Indo-Pacific Economies Develop Strategies To Offset US Tariff Impacts

The new tariffs U.S. President Donald Trump announced April 2 present many challenges and some opportunities for Indo-Pacific countries. Across the region, countries are adopting a mix of strategies to mitigate the impact on their economies. Common trends include diversifying export markets, lowering tariffs, abandoning anti-dumping measures and supporting domestic industries. Many countries hope to engage in bilateral negotiations with Washington to seek favorable terms. Except for China, most have decided against imposing retaliatory tariffs for now, recognizing that such measures could escalate tensions and further disrupt trade relations. Despite some anticipated market disruptions and downturns, the responses demonstrate the region’s efforts to promote collective resilience and adaptability in the face of protectionist policies.

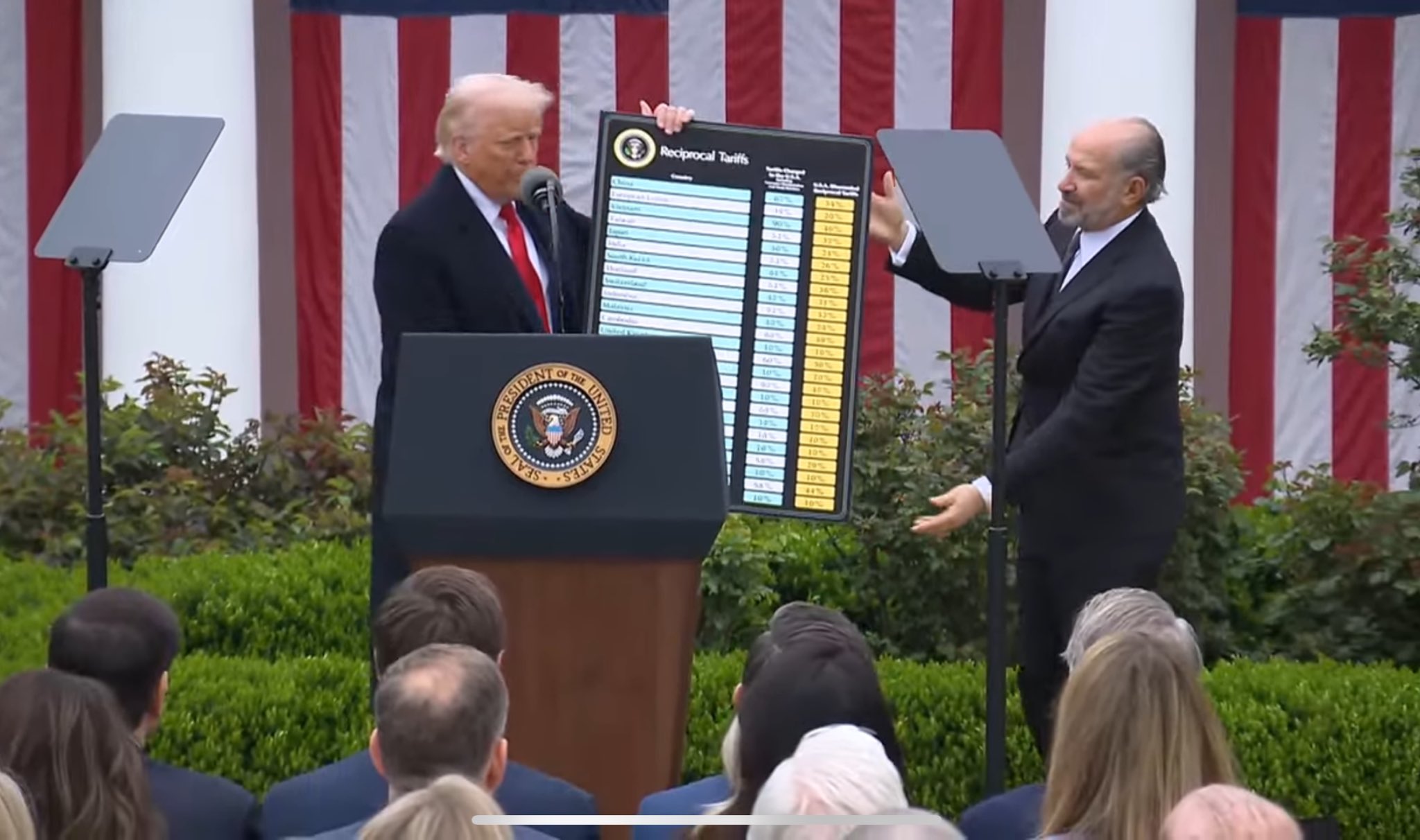

Trump said the tariffs on individual countries with large trade surpluses with the United States were determined by calculating a combination of their tariffs against U.S. goods, their nontariff barriers that hamper U.S. companies and other challenges such as currency manipulation. In the end, it appears the U.S. administration used the figure of country’s trade surplus and divided that by its imports from the United States to determine a figure, which was then divided by 2 to set the country’s percentage tariff rate. The equation used to calculate the reciprocal tariff rate for each country can be found here.

This report synthesizes key findings from BGA’s teams on the ground, providing a comprehensive overview of the responses and strategies Indo-Pacific countries are pursuing in response to the new tariffs. The countries are arranged in the order they appeared on Trump’s reciprocal tariffs chart. Our experts also highlight the diverse approaches each country is taking, offering our clients a detailed and nuanced understanding of the regional landscape.

China

Trump hit China with 34 percent new tariffs on top of previously imposed levies. The new U.S. tariffs in addition to existing duties of 20 percent will bring the total to 54 percent tariffs on goods. This will hit China’s economy hard. It is the highest level imposed on any major economy and higher than market expectations.

