirmed Thailand’s intention to continue dialogue. A revised counterproposal was submitted on July 6, just ahead of the U.S. announcement. It reportedly includes increased access for U.S. agricultural and industrial goods, along with potential openings in energy and aerospace. Thai officials remain confident that a negotiated adjustment is possible before the formal tariff implementation.

Thailand recognizes that U.S. concerns also center on nontariff barriers, especially in sectors such as banking, telecommunications and investment restrictions. These issues have been incorporated into Thailand’s ongoing interagency engagement and are being considered as part of a broader regulatory review.

Meanwhile, the government is preparing parallel domestic mitigation measures. Budget reallocations have been announced to support structural investment, infrastructure and small and medium-sized enterprise resilience. These are intended to cushion key export sectors if the tariff proceeds as scheduled. In the longer term, Thailand is exploring trade diversification through regional frameworks such as the Regional Comprehensive Economic Partnership. The Thailand Economic Task Force — which was set to convene July 11 — has floated the idea of offering zero percent tariff treatment to the United States as part of a recalibrated export model. This dual-track strategy reflects Thailand’s attempt to preserve market access while rebalancing its longer-term trade exposure.

If you have any questions or comments, please contact the individual experts who wrote each section, BGA Managing Director for Global Trade and Economics Nydia Ngiow or BGA Head of Research Murray Hiebert.

Best regards,

BowerGroupAsia

Nydia Ngiow

Managing Director, Global Trade and Economics

Subscribe to Asia Street

Insights & News

China Forecast: Navigating Growth, Tech Ambitions, Social Strains and Investment Opening

WHAT YOU NEED TO KNOW ON THE HORIZON China Market Overview and Forecast Political Climate …

Eric Wang

Eric Wang

India Forecast: Economic Resilience and Strategic Reforms Drive Investor Confidence

WHAT YOU NEED TO KNOW ON THE HORIZON India Market Overview and Forecast Political Climate …

Anuj Gupta

Anuj Gupta

Tech in 2026: AI Investment, Regulatory Impacts and Supply Chain Resilience

WHAT YOU NEED TO KNOW ON THE HORIZON Sector Overview and Forecast Macrotrend Monitor Section …

William Heidlage

William Heidlage

At BowerGroupAsia, we are committed to

delivering result-oriented solutions for our clients

We have proven track record of helping the world’s top companies seize opportunities and manage challenges across the dynamic Indo-Pacific region.