The tariffs will severely impact Chinese exports to the United States. China’s earlier effort to circumvent U.S. tariffs by manufacturing in or shipping through Southeast Asian countries, specifically Vietnam, will not be effective because they are also facing high tariffs.

Another U.S. move against China is the closure of the de minimis exception, which previously allowed low-cost Chinese imports (under $800) to bypass tariffs. With cross-border e-commerce accounting for about 5 percent of China’s total exports, the removal of the tariff exemption will subject these goods to higher tariffs and more customs paperwork, worsening the situation for Chinese exports.

China retaliated on April 4, announcing tariffs of 34 percent on all U.S imports, sharply escalating the trade war and pushing Beijing’s average tariffs on U.S. exports to around 50 percent. China also introduced other measures, such as restrictions on exports of rare earths, and added 11 U.S. entities to its list of unreliable entities and another 16 to its export control list.

China will likely coordinate efforts with other countries to counter U.S. actions, especially through deeper strategic and economic collaboration with Southeast Asia, the European Union, Korea, Japan and emerging markets. These countries may not share identical policy priorities with Beijing, but shared concerns about U.S. protectionism could prompt multilateral coordination in trade policy and even joint legal challenges. In this context, ongoing bilateral disputes — such as China’s tensions with Canada — are expected to take second priority or even be temporarily suspended, as Beijing shifts diplomatic resources toward building a united front against U.S. trade aggression.

Although these markets may not fully compensate for its loss in the short term, they offer China an opportunity to overtake the United States as many of their largest trading partners. However, China’s already weak domestic consumption will likely be hit harder by Trump’s tariffs.

China has condemned the new tariffs as “self-defeating bullying” and vowed to take countermeasures. Negotiations with the United States remain possible, and China could leverage its approval of ByteDance’s sale of TikTok to U.S. buyers, because Trump has expressed a willingness to offer tariff relief in exchange. The trade war’s outcome remains uncertain, but both economies face potential long-term disruptions.

Vietnam

The U.S. president imposed tariffs of 46 percent on Vietnam. Two days after Trump announced the new tariffs, Trump posted on his Truth Social social media platform that he had just had a “productive call” with Vietnam Communist Party chief To Lam, who had told him Vietnam wanted to cut its “Tariffs down to ZERO if they are able to make an agreement with the U.S.” Trump said he had told the Vietnamese leader that he looked forward to a meeting in the near future.

Prior to the call, Vietnam responded to the tariffs with caution, advocating bilateral negotiations to find a mutually beneficial solution. Prime Minister Pham Minh Chinh chaired an urgent cabinet meeting April 3 to assess the potential impact of the tariffs and consider mitigating measures. Some of the actions discussed included diversifying export markets, supporting export manufacturers, continuing efforts to negotiate with Washington, increasing purchases from the United States, protecting domestic production and stimulating domestic consumption.

Chinh requested the immediate establishment of an interdisciplinary taskforce led by Deputy Prime Minister Bui Thanh Son to closely monitor the situation and advise the government on follow-up measures. Deputy Prime Minister Ho Duc Phoc was assigned to hold a consultative meeting with businesses impacted by the tariffs. He will also lead a delegation to the United States the week of April 7 to seek opportunities to initiate a bilateral negotiation.

Minister of Industry and Trade Nguyen Hong Dien sent a diplomatic note to U.S. officials requesting a delay in implementation of the tariffs to give time to discuss more reasonable solutions for both sides. The ministry is working to schedule a call between Dien and U.S. Secretary of Commerce Howard Lutnick and working-level officials.

Prior to the tariff announcement, Minister Dien had visited Washington and explored ways that Vietnam could reduce its trade surplus, which reached $132.5 billion in 2024. He told U.S. officials Vietnam would seek to purchase more U.S. aircrafts, liquified natural gas and agricultural products. Days before Trump imposed tariffs, Vietnam announced the reduction of some tariffs and pledged to tackle some of its nontariff barriers to boost imports from the United States.

Taiwan

The Trump administration imposed a 32 percent reciprocal tariff on Taiwan. This is much higher than the Taiwan government had anticipated. While certain semiconductor products are exempted from the current wave of country-specific reciprocal tariffs, much of Taiwan’s biggest export categories to the United States — personal computers, servers and other information and communications technology products — are not shielded from the new tariffs.

Once implemented, nearly 93 percent of the Taiwanese exports to the United States will be subject to the blanket 32 percent import tariff. Taiwan is on a public holiday from April 3-4, but the Executive Yuan issued a short statement April 3 with unusually stern language against the United States, calling the reciprocal tariff for Taiwan “deeply unfair” and “highly regrettable.”

The Executive Yuan criticized the Trump administration for using “unclear” methodology behind the tariff measures, noting that the 32 percent rate “does not accurately reflect the trade and economic situation” between Taiwan and the United States.

The Taiwan government said targeting the U.S.-Taiwan trade deficit is misguided because the widening trade gap was driven by supply chain shifts out of China to Taiwan over the past few years, in compliance with Trump’s first-term policy and contributing to the U.S. national security and economy.

The significantly higher reciprocal tariff against Taiwan relative to some of the export-oriented Asian rivals, such as Korea, Japan, Malaysia and Singapore, could also put Taiwan’s manufacturers and exports in a disadvantage. Taiwanese business associations are urging the government to take a tougher stance in negotiations with the Trump administration, arguing that more favorable terms can only be secured through firm engagement, not by simply yielding to Washington’s demands.

Politically, the shock of a larger-than-expected reciprocal tariff against Taiwan is fueling already growing public skepticism over the U.S. relationship and bolstering the China-friendly opposition parties and China’s own direct signaling over the reliability of Washington as a partner. Leaders of the opposition Nationalist Party and the Taiwan People’s Party criticized President Lai Ching-te’s government for inaction and demanded that more assertive countermeasures be taken against the U.S. tariffs.

Japan

The United States imposed a 24 percent reciprocal tariff on Japan. Prime Minister Shigeru Ishiba expressed strong dissatisfaction with the U.S. government’s decision, emphasizing Japan’s role as the largest investor in the United States. Ishiba convened a meeting with the leaders of major opposition parties April 4. Such all-party meetings have historically been held during times of national crisis — such as natural disasters — to demonstrate political unity in the face of major challenges.

Ishiba successfully secured backing from opposition leaders, who encouraged the government to engage in negotiations with the United States. They also called for an early U.S.-Japan summit, urging the government to take swift and comprehensive action to mitigate the impact on Japanese companies, especially on small and mid-sized auto parts suppliers. These calls, aligned with Ishiba’s policy stance, are expected to help solidify the political footing of the LDP-Komeito coalition, which currently governs as a minority in the lower house.

In the upcoming bilateral negotiations, a key focus will be on expanding Japanese investment in the United States and increasing imports of U.S. liquefied natural gas and bioethanol, as agreed during the Ishiba-Trump summit in February. In response to the announced tariff hike, Nissan has revealed its plans to ramp up production at its U.S. facilities.

The Office of the United States Trade Representative’s National Trade Estimate Report, released March 31, raised concerns about some Japanese trade practices, including tariffs on rice and seafood, automobile safety regulations, drug pricing procedures and alleged preferential treatment for Japan Post. While Japanese officials have challenged the accuracy of some claims, several of the proposed U.S. reforms have domestic support, making them potentially negotiable.

The removal or easing of the tariffs continues to be Japan’s primary goal. Tokyo currently has no plans to pursue retaliatory measures because of the significance of its alliance with the United States.

India

India faces reciprocal tariffs of 26 percent. New Delhi’s response has been measured, with the Ministry of Commerce and Industry stating that it is a “mixed bag and not a setback.” Any response from India to the reciprocal tariffs is unlikely to be outside of the ongoing bilateral trade agreement negotiation framework to ensure there are no disruptions to the trade talks.

Washington’s reciprocal tariffs may accelerate the government’s strategic approach to diversify exports to alternate trade blocs and markets. The impetus for new trade routes, such as the India-Middle East-Europe-Economic Corridor, and trade negotiations with the European Union, the United Kingdom and others is likely to increase.

The reciprocal tariffs will impact Indian exports across telecommunications instruments, auto components, petroleum products, chemicals and precious stones and jewelry in the coming months. Exports from electronics and textiles, where India faces fewer tariffs compared to competitor exporting markets, could gain a competitive edge if the tariffs persist. Pharmaceuticals and semiconductors got a reprieve, with combined exports to the United States valued at $10.7 billion.

The overall impact on India’s $77.5 billion total exports to the United States is expected to be moderate to considerable. Market estimates suggest an approximate $30 billion loss to the manufacturing sector, with the potential to slow the GDP growth down by 0.7 percentage points.

India’s gross goods exports to the United States stand at 2.2 percent of its GDP, which is lower than the 4.5-8.9 percent of GDP for major regional economies. New Delhi’s lower reliance on external demand and its deeper domestic market make the economy relatively insulated compared to other export-driven economies.

In the near term, higher tariffs may impact investor confidence and markets. On the flipside, with India trying to tap into shifting global supply chains, sustained lower reciprocal tariff vis-a-vis other competing investment destinations could help investments in certain sectors.

Korea

Korea will be hit with a 25 percent reciprocal tariff, making the Korea-U.S. Free Trade Agreement — enacted in 2012 and revised in 2018 — effectively obsolete. Under the agreement, the average effective tariff rate between the two countries was just 0.79 percent, but beginning April 9, the new rate will take effect.

Despite multiple efforts by the Minister of Trade, Industry and Energy to clarify that the data used by the Trump administration was inaccurate, Washington maintained its position, relying on flawed statistics.

There was confusion over the exact tax rate of the Korea reciprocal tariff. Although Trump announced a 25 percent tariff on Korea April 2, as part of a country-specific reciprocal tariff initiative, the annex of his executive order listed the rate as 26 percent. This was revised to 25 percent the following day.

Rather than pursuing immediate or retaliatory measures, the Korean government is maintaining a cautious posture aimed at minimizing a broad industry-wide impact.

Meanwhile, a cross-ministerial response team has been formed to explore industrial support measures and trade negotiation strategies. A high-level delegation led by Minister for Trade Jeong In-kyo is scheduled to visit the United States soon to engage in negotiations.

Next week, starting with automobiles, the Korean government is set to announce a comprehensive response to the U.S. decision to impose tariffs. Support measures will include not only automakers but also related upstream and downstream industries. Emergency support plans will be rolled out sequentially for other industries the tariffs are expected to affect.

Since most of Korea’s top export items to the United States — such as semiconductors, automobiles, steel, aluminum and pharmaceuticals — are subject to individual tariffs, the government is more closely monitoring potential increases in these specific tariffs rather than the broader impact of reciprocal tariffs. Ultimately, Korea’s small and medium-sized enterprises are structurally more vulnerable to the effects of the reciprocal tariff measure on exports to the United States.

Thailand

Thailand will face new U.S. tariffs of 36 percent. The Trump administration’s reciprocal tariffs are a double whammy for the Thai economy and for Thai-U.S. relations more broadly. The Trump tariffs were anticipated because Thailand has ranked 11th on the U.S. trade deficit list of countries with a $46 billion surplus last year. The whopping 37 percent levy rang local alarm bells because exports to the U.S. market account for 19 percent of Thai goods going abroad and nearly 11 percent of Thailand’s GDP. Many also questioned how the 37 percent was derived and the extent to which nontariff barriers were included because they are harder to quantify.

Goods and sectors at risk include consumer electronics, rubber, semiconductors, auto parts, gems and jewelry, raw animal feed, integrated circuits and rice. Thailand’s growth projection of 3 percent for 2025 is now in jeopardy. The worst-case scenario would be a GDP contraction of more than 1 percent, according to estimates by local independent sources. With such heavy reliance on the U.S. market and without much of a bargaining chip, the government of Prime Minister Paetongtarn Shinawatra is unlikely to issue retaliatory tariffs but will opt for negotiations.

However, such negotiations are fraught because of a major setback in recent Thai-US relations. In response to the Thai government’s deportation of 40 Uyghurs to China February 28, U.S. Secretary of State Marco Rubio imposed visa restrictions on “complicit” Thai officials, presumably including the highest decision-making echelons. The Chinese government responded by defending the deportation, turning Thailand into an open pawn in the U.S.-China conflict.

If the most senior Thai officials are not allowed to visit Washington, the negotiations phase of the U.S. tariff offensive may be impeded. Thai-U.S. relations and the bilateral treaty alliance are at an unprecedented inflection point in favor of China unless Washington gives the Paetongtarn government a chance to redress the deficit issue and reset Bangkok-Washington ties.

Indonesia

Trump imposed 32 percent tariffs on Indonesia. Jakarta so far has adopted a muted but conciliatory stance toward the Trump administration’s decision to impose hefty tariffs on the country’s exports. The announcement came during the Eid Al-Fitr holidays — the country’s longest annual break — when government offices and markets were closed, delaying Jakarta’s comprehensive response.

Officials and commentators have voiced concern about the impact on key export sectors — including electronics, palm oil, textiles, footwear, rubber, furniture and fisheries — which together account for a large share of Indonesia’s $28 billion in annual exports to the United States, its second-largest export destination. Although Indonesia runs a $18 billion trade surplus with the United States, its largest with any trading partner, the government had until recently appeared confident it would not be targeted, banking on the potential for a negotiated outcome.

The government’s most substantive response came in a short press statement from Chief Economic Minister Airlangga Hartarto on April 3 following a virtual meeting with a handful of ministers. It outlined plans to dispatch a delegation to Washington and expressed Jakarta’s willingness to address the U.S. Trade Representative’s concerns about tariffs and nontariff barriers. This marked an acknowledgment of Indonesia being called out in a White House statement, which cited local content requirements — until recently responsible for the suspension of Apple’s iPhone 16 imports — as well as restrictions on profit repatriation from natural resources.

The statement included a notable pledge to pursue “structural improvements and deregulation” aimed at reducing such measures, marking a potential shift in Indonesia’s long-standing protectionist trade stance. Whether this leads to meaningful, lasting reform — long sought by businesses — remains to be seen.

A presidential spokesperson separately moved to reassure the public, noting that President Prabowo Subianto’s flagship initiatives, including the new Danantara sovereign wealth fund, were designed in part to buffer Indonesia from external shocks. Full market reactions are expected to emerge once the holidays conclude April 8.

Malaysia

The U.S. administration hit Malaysia with 24 percent tariffs. Prime Minister Anwar Ibrahim convened a special Cabinet meeting April 4 to discuss Malaysia’s response to the reciprocal tariffs. The meeting, joined by the National Geoeconomics Control Center and Central Bank Governor Abdul Rasheed Ghaffour, concluded with a consensus to refute the claim that Malaysia had imposed a 47 percent tariff on U.S. imports into the country, which Trump used as the basis for the reciprocal tariff.

The tariffs are expected to have significant economic implications for Malaysia’s export-driven economy, with electric and electronic products, machinery, medical devices, furniture and rubber products expected to be hit the hardest — despite the tariff exemption on certain products, including semiconductors — at least for now. Because of this, the 2025 GDP growth forecast of 4.5-5.5 percent will be subjected to a review and possible downgrade.

Malaysia’s Ministry of Investment, Trade and Industry announced April 3 that it will not impose retaliatory tariffs against the United States and will actively engage with its U.S. counterparts to “uphold the spirit of free and fair trade.” On the negotiation front, Malaysia will seek to bank on its Trade and Investment Framework Agreement with the United States to seek “reciprocal trade gains” and negotiate a Technology Safeguards Agreement with Washington to enable high-technology cooperation in priority sectors seen as key drivers for the Malaysian economy.

As chair of the Association of Southeast Asian Nations (ASEAN) this year, Malaysia will be keen to develop new economic partnerships with Southeast Asian neighbors and will seek the cooperation of ASEAN to form a coordinated response in collective negotiations with the United States. Trump’s reciprocal tariffs will likely be a key point of discussion between ASEAN members in the run-up to the ASEAN Summit in Kuala Lumpur later this year.

Malaysia’s own negotiations with Washington may face some challenges until larger political disputes are resolved. Anwar angered the previous U.S. administration with strong support for Hamas in its war with Israel and his sharp criticisms of Washington’s backing for Israel. Anwar, at least publicly, has not taken steps to improve relations with the new Trump administration, which also strongly supports Israel. Malaysia’s diplomatic efforts have also been hobbled by the fact that it has not had an ambassador in Washington since the beginning of the Trump administration.

Cambodia

Cambodia faces tariffs of 49 percent. The Ministry of Economy and Finance said officials are assessing the impact of the tariffs and exploring potential solutions, following a closed-door high-level meeting led by the minister shortly after the tariff announcement. The meeting included key private sector representatives to discuss the impact and develop proposed measures and recommendations to submit to the prime minister for the next steps.

The Minister of Labor and Vocational Training acknowledged some effects but confirmed job security through the end of 2026, citing diversified trade, secured contracts and the fact that other countries in the supply chain also face tariff increases, albeit at different rates. The Ministry of Commerce added that the U.S. tariffs on Cambodian goods are not politically motivated and urged the public to remain calm while the government works on a solution. The prime minister announced that the government will enter negotiations with the United States to address the tariffs.

The minister of commerce said that Cambodia does not impose 97 percent tariffs on U.S. goods as Trump claimed but rather a range of 0-35 percent as a World Trade Organization member. She also warned that the 49 percent U.S. tariff hike could harm both U.S. consumers and producers.

Key business chambers, including the American Chamber of Commerce in Cambodia and the Government-Private Sector Working Group, backed the government’s response to the U.S. tariffs, calling them unfair and advocating a unified position. The Textile, Apparel, Footwear, and Travel Goods Association in Cambodia, representing 920,000 workers, urged for calm and emphasized Cambodia’s regional competitiveness.

Civil society groups and analysts warned of serious risks to the garment industry — such as factory closures, job losses and economic decline — and called for urgent negotiations, similar to the European Union’s (EU) Everything but Arms talks. Others urged Cambodia to strengthen democracy and human rights to align with U.S. and EU standards. With the tariff implementation imminent, pressure for swift diplomatic action is mounting.

Bangladesh

Trump announced a 37 percent reciprocal tariff on products from Bangladesh, sending shock waves across the country. Business leaders have termed the U.S. decision a “perfect storm” for Bangladesh. They fear that the tariff regime will threaten the $40 billion apparel industry in Bangladesh, delivering a devastating blow to the $10 billion ready-made garment (RMG) exports to the U.S. market. Business leaders are concerned that other sectors of economy will also be affected by this decision.

Experts warn that the tariffs will have a knock-on effect on 4 million workers employed in the RMG sector, most of whom are women, and negatively impact the investment climate in Bangladesh. GDP growth could slow the economy, which has been under huge pressure during the last year and is now supported by International Monetary Fund loans. It now looks like the entire economy, which was showing signs of recovery in recent months, will lose momentum, including facing slower export performance.

Policymakers are trying to absorb the shock and are making every effort to reassure people that the government will do whatever is required to work out a deal beneficial to both countries. Finance Adviser Salehuddin Ahmed instructed his ministry’s relevant departments to conduct a thorough assessment of the tariffs’ impact and take necessary remedial measures.

Going forward, it is possible that Bangladesh will engage with the United States. The government could propose rationalizing Bangladesh’s tax and duty regimes, buying more U.S. cotton and scrap metal at a zero tariff rate and liberalizing the country’s investment regime. Dhaka could also reenergize the U.S.-Bangladesh Trade and Investment Cooperation Forum Agreement and invite more investment from the United States in many sectors, including energy and information technology.

Singapore

Singapore will be hit with 10 percent tariffs. Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong stated that the implementation of reciprocal tariffs would have a significant impact on Singapore and could escalate into a global trade war. He expressed Singapore’s disappointment with the tariffs imposed on the country, noting that the two countries have had a long-standing economic relationship and a free trade agreement that has given U.S. imports to Singapore tariff-free access for more than 20 years.

Gan added that while Singapore has recourse to take countermeasures and could seek dispute resolution under the agreement, Singapore decided not to do so because “imposing retaliatory import duties will just add costs to our imports from the U.S., and this will affect our consumers and our businesses.” Although the tariff of 10 percent on goods from Singapore is less than that on goods from other countries, Singapore’s growth will be affected if global trade and economic activity slows down significantly in light of potential retaliatory tariffs. Singapore will reassess its growth forecast for 2025.

Senior Minister Lee Hsien Loong also said that the measures in Budget 2025, released February 18, should provide adequate support to cover businesses and households during this period and that the Singapore government will be ready to intervene to support if necessary.

In the meantime, like many other countries in the region, Singapore plans to engage Washington to understand how it has calculated the tariffs, particularly considering the trade surplus the United States enjoys with Singapore, and to clarify any misunderstanding that has led to this imposition. Singapore will also double down on engaging other trade partners, including through Association of Southeast Asian Nations and the World Trade Organization, to preserve the multilateral system and protect international trade under a rules-based order.

Philippines

Trump imposed a 17 percent tariff on the Philippines. The decision brings both challenges and opportunities for Manila. Although this move could make Philippine products less competitive in the U.S. market, it also opens doors for new trade and investment prospects.

For decades, the United States has been the Philippines’ top export market and a key economic partner. With higher tariffs now in place, Philippine exports, particularly in the electronics industry, may face declining demand due to increased costs. As one of the Philippines’ largest export sectors, any slowdown in this industry could have ripple effects on jobs and trade growth.

However, amid these challenges, the Philippines also stands to benefit. Given that Washington is targeting multiple Asian economies with high tariffs — with Cambodia facing up to 49 percent and China 34 percent — the Philippines, with a comparatively lower tariff rate, could position itself as an attractive alternative for businesses looking to diversify their supply chains. Moreover, the Philippines could serve as a transshipment hub, allowing businesses from countries facing higher tariffs to route their exports through the country to take advantage of its lower tariff rates. The Philippines’ skilled workforce, geostrategic location and natural resources further strengthen its appeal as a manufacturing and investment hub.

Beyond trade, this shift also presents an opportunity for the Philippines to strengthen its domestic economy. By expanding local production and manufacturing, the country can reduce its reliance on imports while encouraging investments that cater to the growing domestic market. With its large consumer base, the Philippines has the potential to spur economic growth from within.

Ultimately, while these tariffs introduce uncertainties, they also push the Philippines toward adaptation and resilience. By leveraging new opportunities beyond the United States‚ such as expanding trade with the European Union through the planned EU-Philippines Free Trade Agreement — and promoting local industries, the country can navigate the challenges of protectionist policies and emerge stronger in the evolving global economy.

Australia

Australia faces U.S. tariffs of 10 percent. Prime Minister Anthony Albanese said it was “not the act of a friend,” although no country had “received a better outcome than Australia.” Australia will not impose retaliatory tariffs but will strengthen anti-dumping measures — not directed at the United States — and provide businesses support — not subsidies — to grow new markets.

Industry stakeholders are relieved that pharmaceuticals and certain critical minerals are at this point exempt and that Australia has escaped a ban on beef. Australia’s top three exports to the United Stats are professional services, intellectual property charges and beef. Although the United States accounts for just 6 percent of Australia’s exports, some analysts are concerned about the impact of the tariffs on Australia’s major trading partners, including China and Japan.

The Australian Chamber of Commerce and Industry said the decision is a clear breach of the Australia-U.S. free trade agreement. Albanese has ruled out any “phenomenal” offers to the United States as part of Australia’s efforts to reduce the tariffs, although Australian officials continue to point to Australia’s abundant deposits of critical minerals.

If you have any questions or comments, please contact the individual experts who wrote each section or BGA Head of Research Murray Hiebert at mhiebert@bowergroupasia.com.

Best regards,

BowerGroupAsia

Murray Hiebert

Head of Research

Subscribe to Asia Street

Insights & News

India Spurs Innovation and Industrial Growth With New Landmark Initiatives

The BGA India team, led by Managing Director Anuj Gupta, wrote an update to clients …

Anuj Gupta

Anuj Gupta

Vietnam Tariff Tracker | July 7, 2025

Context Significance Implications We will continue to keep you updated on developments in Vietnam. If …

Nguyen Viet Ha

Nguyen Viet Ha

Strategic Insights for Business Planning Highlighted in New Surveys

The BGA Philippines team, led by Managing Director Victor Andres Manhit, wrote an update to …

Victor Andres Manhit

Victor Andres Manhit

At BowerGroupAsia, we are committed to

delivering result-oriented solutions for our clients

We have proven track record of helping the world’s top companies seize opportunities and manage challenges across the dynamic Indo-Pacific region.